Edelweiss Financial Services, one of the fastest growing non-banking financial companies (NBFCs) in the country, is considering part monetization of its stake (around 20-25 percent) in its wealth and asset management business as per media sources.

As reported by The Economic Times, the potential deal is likely to value the wealth and asset management business around Rs 12,000-15,000 crore. Edelweiss’ current market capitalization is around Rs 17,300 crore. The stock has corrected more than 40 percent from its 52-week high after concerns over liquidity engulged the NBFC sector.

If the deal value reported by ET is anything to go by, the upside to the stock can be meaningful.

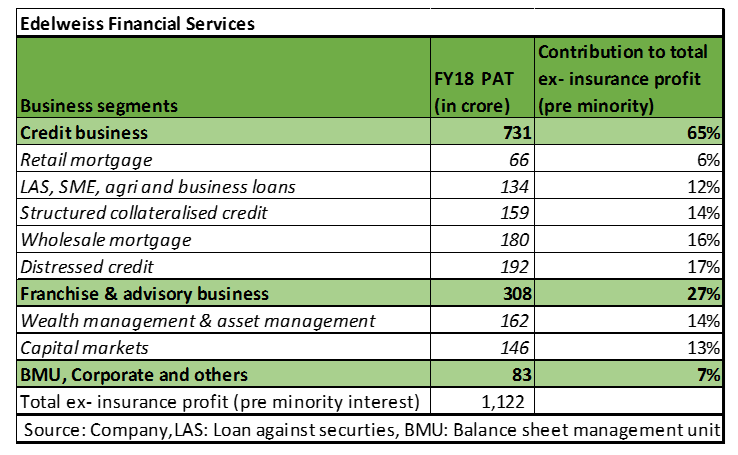

The Edelweiss group, which commenced operations as a capital market player, has incubated several business segments like credit (wholesale and retail lending), distressed assets, insurance, and wealth and asset management over the past few years.

While the news is as yet unconfirmed, the reported interest enthuses us, especially the fact that the wealth and asset management business is drawing huge interest despite the business being adversely impacted by SEBI’s order to cap total expense ratio and resultant cut in distributors’ commissions.

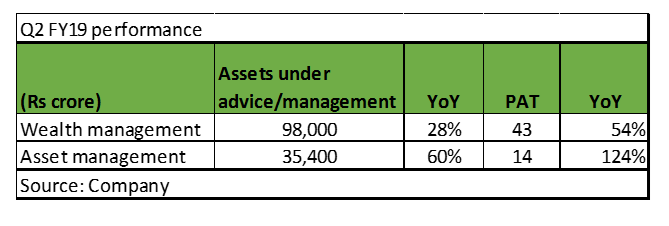

Edelweiss is India’s third-largest wealth manager after Kotak Mahindra Bank and IIFL Wealth. Its assets under advice (AuA) in wealth business stood at Rs 98,000 crore, increasing by 28 percent YoY as at end September. 23 percent of these assets are under the advisory model while a bulk of it is distribution assets.

The asset management business comprising mutual funds and alternative assets is small but fast growing. It saw a 60 percent YoY growth in assets to Rs 35,400 crore, as at end September.

Earlier this year, IIFL Wealth (subsidiary of IIFL Holdings), the largest wealth manager with assets of around Rs 1,30,000 core, raised Rs 746 crore from marquee investors. It valued the company at Rs 14,600 crore, which is 38 times its trailing (FY18) profits.

Edelweiss has multiple business lines. But it is the fee-based wealth and asset management business that is drawing interest of the top PE investors. There are strong reasons for the same.

First, the wealth and asset business does not have high capital requirement. Hence, it can potentially generate non-linear profit growth and RoE expansion.

Second, revenue streams from these businesses are less cyclical relative to capital market business and can provide cross-selling opportunities.

Last but not the least, the outlook for both wealth and asset management sector is promising as the market is underpenetrated, and will likely grow in sync with India’s economic growth and rising income levels in the economy.

The phenomenal growth in wealth, mutual fund and alternative assets has been the key highlight in the growth of Edelweiss over the last two years. However, so far it was overshadowed by its ARC (asset reconstruction company) business, in which Canada’s second largest pension fund, CDPQ holds 20 percent. The talks of potential stake sale brings wealth and asset management business to the forefront.

Edelweiss has fast evolved into a ‘bank-like’ structure. Its lending business is facing sectoral headwinds in form of high-interest rates, reduced liquidity and intense competition.

However, there are multiple growth levers for the stock in the long term. A potential stake sale in the fee-based business can be an immediate trigger prompting investors to keep the stock on their radar.

Follow @nehadave01For more research articles, visit our Moneycontrol Research page.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.