Sachin PalMoneycontrol Research

VRL Logistics, one of the largest transportation and logistics company in India, had a muted performance in the first quarter of this fiscal year as the volume growth was offset by an increase in fuel costs.

The company has seen an uptick in demand after the implementation of the goods and services tax (GST) and along with the e-way bill, this is helping organised players attract fresh business as smaller unorganised players are facing compliance as well as regulatory cost pressures. Despite a subdued quarterly show, VRL seems an interesting long-term bet at this juncture as the company is staring at an optimistic future post these structural changes and an uptick in economic consumption also bodes well for the sector.

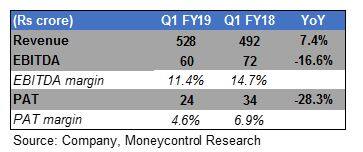

Result snapshot

VRL’s sales for the quarter increased 7 percent to Rs 528 crores. Earnings before interest, tax, depreciation, and amortisation (EBITDA) declined 17 percent to Rs 60 crores while profit after tax (PAT) fell 28 percent to Rs 24 crores.

Higher fuel costs and employee expenses (salary increments to comply with minimum wage regulation) kept the operating margins under pressure. Diesel prices have increased by more than 15 percent in the past one year and have been the primary reason for the drop in operating margins from 14.7 percent last year to 11.4 percent this year. The decline in PAT was much sharper on account of lower other income.

In order to protect the margins, VRL had implemented freight rate hikes on a majority (around 60 percent) of the routes in May 2018. The company is mulling rate hikes on the remaining routes to pass on the costs.

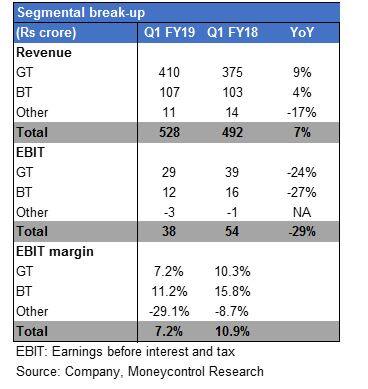

Goods transport segment driving earnings

The goods transport (GT) segment revenue growth stood at 9 percent in the first quarter of FY19. This was driven by a combination of 5-6 percent growth in volumes (tonnage) and 2-3 percent growth in realisations year-on-year (YoY). There was a moderate uptick in the realisations on a quarter-on-quarter (QoQ) basis. Bus transport (BT) segment grew at 4 percent in Q1 FY19. This was led by realisations as the passenger volumes remained stagnant YoY.

Incurring a capex to expand fleet size

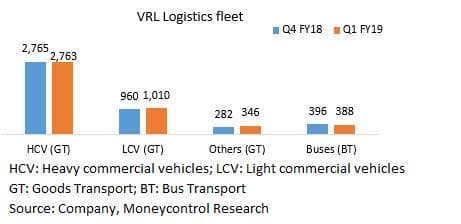

VRL has indicated a capex of Rs 500-550 crores over the next 2 years of which around Rs 250 crores will be spent in FY19. The capex will be used to add 1,000-1,200 vehicles in the good transport segment over the next 24 months (at a run rate of 40-50 trucks per month). The company is not looking to add additional capacity in passenger transport segment.

During the quarter gone by, the company had a gross addition of 120 vehicles in the goods transport segment. New purchases of small vehicles and LCV (Light Commercial Vehicles) mainly contributed to the fleet expansion. On the net level, the company’s fleet increased by 120 and the total owned fleet size stood at 4,507 at the end of Q1 FY19.

The company continues to deleverage its balance sheet. Healthy cash flow from operation helped the company reduce the net debt from Rs 63 crores in Q4 FY18 to 42 crores in Q1 FY19. The debt-equity ratio stood at 0.1x at the end of June.

Leveraging technology to drive efficiencies

The company has started technology integration in its fleet with an aim to bring in operating efficiencies. The company is in the process of rolling out an automated toll payment system (through bank tie-ups) with an aim to save both time and costs. For the outsourced vehicles, VRL has started implementing GPS services in order to have real-time tracking and traffic management.

Outlook and Recommendation

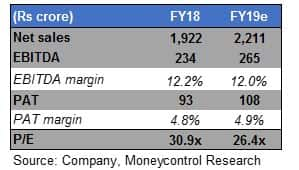

VRL has a pan-India presence and enjoys a market leadership position in the logistics sector. VRL has seen a gradual pick-up in demand post the implementation of GST. With the business gaining scale, the company stands to benefit from operating efficiencies. Pick-up in industry demand along with new fleet addition should help the company post steady earnings growth in the coming years. Price hikes should ease off the temporary blip of margin pressures.

We expect VRL to be a stable compounder over the next few years and therefore, advise long-term investors to accumulate the stock on dips.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.