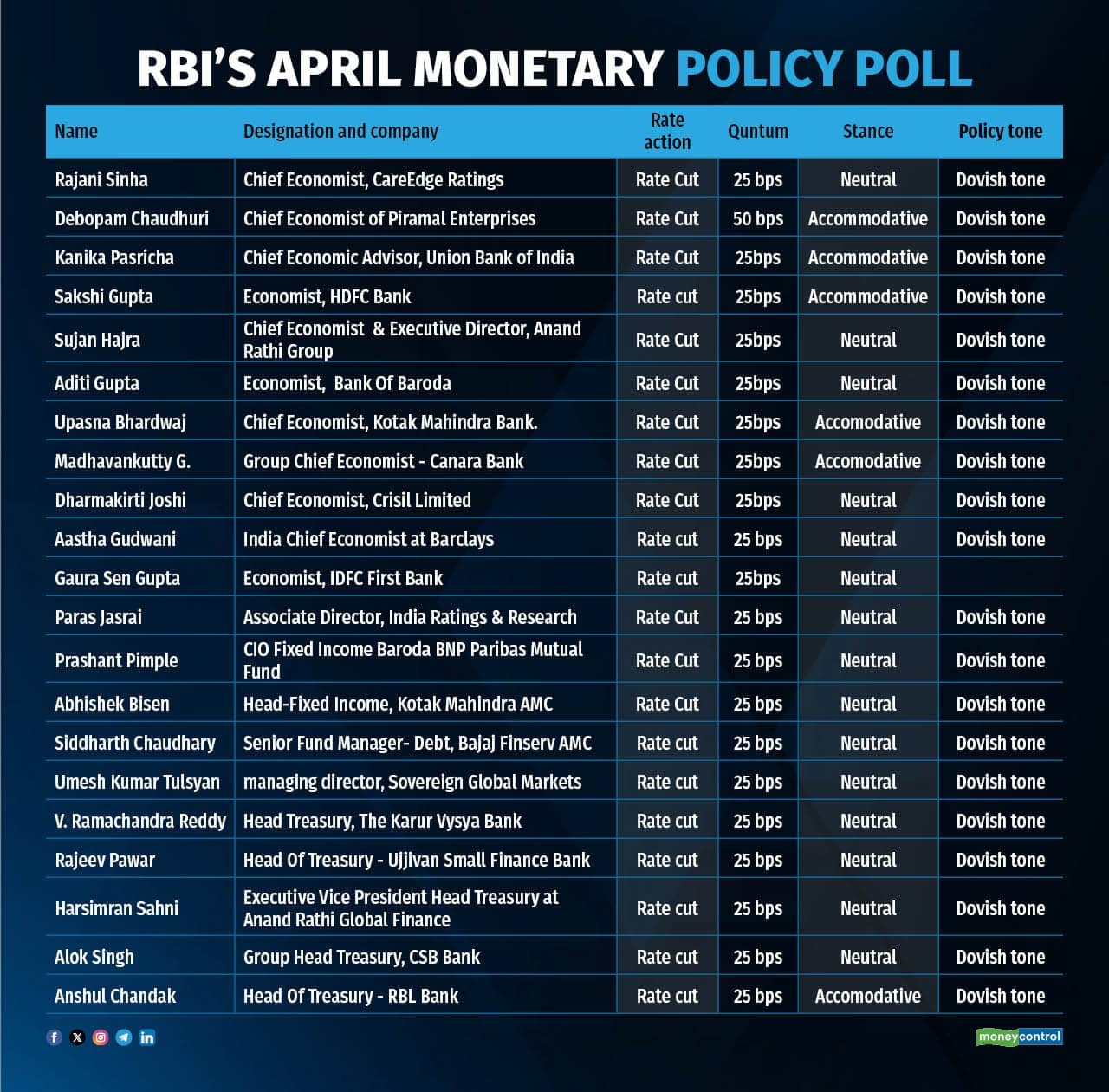

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) is likely to cut repo rate by 25 basis points (bps) in the upcoming monetary policy on April 9, according to Moneycontrol’s poll of 21 economists, treasury heads and fund managers.

Experts said that lower Consumer Price Index (CPI) inflation allows the MPC to focus more on growth amid global uncertainties and paves way for another rate cut, which will further boost demand in the current scenario.

“We expect the MPC's focus to shift from concerns about inflation to supporting growth. As a result, the MPC is likely to continue the rate-cutting cycle that began in February, with another 25 bps reduction in the repo rate during the April MPC meeting, while maintaining a neutral stance amid global headwinds,” CareEdge said in a report.

Treasury heads added that the central bank will also focus more on liquidity management because it is still deficit despite several measures announced by the RBI. However, this week witnessed easing of liquidity deficit, which also helped money market rates to ease.

The expected rate cut in the April monetary policy will come after the central bank, for the first time in five years, cut repo rate by 25 bps in February monetary policy.

Most experts are of the view that the central bank may continue with the ‘Neutral’ stance because it can allow the RBI to act on both sides on the rate front. A section voted for a change in stance to "Accomodative” for smooth transition of policy rates.

“The stance is likely to be accommodative as this is essential for the smooth transmission of policy,” said Madhavankutty G, Group Chief Economist at Canara Bank.

"Neutral" suggests that the RBI can cut or increase interest rate. Typically, this position is adopted when the policy priority is equal on both fronts — inflation and growth.

On the policy tone front, all respondents have voted that the RBI will have a dovish policy tone, with assurance on liquidity. “Dovish tone with an assurance of comfortable liquidity to the market,“ said V Ramachandra Reddy, treasury head at The Karur Vysya Bank.

The RBI has kept its policy repo rate unchanged for the 11th time, till its December MPC meeting, before cutting rates in the February policy. This is after increasing it by 250 bps from May 2022 to February 2023.

Currently, the repo rate stands at 6.25 percent.

Some experts believe that the central bank will revise down its inflation projection in the April policy due to the comfort from food inflation. However, the downward revision is unlikely to be higher, given the uncertainty on monsoon, heatwaves, and other potential adverse weather events.

“FY25 CPI inflation estimate could be revised down marginally to 4.6 percent, as compared to the estimate of 4.8 percent. We also see a downside risk to the FY26 estimate of 4.2 percent, but the RBI might retain it, given that the uncertainty on monsoon and other potential adverse weather events persist,” said Gaura Sen Gupta, Economist at IDFC First Bank.

In the February monetary policy, the RBI has projected retail inflation for the next financial year starting April to be at 4.2 percent, while maintaining the forecast for the current year, 2024-25, at 4.8 percent. The central bank also reduced CPI inflation print projections for Q4FY25 and Q1FY26 .

CPI inflation for the current financial year was projected at 4.8 percent, with Q4 projections at 4.4 percent. Assuming a normal monsoon, CPI inflation for financial year 2025-26 was projected at 4.2 percent, with Q1 at 4.5 percent, Q2 at 4 percent, Q3 at 3.8 percent, and Q4 at 4.2 percent.

Growth projectionsMost economists and treasury have said that the central bank is unlikely to change its projections on the growth front, considering the downward risk amid global uncertainties.

“We expect MPC’s FY26 GDP forecast to remain unchanged at 6.7 percent but expect the statement to cite downside risks,” said Aastha Gudwani, India Chief Economist at Barclays.

In the February policy, RBI projected the economy to grow at 6.7 percent for financial year 2025-26.

RBI Governor Sanjay Malhotra said the central bank projects a real GDP growth of 6.7 percent for FY26. The RBI revised Q1 projections to 6.7 percent from 6.9 percent; and Q2 to 7 percent from 7.3 percent. It projects Q3 and Q4 growth at 6.5 percent each.

Healthy Rabi prospects and an expected recovery in industrial activity should support economic growth in 2025-26, Malhotra said while announcing his first bi-monthly monetary policy for the current fiscal.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.