Madhuchanda Dey

Moneycontrol Research

The new leadership at Axis Bank has outlined the bank’s medium–term growth strategy while announcing its Q3 FY19 earnings. With an aim to achieve 18 percent return on equity (RoE) within the next three years, the strategy rides on three pillars of growth, profitability and sustainability. Strengthening the liability franchise as well as processes across all levels and risk adjusted growth lie at the heart of this drive. With a clear strategic intent, the bank looks all set for a rewarding long-term journey for its investors.

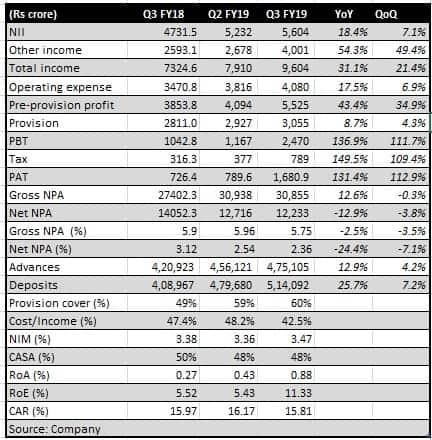

The headline jump in profitability was impacted by recovery in written off accounts, but the core wasn’t uninspiring.

Key positives

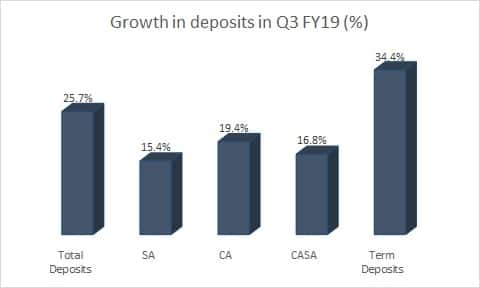

- The quarter under review saw exceptionally strong growth in deposits (25.7 percent) driven by low cost CASA (current and savings accounts) as well as term deposits. The latter was supported by both retail as well as wholesale. Probable shift in liquidity from mutual funds could be one of the drivers of this surge

Source: Company

- The bank boasts of a solid granular deposit base with retail term deposits along with low-cost CASA constituting close to 80 percent of total deposits

- Q3 witnessed a significant jump in non-interest income. Driven by retail fees, while core fees grew by over 16 percent, the sharp spurt came from recovery in written-off accounts (Rs 998 crore as against Rs 40 crore in the year-ago quarter) and monetisation of stake in two strategic investments, resulting in gains of Rs 342 crore

- The recovery in one of the large steel account (cash recovery of Rs 714 crore) resulted in a five basis points (100 bps=1 percentage point) positive impact on interest margin. Net interest margin improved 11 bps sequentially and 9 bps year-on-year to 3.47 percent. The benefit of MCLR (marginal cost based lending rate) repricing is also starting to contribute. The management is quite confident of maintaining its improved margin trajectory

- While overall advances grew 13 percent, there was de-growth in the international book. Domestic advances grew 18 percent, supported largely by retail, which is now close to 49 percent of total advances

- Quality of lending is improving with 86 percent of SME exposure rated SME3 and above and 82 percent of corporate exposure rated A or better. The decline in the ratio of risk weighted assets to total assets stands testimony to the same

- The improvement in quality of the book has resulted in capital conservation with the bank adding nine bps to its core capital. Its overall capital position is extremely healthy (Tier I: 13.07 percent) to take care of future growth acceleration

- Asset quality is stable with gross and net non-performing assets (NPA) declining to 5.75 percent and 2.36 percent, down from 5.96 percent and 2.54 percent reported in the previous quarter, respectively

- Most of the slippage in Q3 were from below BB rated accounts and this pool has declined by 14 percent sequentially to Rs 7,645 crore. The management after a careful scrutiny of the books feels that the BB and below rated book can only improve from hereon and that the rating downgrade exercise is complete

- The bank has created an ad-hoc provision of Rs 600 crore towards non-performing assets. Excluding this, the provision coverage ratio (provision held against NPA) has improved to 75 percent. Q3 also saw a provision write-back on investment

- The management is planning to focus on its subsidiaries and targets to take them to a meaningful size in the coming years through the organic as well as inorganic route

Key negatives

- RBI audit for FY18 pointed to minor divergence. Accounts worth Rs 225 crore wasn’t recognised as NPA. However, the same had turned into a bad loan in Q1 FY19. The regulator wanted the bank to provide an additional Rs 99.7 crore, which has also been complied with

- CASA ratio has decelerated to 46 percent

- Although recovery was encouraging, the total quantum of gross slippage at Rs 3,746 crore was a tad higher

OutlookThe bank under the new leadership and a revamped senior management is eyeing strong risk adjusted growth, with a thrust on garnering market share, improving cost matrix and leveraging technology. With the worst of corporate NPA cycle behind, a moderation in credit cost would also be a key earning kicker. At 2.6 times FY20 estimated adjusted book, we do see scope for re-rating should the bank successfully complete its journey of reaching high-teen RoE in the future. Axis Bank is an ideal candidate for any long term portfolio.

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!