- Government increases advertisement rate by 25 percent - Revenue and margins likely to improve in FY20 - Multiple levers for earnings improvement and attractive valuations - Jagran Prakashan and DB Corp, leading players, ripe for re-rating

-------------------------------------------------

There is finally some good news for print media companies that have suffered a flurry of setbacks in the past two years or so. On January 8, the Ministry of Information and Broadcasting (MIB) announced a 25 percent increase in the rates for newspaper advertisements by the Bureau of Outreach and Communication (erstwhile Directorate of Advertising and Visual Publicity- DAVP), an agency that takes care of the paid publicity requirements of all Central Government organizations. The rates will be effective immediately and valid for three years. The last revision in advertisement rates took place in 2013 when an increase of 19 percent was announced over and above the rates of 2010.

Shares of leading print media companies reacted positively to the development gaining between 5-20 percent in the first half of trading on January 9.

We sniffed the likely reversal of misfortune of the print media companies and recommended these stocks as safe bets heading into an election year. Read: Ideas for Profit | Jagran Prakashan, DB Corp to be key beneficiaries of election season

Earlier, the central government was compulsorily required to tender notices in print media. The practice was stopped in FY18 through changes in General Financial Rules (GFR, 2017). Despite this, the substantial revenue (around 15-20 percent of total revenues) of newspaper companies comes from the government. As a result, most players will benefit immensely from this move. Subsequent to the ad rate hike, we will see revenue increase and improvement in EBITDA margins for leading players. While the impact will not be visible in the coming quarter as the existing contracts carry the older rates, FY20 financials stands to improve due to the directive. Consequently, we can expect valuation re-rating of print media companies.

Print sector reeling under multiple issuesThe print media industry has been saddled with multiple roadblocks in the past two years. It all began with demonetisation which disrupted the advertising revenue growth of the sector. While the sector was still recovering from the aftereffects of demonetisation, the implementation of GST and RERA caused many advertisers to cut down on their advertisement budgets again. As the second largest recipient of advertising revenue after broadcasters, print media sector was shaken by the new tax regime as print advertising came under 5 percent GST ambit. Consequently, revenue growth of newspaper industry in FY18 was the lowest in a decade at 3.9 percent as per KPMG report.Just when the sector started stabilising with ad spends reverting back to normal level, a rise in newsprint prices jolted sentiments again.

But revival on the cardsSo while the print media is facing tough times, what makes us constructive on its future? The answer isn’t quite so simple and there are multiple reasons for the same.

First, upcoming elections are expected to boost advertising revenue. During the 2014 national elections, advertising revenue had risen by around 7 percent for the sector. Taking a cue from the same, we expect a rise in advertising revenue in H2FY19 on the conclusion of several state elections and in the FY20 due to national elections.

Second, the biggest respite for newspaper companies comes from peaking of newsprint prices. The steep slide in crude is good news. The cost of newsprint has a positive correlation with crude prices as its production is a highly energy-intensive process. Stabilising rupee would further comfort the newspaper companies importing newsprint.

Third, the operational performance of print companies is likely to improve. Most companies have initiated cost-control measures such as curtailing circulation of less remunerative copies and optimising pagination to reduce the newsprint consumption. Also, the industry may consider increasing the cover prices. With around 70 percent of newspaper companies’ revenue coming from advertising, circulation so far has merely functioned as “a loss-leader to build audiences”. However, with the sudden and unusual increase in raw material costs, the likelihood of increasing cover prices though small, has increased.

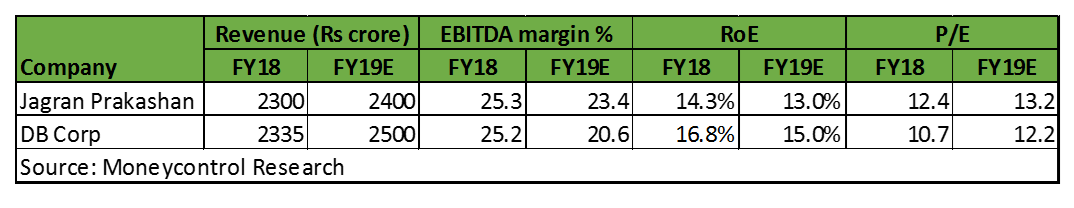

Last but not the least, attractive valuations motivates us to look at leading print media companies - Jagran Prakashan and DB Corp. Valuations of these companies are at historic lows. As such, the current valuation reflects most of the concerns facing the industry.

For print media companies, FY18 was an aberration and FY19 too has been a difficult year so far. While competition from digital the world is real, though much less pronounced for Hindi and regional newspapers, reports of the demise of newspaper industry seems vastly exaggerated. Multiple levers of earnings improvement in FY20 including yesterday’s rate hike announcement makes print media stocks worthy investment in an election year.

Follow @nehadave01For more research articles, visit our Moneycontrol Research pageDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.