ITC's quarterly result was in line with expectations. While the cigarettes business was adversely impacted by GST flipflops, improving topline growth and margins for the FMCG business was comforting.

Quarterly update

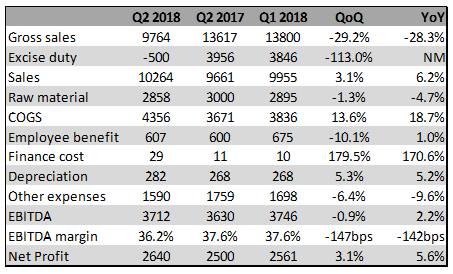

ITC reported a Q2 2018 sales of Rs 16,391 crore (on a like-to-like comparison) after excluding rebates and discounts translating to year-on-year (YoY) growth of 3.9 percent. Headline numbers were in line with expectations. Cost of goods sold was higher by 19 percent, mainly due to change in inventories, which impacted EBITDA margins by 142 bps on reported basis. At net profit level, company reported 5.6 percent YoY growth

Company reported lower volumes on account of increase in tax incidence in the GST regime. ITC’s business was also impacted due to non-availability of additional duty surcharge credit on the transition stocks.

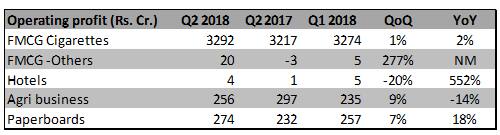

FMCG business – Up 10 percentITC’s core FMCG business posted a comparable sales growth of 10 percent which is broadly in line with the industry reported growth so far. As per management, this growth was aided by strong performance in Branded Packaged foods and Personal care businesses. It’s noteworthy that closest peer HUL also reported a decent 8 percent YoY growth for the Personal care division wherein it reported good traction for all categories except for oral care segment.

Among product lines, which garnered traction were Aashirvaad atta, Bingo range of snacks and B Natural juices. Further, among Personal Care products, ‘Engage On’ range of products witnessed good customer response.

Other businessesPerformance of other segments of businesses were subdued. Hotels was impacted by highway liquor ban, Agribusiness was lackluster due to shortage of tobacco leaf crop (drought in Andhra Pradesh in 2016) and Paperboard business remained weak due to subdued demand in Cigarette industry.

With respect to trade channel, company mentioned that wholesale channel is yet to fully recover but offtake in the retail channel has normalized towards the end of quarter.

Overall, ITC result was on expected lines, adverse impact on cigarette volumes was more than compensated by pick up in FMCG business. Improving offtake in the FMCG business and the traction of product portfolio is comforting, which adds to our positive view on the stock.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.