Several jewellers have lined up deals to entice you to buy gold jewellery this Akshaya Tritiya that falls on April 22, 2023. But a big deterrent for many buyers thronging jewellery stores for wedding purchases, is the exceptionally high prices of the yellow metal.

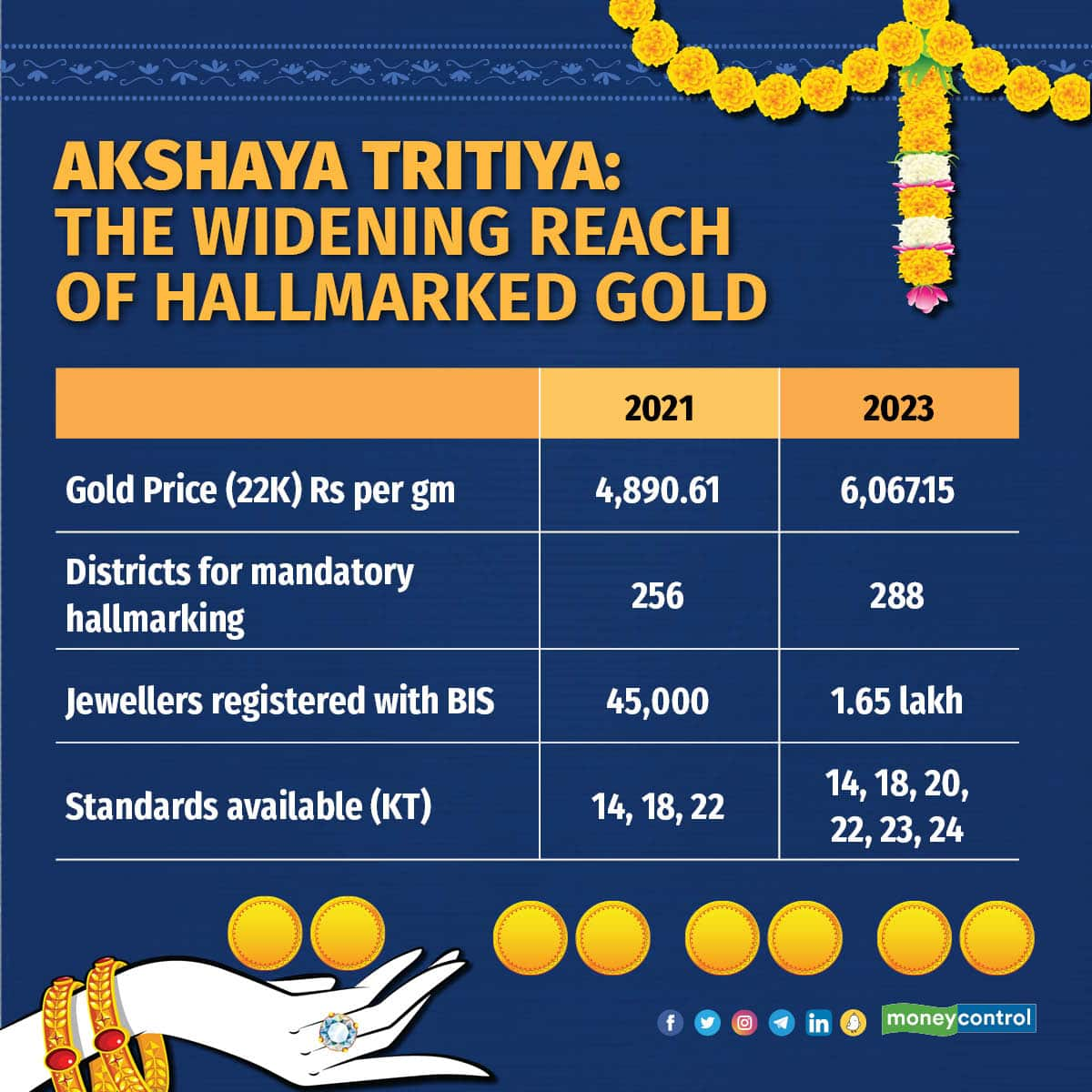

The price of 24K (karat) gold surged to Rs 6,618.71 per gram on April 19, 2023, up from Rs 4,849 per gram last Akshaya Tritiya, a steep 36.5 per cent increase. But gold jewellery made of lower karatage of 22k is available at Rs 6,067.15 per gram.

A strategy many Indian buyers are resorting to this year is to sell a bit of old gold in the form of jewellery or coins purchased earlier.

“We are receiving a lot of old gold as some of them are looking at changing the designs and some are looking at enchasing the value of their gold as the rates have increased,” says Saiyam Mehra, Chairman of the All India Gem and Jewellery Domestic Council.

When currency depreciates, gold tends to be the safe haven. Additionally, the worsening economic scenario due to the Russia-Ukraine war, and the banking crisis in the US and Europe have led to price rise.

“When there is a spike in gold prices, 40-42 grams of old gold is seen being offered by buyers for every 100 gram of purchase,” says Ashish Pethe, Partner at Waman Hari Pethe Jewellers.

If you too are thinking of offering that old chain that has lost its sheen as part of your gold deal this Akshaya Tritiya, then you need to know what might affect your fresh gold purchase in exchange.

Starting 2021, only gold hallmarked by the Bureau of Indian Standards (BIS) laboratories can be sold in 288 districts in India. Additionally, the 6-mark HUID is compulsory, starting April 1, 2023.

But, your old jewellery may not be hallmarked. Does that mean you would get low prices?

To be sure, non-hallmarked jewellery can also be sold in these 288 districts, at market rates. Don’t fall for the argument that since your gold isn’t hallmarked, you can’t get the right price for it. “With respect to purity, we buy 100 percent of the old gold value based on the rate displayed in the retail store,” says Mehra. In simple words, even if your old gold is not hallmarked, you can still sell it.

Checking the purity

If it is a non-hallmarked piece, then your jeweller will test its purity. Two methods are available at shops to conduct this test. The karatmeter test (a five-minute exercise) or a fire-assay test (a 1-3-hour long process) is used to determine the purity of the metal.

Traditionally, it has been easier to sell gold to the same jeweller from where you had bought it, compared to going to another jeweller. But over time with the rise in gold prices, the general confidence in the markets about gold has gone. Still, if you are headed to the same jeweller from where you had purchased your old jewellery, carry your old invoice with you, Pethe suggests.

But the type of jewellery would also play a role in how fast you can get the deal through. “Selling gold jewellery to another jeweller is easy. But selling diamond jewellery to another jeweller is difficult,” says C Vinod Hayagriv, Director & MD of C. Krishniah Chetty Group of Jewellers. If you wish to sell your diamonds, it’s always better to go to your old seller.

This is because each jeweller deals in a select range of diamonds. For instance, some jewellers sell best quality VVS (considered among the best quality) diamonds, while others prefer GVS (good quality; but has some impurities) quality.

But if your diamonds aren’t laboratory-certified, then the valuation would done be as per the jeweller. “Diamond valuation can be done over the counter, but opt for lab-tested valuation, which would be accurate and would take two days,” says Rajiv Popley, Director of Popley Group.

Lower karatage concerns

Although jewellery shops accept old gold that you wish to sell, there could be a challenge. As per government rules, only six types of karatage of jewellery are hallmarked (14, 18, 20, 22, 23, 24K). If your old jewellery comes in a different karatage, your jeweller might press you to sell it at the nearest (preferably lower) level karatage. This will result in a small loss for you. For instance, if you have 19K gold, your jeweller might nudge you to sell it at 18K price. This, jewellers claim, is usually because they cannot sell the 19K further as that cannot be hallmarked. Experts say that you need to bargain here and give it a try to get the price that reflects your jewellery’s true karatage.

“Hallmarking centres declare jewellery only within the set standardisation levels of 14K, 18K, 20K, 22K or 24K. If you offer 19K, then it would be certified in the next lowest level of 18K, as 19K is not a standard,” says Hayagriv. But this doesn’t affect the price you would get in exchange for old gold.

Also read | Looking to invest in gold this Akshaya Tritiya? You can still bank on gold ETFs’ shimmer

‘0% labour cost’ is a myth

Another offer that many make is of zero labour cost. But such an offer would mean you pay the labour charge in the form of either higher cost of gold or some other transaction charge.

“It is fine if the jeweller offers a discount in the labour charge as that would be lowering the margin. But avoid falling for ‘zero percent labour charge’ offer. The deal would be ambiguous, and you would be charged in some other form. Opt for transparent offerings to get maximum gold value as every jewellery has a value addition (labour cost), which has to be paid,” says Popley of Popley Group.

Also read | Sovereign gold bonds – should you buy them this Akshaya Tritiya 2023?

Price differential

You can check the rate of gold on national jewellery associations websites to avoid falling into traps. “There is a rate differential in gold prices across jewellers based on their geography, business policy (such as labour cost, real estate cost, profit margin, operating costs, and so on). Check the websites of various national associations for wholesale rates for that day. The retail rate would be in the similar range,” says Pethe.

Can I still question the purity of the gold?

Just because hallmarking is mandatory, doesn’t mean you are guaranteed pure gold all across India. If you buy gold outside any of these 288 districts where hallmarking is not mandatory, you need to be sure of the purity of gold that you buy. Also, some jewellery below 2 grams and studded pieces are excluded from mandatory hallmarking. “Even though diamond jewellery and kundan pieces are hallmarkable, they are exempted so far, unfortunately,” says Hayagriv.

So, you could still be handed a piece that isn’t worth the gold it promises.

However, the good news is that you can check the purity and hallmarking while sitting in the jewellery store by using the BIS CARE app (see picture).

Preserve invoices

When you are exchanging old gold, get a receipt so that you have all the details and the break-up.

“Get an invoice of the purchase and preserve it as certificate of authenticity, along with the HUID and the gold rate applicable. You will get the break-up of the labour charge. Gold purchase in any form would attract a Goods & Services Tax (GST) of 3 percent and loose diamonds, 1.5 percent,” says Popley.

Also read | Akshaya Tritiya 2023: Should you invest in gold and silver fund of funds?

Can I get cash in return for jewellery?

“We aren’t allowed to offer cash beyond Rs 9,999. Old jewellery can be encashed, but a cheque or bank transfer would be offered,” says Mehra.

For transactions above Rs 2 lakh, the PAN number would be required. A declaration of exemption needs to be submitted for foreigners along with the details of their passports.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.