Highlights

- Volumes in Q2 were higher by 7 percent

- Margins improvement aided profit growth

- Building new sorting centres at Pune and Gurgaon- Trading at 32 times FY20 estimated earnings

-------------------------------------------------

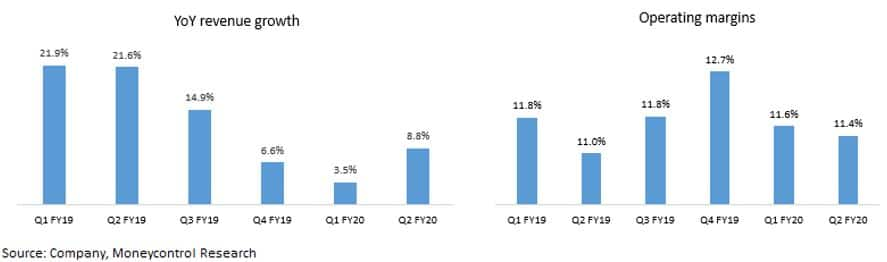

Third-party express logistics service provider TCI Express (TCIX) continued to deliver a robust quarterly performance in Q2 FY20. Sales growth saw a slight recovery in the quarter gone by, while continued expansion in operating margins aided profits.

Quarterly result highlights

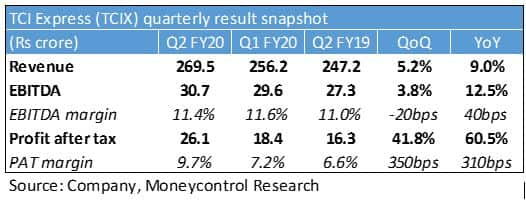

TCIX’s revenues increased by 9 percent year-on-year (YoY) to Rs 269 crore in Q2. Underlying revenue growth was largely driven by higher volumes. New client addition in the SME segment aided a 7 percent jump in volumes. Pricing growth was, however, muted at around 2 percent.

Its operational performance got a boost from margin expansion. Price hikes, higher economies of scale and operating efficiencies contributed to a 12.5 percent growth in earnings before interest, tax, depreciation and amortization (EBITDA), which came in at Rs 31 crores. Margins, however, dipped slightly on a sequentially basis. The government's recent move to reduce corporate taxes boosted earnings of TCIX to Rs 26 crore.

Cash flow generation continues to be strong. The company has repaid all its outstanding debt during the previous quarter. During Q2, TCIX further strengthened its balance sheet and ended the quarter with a cash balance of Rs 27 crore.

During H1 FY20, the company invested Rs 7 crore towards the expansion of sorting centres and technology upgradation. The company expects a significant pick-up in investments in second half and expects to incur Rs 80 crore towards capital expenditure for the full year. TCIX is upgrading its old sorting centres by developing larger sorting centres at Pune and Gurgaon. The construction of these mechanised warehouses is underway and the same will be operational from FY21 onwards.

The demand pattern was quite mixed during the quarter gone by. For TCIX, business volumes were stronger during the months of July and September. However, floods in various locations along with muted manufacturing activity had an adverse effect on August volumes. From a sector perspective, the demand footprint was weak in the engineering and industrial sectors, but better in SME, pharma and retail industries.

Overall demand environment has been challenging, although the company saw a minor uptick in demand at the onset of festive season. The management guidance of 13-14 percent revenue growth in H2 FY20 hinges on a revival in overall economic activity. However, targeted number appears challenging as the slowdown has spread across multiple sectors over the past few months.

Outlook and Recommendation

Express logistics currently forms a small portion of the overall logistics market and the demand for express cargo is anticipated to grow much faster (~2x) than the growth in economic activity of the country. The medium to long-term outlook on TCIX appears fairly promising on the back of increasing demand for time-bound delivery and structural reforms in the industry. However, the near-term growth prospects of the sector as well as TCIX appear sluggish as the demand for material handling continues to moderate. Freight rates are becoming hyper-competitive as the truck carriers are facing low capacity utilisation levels. Any correction in freight prices could squeeze the margins of the entire logistics value chain --including that of TCIX.

TCIX is among our preferred pick in the logistics sector owing to its solid business fundamentals and proven track record of execution. The focus on technology and wide distribution network would further widen its business moat in the coming years. Superior returns on capital should sustain due to its asset light business model.

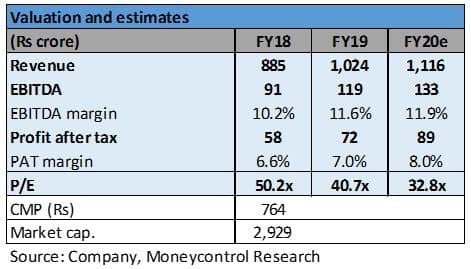

However, the stock recently retraced from its life-time highs and current valuations (32.8 times based on FY20 projected earnings) leaves no room for error on the execution front, and therefore offers a low margin of safety for investors. The business has potential to generate shareholder wealth but investors should wait for a correction, and fresh capital allocation should be deployed in a phased manner.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.