Tyre companies have posted mixed set of numbers in the second quarter of fiscal year 2019 (FY19). Strong volume growth helped the companies report healthy topline growth, but rising raw material (RM) prices mounted pressure on their profitability.

Raw material prices continue to inch up and remain a big concern. Most companies, however, have started passing on the rise in input cost to their customers by increasing prices of their products.

Concerns over demand from original equipment manufacturers (OEMs) and margin pressure have kept sentiment subdued for tyre companies. This soft patch, however, will provide a good opportunity to buy into the fundamentally-strong business for the long-term.

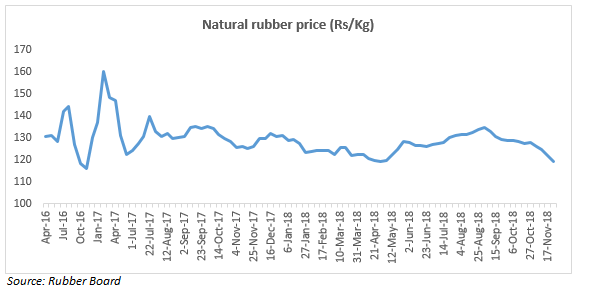

Raw material prices: A big worryTyre companies are operating under fragile industry dynamics with an increase in commodity prices and the depreciation of the rupee leading to an increase in raw material cost, which in turn puts pressure on operating profitability.

Natural rubber prices have started falling as production has resumed in Kerala after the recent floods. Also, the recent softening in oil prices is expected to lend support to the raw material basket as a whole.

Multiple macroeconomic factors such as rising interest rates, fuel prices and compulsory long-term insurance have dampened the demand for passenger vehicles and two-wheelers. The commercial vehicle (CV) segment, however, continued to be resilient and posted good volume growth.

We believe market conditions are expected remain sluggish in the near term but the long-term outlook for all segments continues to be positive on the back of economic growth, rising income levels, lower penetration, the government's thrust on increasing rural income and a growing focus on infrastructure and construction.

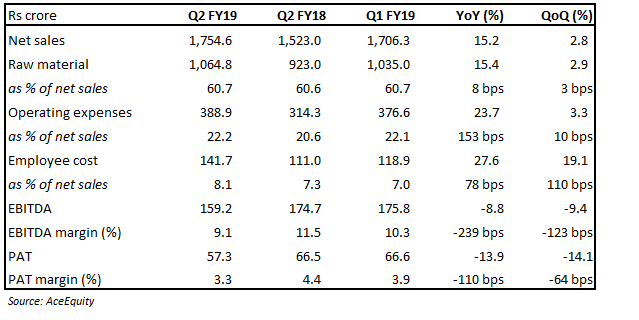

CEAT posted a year-on-year (YoY) growth of 15.2 percent in its net revenue from operations, primarily due to a 12.4 percent rise in volumes. The volume growth came on the back of increased demand from both OEMs and the export market. The company reported a 2.8 percent rise in realisations, thanks to a favorable mix tilted towards replacement and passenger tyres, and the company's decision to increase product prices.

The company's earnings before interest, tax, depreciation and amortization (EBITDA) fell 8.8 percent YoY on the back of a significant increase in operating expenses (higher advertisement expenses) and employee cost (increase in salaries, new employee cost and one-time expense of Rs 7–10 crore because of a settlement with workers in Bhandup and Nashik). As a result, EBITDA margin contracted 239 basis points.

We believe the company is poised to benefit from an increase in market share in the passenger vehicle (PV) and 2/3-wheeler segments, and capacity expansion in select pockets.

MRF reported a mere 9.4 percent YoY rise in its net revenue for the reporting quarter. The revenue growth was much lower than that of its peers, indicating a loss of market share, primarily due under-penetration in the truck/bus radial tyres segment and increased competitive intensity in the two-wheeler segment.

The company's EBITDA margin contracted 208 bps as operating expenses spiked.

Apollo Tyres reported a strong growth of 22.5 percent on year in its net sales on the back of good performance across regions. The company's business in Asia Pacific, the Middle East, and Africa (APMEA), grew 25.1 percent and its business in Europe grew 17.4 percent, thanks to better volume growth and a rich product mix.

Demand in India continued to be strong from original equipment manufacturers (OEMs) and aftermarket players. The company's net revenue from India rose 25 percent on year, primarily due to volume growth. In terms of segment-wise volume growth within India, truck volumes grew 35 percent, PVs grew at 17 percent, farm tyre volumes rose 17 percent and two-wheeler volume grew 60 percent on year.

The company's EBITDA margin expanded 49 bps on year but contracted 134 bps on quarter. We believe EBITDA margin should improve due to strong volume growth, and the 3 percent hike in product prices in November and the 2.5 percent hike in September before that, to pass on the rising raw material price pressure.

The management maintained its guidance on capital expenditure at Rs 6,500 crore over the next three years. And, on the capacity expansion front, the management indicated that the company is on track to ramp up its Chennai plant's capacity to 12,000 tyres per day (TPD) from 10,000 TPD currently. New plant construction in Andhra Pradesh for CVs and PVs has also started, and is expected to be commissioned in H2 FY20. Further, the Hungary plant's capacity is expected to be 16,000 TPD by end of FY19.

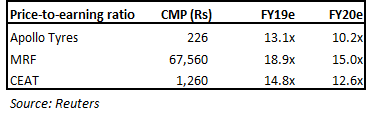

Amid market volatility, sluggish industry demand outlook and significant rise in RM prices, stock prices of tyre companies have come down significantly from their 52-week highs (MRF: 17 percent, Apollo Tyres: 27 percent and CEAT: 38 percent).

MRF is the leader in the space and deserves premium valuations because of its formidable record. We would advise investors to accumulate the stock on any short-term weakness.

After the recent correction in CEAT, the valuations are at reasonable levels and the plan for capacity expansion is expected to bring in growth. Similarly, Apollo Tyres is also trading at a reasonable valuation and we advise long-term investors to accumulate these two stocks on any weakness as these companies might witness some pressure due to the rise in RM prices and moderation of demand in the upcoming quarter.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!