Pankaj Mathpal

If the recent volatility in equities has unnerved you, worry not. Equity markets tend to get ruffled on account of negative local or global news flow. Over the past few weeks, global investor sentiment was hit by trade duty announcements and rising bond yields in the US. Hence, stock prices across the globe slipped, and Indian markets too followed suit.

For those investors invested in dynamic asset-allocation funds, especially balanced advantage category of funds, the impact has been minimal. The reason – Such funds cut back on their equity exposure as markets scaled higher levels. A key advantage of these funds is that to manage risk and reduce it they invest in different assets such as bonds and equity. Hence, for a vast majority of investors who would like to tailor investments depending on equity markets, these funds prove to be both profitable and defensive. And one of the oldest and a consistent performer in this category is the ICICI Prudential Balanced Advantage Fund.

Valuations-first strategy

Dynamic asset-allocation funds factor in market valuations before investing in various assets. An important criterion which helps decide when one should move into equities is the underlying market valuation or markers such as price-earnings or price-to-book value.

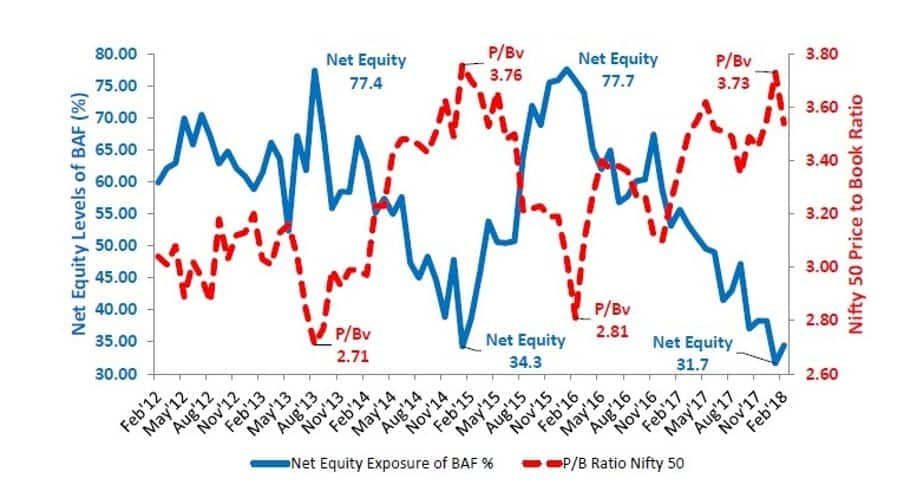

When equity markets climb higher, dynamic asset-allocation funds get busy booking profit and moving out of equities. The PE or the price-to-book in a rising market is constantly rising. At every increase, these funds are locking in profits and shifting allocation to debt.

For example, let’s look at how ICICI Prudential Balanced Advantage Fund stacks up against the Nifty Price to Book Ratio (please note this is just an illustrative example as final allocations differ from fund to fund).

Source: NSE India & MFIE, As on 28thFebruary, 2018.

Suffice it to say, dynamic asset-allocation funds raise the investing strategy several notches. They not only give the investor an advantage of booking profits in stocks, but also ensure that any downside is protected.

Sidesteps emotions

In times of a market correction, usually the investor reacts in the extreme, which is to sell all the holdings, instead of accumulating at lower levels. So, here the decision is based on emotions. By investing in dynamic asset-allocation funds, one gets to sidestep emotion based investments.

As a result, dynamic asset-allocation funds are excellent investment vehicles for volatile times. The reason being: such a fund gets to invest at opportune times into debt and equity, thereby containing either ends of the market extremes. In effect, it aids the investor to not only reduce risk but also face market volatility with confidence.

Suitable for…

Owing to the nature of the product, this type of a fund can be used as a stepping stone when it comes to investing in equities. A risk-averse investor can also consider investing in this fund. Ideally one should consider having this category of fund as a core part of one’s portfolio. In the current market environment, for those looking to make lump sum investment can consider locking in money into this fund, given the inherent asset allocation exercise.

The writer is Managing Director of Optima Money Managers.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.