The asset under management (AUM) of the mutual fund industry at the end of December totalled Rs 23.37 lakh crore, up 2 percent compared to the previous month, as per data released by AMFI on February 11.

The mutual fund (MF) industry witnessed a total inflow of Rs 65,439 crore in January compared to an outflow of Rs 1.37 lakh crore in December mainly due to net inflows into liquid and income funds. Flows into equity funds continued to decelerate while the arbitrage category saw redemptions.

Equity inflows tapering downInflows into equity funds (including ELSS) declined 7 percent on a month -on -month (MoM) basis to Rs 6,158 crore in January. The decline can be attributed to fading equity outlook, market volatility and weak global cues.

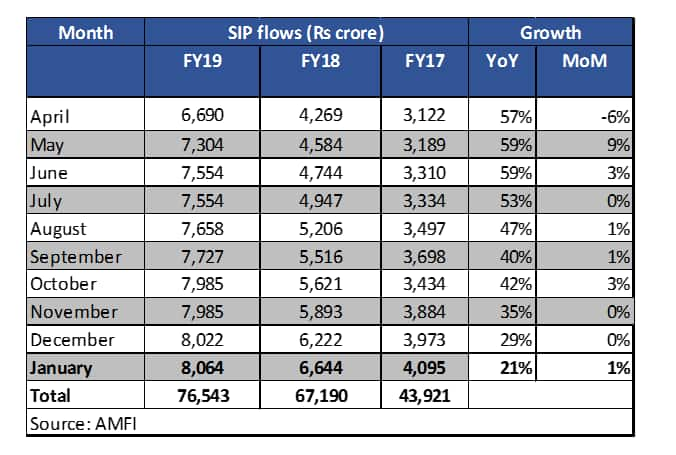

While overall equity flows have been weakening, investment in equity funds through systematic investment plans (SIPs) which is relatively sticky continued holding the fort with Rs 8,064 crore funds mobilised in January. The increased share of SIP contribution has been the key success story of the mutual fund industry in the past couple of years. If the current monthly run rate of SIP of Rs 8,000 crore is sustained, the MF industry will receive equity inflows of at least around Rs 100,000 crore in the next financial year, which is sizeable.

Monthly equity inflows have come off significantly from the high of Rs 20,308 crore seen in November 2017. That said, the underlying trend is still positive as January was the 56th consecutive month with a rise in the total number of accounts (folios as per mutual fund parlance), fueled by growth in retail folios. This is a very encouraging trend indicating buoyancy of retail flows.

Thanks to strong equity mutual funds inflows of Rs 94,980 crore in this financial year so far, Indian equity markets have endured selling by foreign portfolio investors to the tune of Rs 42,874 crore during the same period. In the absence of strong domestic inflows, FPI selling would have wreaked havoc.

Having said that, the resilience of domestic equity flows will be put to test in the coming months as we head closer to general elections. The moot question is will the domestic equity flows sustain? There is no clear answer to this as a lot hinges on the election outcome. So far, while fresh investments into equity mutual funds have come off, the MF industry is not witnessing increased redemption pressure or SIP cancellations. However, it will not be a surprise to see a dreadful scenario of domestic outflows in case of a fractured mandate in the election.

While demonetisation still continues to be widely discussed for its efficacy, the action surely boosted “financialisation of savings” (increase in the size of the financial sector) and accelerated flows into equities through mutual funds. The upcoming elections, however, will be a real litmus test that will reveal whether the increased inflows to equity MFs is a structural or cyclical phenomenon.

That said, the granularity of the flows as reflected in rising SIP amount and the higher share of individual investors in MF industry’s total AUM (53.6 percent as at the end of December 18) are encouraging.

What are the key implications of the liquid flows?Liquid or money market, that has been at the center of the volatility in equity markets as well as fixed income markets saw inflows of Rs 58,637 crore in January. This comes after outflows of Rs 1.49 lakh crore in the previous month which was a quarter-end phenomenon that included withdrawals to meet advance tax payment deadlines.

While money markets have stabilised, the liquidity situation still remains fragile. As of December 2018, Indian MFs hold a significant proportion (around 17.2 percent or Rs 2.3 lakh crore) of their assets in commercial paper and corporate debt paper of NBFCs. In the aftermath of the liquidity crisis, MFs have turned extremely selective. Also, given the recent events around DHFL and trouble at another large group, improved liquid flows may not necessarily translate into a better funding environment for all NBFCs.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.