Krishna Karwa

Moneycontrol Research

Highlights:

- Page Industries is our top pick

- Industry growth outlook remains promising

- Premium products to aid margins

- Focus is on strengthening multi-channel distribution

- Marketing spends will increase

- Working capital challenges may impact earnings

--------------------------------------------------

Presence of retail channels pan-India, growing preference towards brands, increased awareness about hygiene, marketing and brand extension initiatives have helped innerwear and leisurewear stocks (ILCs) grow over the years. In this context, it is worth having a look at some of the country’s leading ILCs to determine the best investment proposition.

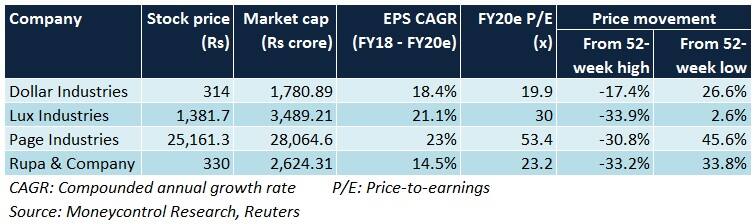

Page Industries is our preferred pick owing to its strong execution capabilities and price correction in recent months. Dollar Industries and Rupa & Company, despite their undemanding valuations, are streamlining their working capital. This implies there could be better entry opportunities at a later stage, subject to how effectively their strategies pan out. Lux Industries’ heady valuations limits its upside potential as of now.

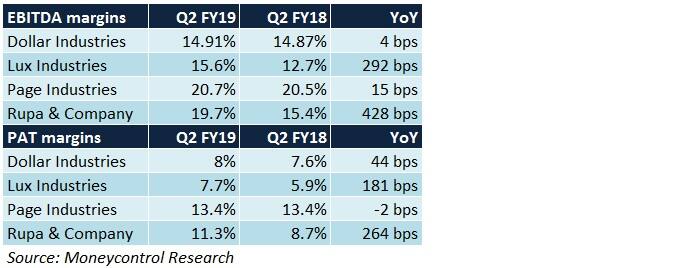

In Q2 FY19, Page Industries reported the most disappointing set of numbers, especially on the margin front.

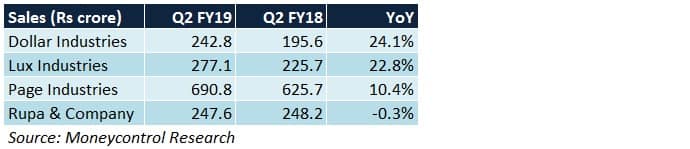

Earnings snapshot

Going forward, here’s what one can look forward to:

Dollar Industries

Revenue drivers: In case of its flagship brand -- Big Boss, the company is banking on volume growth. Sale of economy brands have been on an uptrend as well. Premium products under the 'Force NXT' brand are being promoted actively.

Under a joint venture with Pepe Jeans, the company launched 37 products in H2 FY19 in three south Indian cities. Reach of these products will expand to more cities in south and western India in due course.

Margin drivers: The management is consolidating its supply chain by reducing the number of intermediaries in its trade channels. The share of premium products to annual revenue is slated to rise to 75-80 percent by FY20 from 65 percent in FY18.

The inventory build-up prior to winters is likely to be liquidated during H2 FY19. Conscious efforts are being made by the management to reduce its debtor and creditor days. These measures should ease working capital processes and improve cash flows.

Lux Industries

Revenue drivers: Onn by One8, a new premium brand, will be launched in Q4 FY19. Sales of Venus, an economy womenswear brand, is seeing strong demand. Around 30-40 distributors are likely to be added in south India every year.

Margin drivers: Lyra and GenX, two new brands, fetch higher realisations vis-à-vis other variants. These products are expected to gain scale, especially once the merger of two promoter group companies (JM Hosiery & Company, Ebell Fashions Pvt) with Lux Industries concludes by FY19-end. Manufacturing efficiencies (through increased impetus towards subcontracting), improved inventory/receivables management and timely price hikes will be prioritised.

Page Industries

Revenue drivers: The number of exclusive brand outlets is likely to increase to over 1,000 by FY20-end from 470 as of FY18-end. Additional products for women and children will also be introduced at regular intervals to diversify its customer base. Active wear and athleisure as a segment is gaining traction at a brisk pace.

Margin drivers: Given Jockey's brand recall, the company rarely resorts to discounting. The company is able to pass on incremental raw material costs to its distributors. To keep the business asset-light, the share of outsourced manufacturing operations is estimated to increase to 40 percent by FY20, vis-a-vis 20-25 percent in FY18.

Rupa & Company

Revenue drivers: Increased penetration across multi-brand outlets and large format stores will be pivotal in building brand visibility. Addition of exclusive brand outlets (from 10 at present) is on the agenda too. The company is exploring opportunities in the women and children wear categories.

Margin drivers: The share of top-tier licensed brands (Fruit of the Loom, FCUK) and premium owned brands (Euro, Macroman) in annual sales is expected to increase in coming fiscals.

Which stocks should you invest in?

Though ILCs are well-poised in terms of growth prospects, some of them could face margin pressures. In addition to company-specific risks, the major challenges for ILCs include unforeseen changes in fashion trends, stiff competition from foreign brands, volatile raw material prices and an inability to generate incremental sales despite high investments in branding/advertisements.

Dollar Industries is going through a rationalisation phase to curtail costs, while simultaneously increasing advertisement spends in connection with its high-value products. Though it is a good pick at current levels, it is going through a phase of restructuring. So, a sharp re-rating appears unlikely in the immediate future.

Rupa & Company has been facing issues because its dealers have been demanding extended credit periods. This, in turn, could lead to debt levels spiking. At present, turnover from high-margin international brands (FCUK, Fruit of the Loom) is not material enough to boost overall margins significantly. Taking these into account, we foresee some quarterly disruptions in the near-term. Therefore, one may consider accumulation on price corrections.

Lux Industries, a company with healthy fundamentals, should see a noticeable increase in its earnings once the merger is complete. However, given the stock’s steep valuation vis-à-vis its peers, we suggest buying on dips.

Page Industries' ability to derive operating leverage should facilitate further earnings accretion, notwithstanding the top-line disappointment in Q2 FY19.

The stock's valuation will continue to remain stretched at any price point. To sustain such elevated price-to-earnings multiples, the company will have to consistently deliver industry-leading numbers, and an inability to do so may result in downsides.

Nonetheless, three factors make us bullish on the company. First, the stock has been on a downward price trajectory since August 2018. Second, it is fundamentally robust. And lastly, it is stocks like these that tend to re-rate faster when the markets recover. This is because investors prefer playing safe by parking their funds in reliable and proven bluechips rather than opting for midcaps.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!