Netflix plans to introduce low-cost advertising-supported plans, in a major departure from the company's earlier stance against advertising on the platform. This comes in the backdrop of the service posting its first quarterly subscriber loss in more than a decade.

Netflix co-CEO Reed Hastings revealed this move during the company's earnings conference call on April 19, noting that they will try to figure it out "over the next year or two".

"Those who have followed Netflix know that I have been against the complexity of advertising, and a big fan of the simplicity of subscription," Hastings said. "But as much as I am a fan of that, I am a bigger fan of consumer choice. And allowing consumers who would like to have a lower price, and are advertising-tolerant, get what they want makes a lot of sense."

Hastings noted that this is "not a short-term fix" and indicated that their change in the stance was driven by the success witnessed by their rivals.

"I think it's pretty clear that it's working for Hulu, Disney is doing it, HBO did it. I don't think we have a lot of doubt that it works, that all those companies have figured it out. I'm sure we'll just get in and figure it out as opposed to test it and maybe do it or not do it" Hastings said.

Several of Netflix's rivals in India including Disney+ Hotstar, Zee5, Voot and MX Player also offer an ad-supported tier to consumers. Amazon also offers an ad-supported streaming service miniTV within its flagship shopping app in India.

On April 19, Netflix said it lost 200,000 subscribers during the first quarter of 2022, the first time it has witnessed a subscriber drop since 2011. The company also projected that it will lose another 2 million subscribers in the current ongoing second quarter.

"Our relatively high household penetration - when including the large number of households sharing accounts - combined with competition, is creating revenue growth headwinds" the company said in a letter to shareholders.

Netflix estimates that more than 100 million households are sharing their accounts, including over 30 million in the United States and Canada.

Sluggish economic growth, increasing inflation, geopolitical events such as Russia’s invasion of Ukraine, and continued disruption from Covid also contributed to its slowing growth, the company said.

Shutting down its service in Russia resulted in the company losing about 700,000 subscribers.

In the letter, Netflix also noted that the main challenge for membership growth is "continued soft acquisition across all regions".

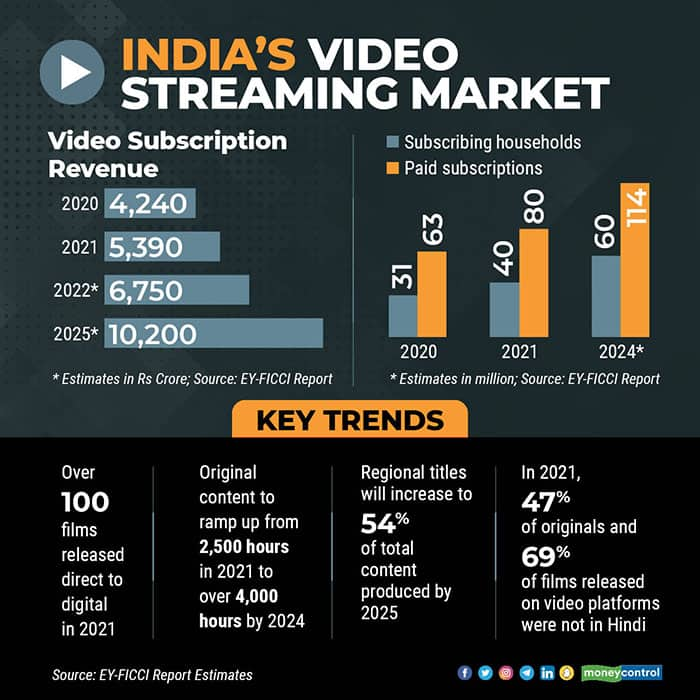

Asia Pacific was a saving graceThe Asia Pacific (APAC) region, which includes India, was the lone saving grace for the company during the quarter as it added 1.09 million paid members in the region. This was however a decline from 2.58 million member additions in the previous quarter and 1.36 million additions in the corresponding quarter last year.

To be sure, the Asia Pacific region is the smallest region for the company, trailing North America, Latin America and Europe. The region’s 33.7 million subscribers account for 15.2 percent of the service’s overall 221.64 million members. However, it has gained importance in recent years as the Los Gatos, California-based streaming service relies more on International markets for growth.

"We're making good progress in APAC where we are seeing nice growth in a variety of markets including Japan, India, Philippines, Thailand and Taiwan. Over the longer term, much of our growth will come from outside the US" the company said in the shareholder letter.

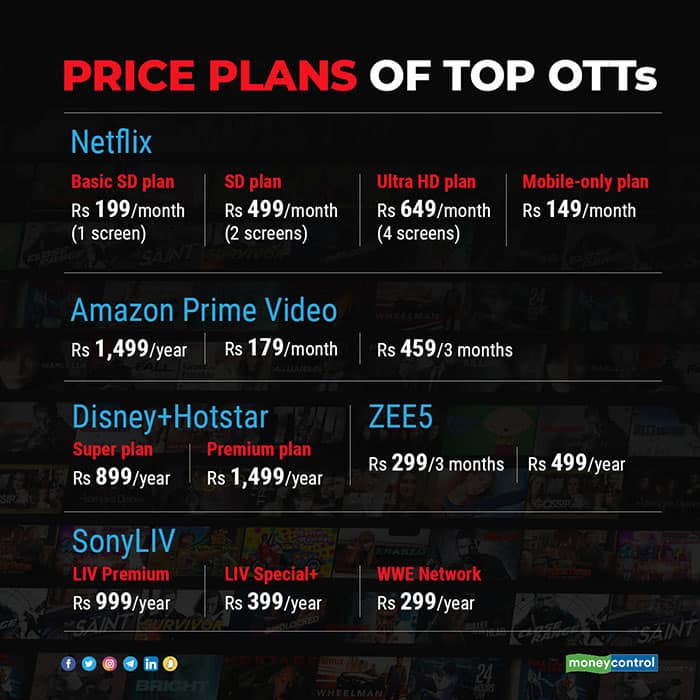

In December 2021, the company reduced its India pricing for the first time since its entry in 2016, with the biggest drop in the entry-level plan, now available at Rs 199 per month compared with Rs 499 per month previously.

This has helped in receiving an additional bump in subscribers, Netflix COO Greg Peters said during the earnings conference call "(The subscribers) are largely behaving similar to the subscribers we've added over the last 12 months. This was a bet in terms of long-term revenue maximization" he said.

Peters said there was an opportunity to broaden the audience amid several upcoming local titles. "The bet is that these folks will enjoy those titles and that they will talk enthusiastically about them to their friends, their family, their coworkers, and that will lead to another sort of positive momentum on the flywheel of sign-ups" he said.

Netflix co-CEO Ted Sarandos also noted during the earnings call that they have seen a "nice uptick in engagement in India".

That said, if the paid member additions during the quarter are any indicators, the growth doesn't seem sizable enough as yet. Netflix does not provide a country-wise breakup of its member base. Prior to the price drop, analysts had pegged the company's subscriber base in India at 5.5 million.

India has been a tricky market to crack for the service as it seeks to gain a foothold in the country amid intense competition. In the past couple of years, Netflix has taken several steps including the introduction of a mobile-only plan and piloting various pricing experiments in the country to make its offerings more attractive to potential customers in the country.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.