Nitin Agrawal

Moneycontrol Research

Automotive Axles (AAL) is a provider of rear drive axle assemblies to commercial vehicles (CV). It caters to all major automobile manufacturers in this space. Market leadership, marquee clientele, operating leverage, lean balance sheet and strong financial performance should support earnings going forward. The business is also gearing itself for the upcoming electric vehicle (EV) wave and trades at reasonable valuations which beckon investor attention.

AAL provides rear drive axle assemblies to CVs

The company is the largest manufacturer of rear drive axle assemblies in India. Major products include drive axles, non-drive axles, front steer axles, specialty and defence axles and drum and disc brakes. It also manufactures S-Cam actuated quick change air brakes and trailer axles for 10 tonne to 13 tonne gross vehicle weight (GVW).

AAL supplies its products to major OEMs across India and abroad and caters to segments such as medium and heavy commercial vehicles (M&HCV), military and off-highway vehicles, aftermarket and exports segments. AAL has manufacturing plants in Mysuru, Rudrapur and Jamshedpur.

We exude confidence in the company on the back of the following:

Robust client base

Over the years, AAL has been able to develop strong relationship with marquee clients in the industry and boasts of domestic clients such as Ashok Leyland, Daimler India Commercial Vehicles, MAN Trucks India, Mahindra & Mahindra, Tata Motors, VE Commercial Vehicles and Asia Motor Works. Ashok Leyland is the largest client of AAL followed by Tata Motors.

In terms of international presence, AAL continues to deepen its presence in China, US, France, Italy and Brazil. In FY18, it added Volvo Thailand to its client list by securing export order for solo and tandem axles and brakes.

Ownership lends comfort

Promotors holding of over 71 percent of total shares in the company lends comfort in the company. Additional comfort comes from holdings of mutual funds such as Reliance Focused Equity Fund and UTI-Midcap Fund.

Strong CV cycle

AAL is a proxy play on growth in the CV segment. The latter passed through a tough phase in FY17. The same continued at the start of FY18 on the back of various regulatory challenges. The segment, however, picked up strongly in the latter half of FY18 and witnessed a strong 19.9 percent year-on-year volume growth in FY18 as compared to 14.2 percent overall auto industry volume growth. Strong growth was supported by increased focus on infrastructure development, mining activity and normal monsoon.

We believe the momentum would continue on the back of government’s continuous focus on rural economy and infrastructure ahead of general election next year. Despite the new axle load norms, the momentum in CV demand continues. Secular growth in CV demand is expected to augur well for AAL.

Additional demand drivers include rebuilding Kerala infrastructure after the floods and pre-buying in Q4 FY20 ahead of new emission norm (Bharat Stage-VI) implementation at the start of FY21.

Capacity expansion to meet rising demand

In light of strong demand for its products, AAL is expanding its capacity, which will help it cater to growing demand. It plans to increase axle housing line’s capacity to 20,000 units from 16,500 units per month and brake capacity to 120,000 units from 83,000 units per month.

Gearing for EV wave

The EV wave is the upcoming disruption within the Indian auto industry. AAL is gearing itself to provide electrical solutions through electric drivetrains for the electric CV segment. The management believes EV production is poised to grow in India over the next few years.

Strong operational efficiencies, reduction in debt

AAL posted a strong compounded annual growth rate of 49 percent in net revenue over FY15-18 led by strong demand accruing in from CVs, constant focus on developing new products and rich product mix.

Its earnings before interest, tax, depreciation and amortisation (EBITDA), however, witnessed much higher annual growth rate of 67.6 percent over the same period. Growth was supported by operating leverage and efficiencies. EBITDA margin also expanded 326.5 bps over the same period.

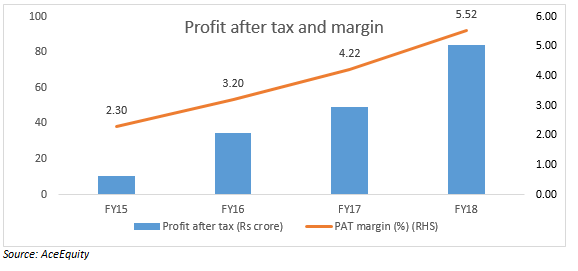

Net profit grew 99.7 percent CAGR over FY15-18 on the back of strong operating performance and reduction in debt. It has become a debt free company and reduced its total debt-to-equity ratio to zero from 0.21 times in FY15.

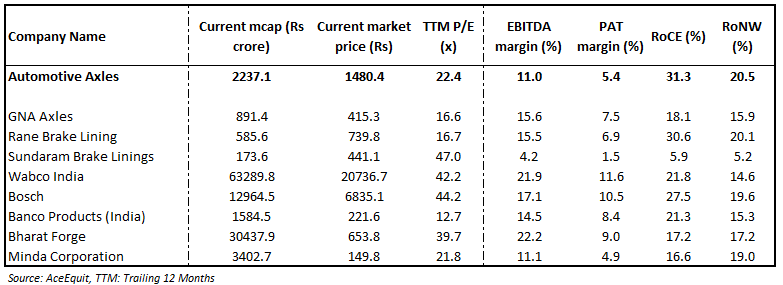

Operational efficiencies and reduction in debt has helped the company improve its return ratios. Return on Capital Employed (RoCE) and Return on Net Worth (RoNW) expanded 2,578 bps and 1,691 bps in FY18 over FY15, respectively. In FY18, AAL’s RoCE and RoNW stood at 31.27 percent and 20.45 percent, respectively.

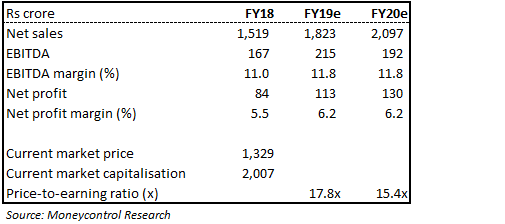

Valuations at reasonable levelsAmid recent market volatility, the stock has corrected 27 percent from its 52-week high, which made valuations attractive. AAL currently trades at a reasonable valuation of 17.8 times and 15.4 times FY19 and FY20 projected earnings, respectively.

Peer analysis

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!