The Reserve Bank of India (RBI) on October 6 proposed to introduce the Card-on-File Tokenisation (CoFT) creation facility directly at the issuer bank level citing the growing acceptance and benefits of tokenisation of card data.

"Given the growing acceptance and benefits of tokenisation of card data, it is now proposed to introduce Card-on-File Tokenisation (CoFT) creation facilities directly at the issuer bank level,” RBI Governor Shaktikanta Das said in his statement.

CoFT or tokenisation is a process used to replace card details by a unique token or code. This allows secure online purchases without exposing sensitive details like card number, card verification value (CVV), etc.

Also read: RBI MPC: Monitoring certain components of personal loans in the books of banks, NBFCs, says Guv Das

Das added that this measure will enhance convenience for cardholders to get tokens created and linked to their existing accounts with various e-commerce applications.

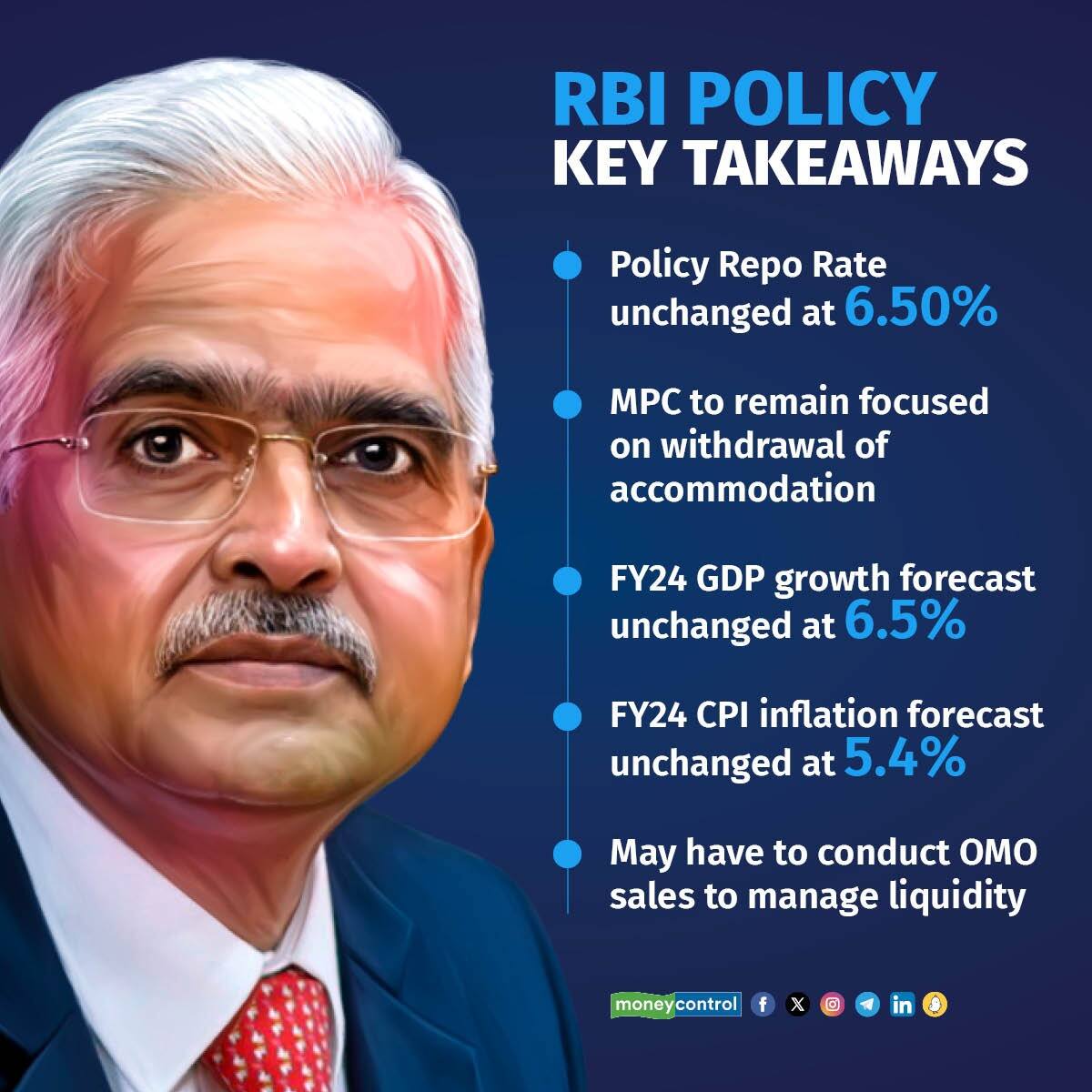

RBI kept repo rate unchanged at 6.5 percent

RBI kept repo rate unchanged at 6.5 percent

"This measure will enhance convenience for cardholders to get tokens created and linked to their existing accounts with various e-commerce

applications," Das said.

How tokenisation helps?

Until now, whenever you bought things from e-commerce websites or booked train or flight tickets through a travel website you had to save your debit or credit card details for ease in future transactions. You would only enter the three-digit CVV number and checkout of the payment transaction within seconds.

But saving card details in the current form is risky. There are instances of popular websites getting hacked by fraudsters and harvesting the saved card data.

Tokenisation will replace a debit or credit card’s 16-digit number with a unique token that is specific to just your card and specific for one merchant at a time. The token masks the true details of your card, so in case there is a data leak from the merchant website, the fraudster cannot misuse the card.

MPC decision

Monetary Policy Committee (MPC), as expected, left the repo rate, the rate at which the central bank lends short-term funds to banks, unchanged at 6.5 percent on October 6.

Also read: RBI holds repo rate at 6.5%, inflation focus continues; FY24 GDP growth forecast unchanged at 6.5%

"MPC voted unanimously to leave the repo rate unchanged at 6.5 percent," Das said while announcing MPC's decision.

Further, the MPC also decided that Standing Deposit Facility (SDF) and Marginal Standing Facility (MSF) rates are also left unchanged at 6.25 percent and 6.75 percent, respectively.

"Global headline inflation is easing but rules above the target of many major economies. Sovereign bond yields have firmed up, US dollar has appreciated, and equity markets have corrected," Das said in the press conference, adding that India is poised to become the new growth engine of the world.

On GDP growth, the MPC's forecast for 2023-24 was left unchanged at 6.5 percent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.