Nitin AgrawalMoneycontrol Research

Hero MotoCorp (HMCL), the largest player in two-wheeler (2W) segment, reported a decent set of numbers in its Q1 FY19 result. While it posted strong volume and revenue growth, its operating margin witnessed a contraction due to rise in raw material prices. Operating leverage, however, arrested the fall in operating margin.

Strong leadership in two-wheeler segment, revival riding on rural growth, a slew of new launches, structural changes from an upcoming product rejig, focus on exports market and reasonable valuations make it a stock worth accumulating for long-term investors.

Quarterly snapshot

Volume continues to grow

Volume continues to grow

In terms of quarterly performance, HMCL registered a year-on-year (YoY) volume growth of 13.6 percent, helped by improving rural sentiments. The management expects the momentum in sales to continue on the back of good monsoon, increase in minimum support price (MSP) lifting rural sentiments and government’s focus towards rural areas.

On the back of good volumes, the company registered a growth of 10.4 percent (YoY) in net revenues from operations as the realization declined 2.9 percent due to Haridwar benefits expiry.

Operating performance impacted by higher RM

The company reported a contraction of 60.5 bps (YoY) in its earnings before interest, tax, depreciation and amortization (EBITDA) margin in Q1 FY19. The contraction was due to significant rise in raw material prices. The company, however, arrested the fall in margin on the back of operating leverage leading to reduction in other operating expenses.

So what makes this stock a long-term bet?

Strong presence in two-wheeler motorcycle segment

HMCL is a formidable player in 100/110cc segment and maintains its leadership position on the back of its strong distribution network and brand recall. The management expects to continue to achieve volume growth in this segment which should be better than the industry’s double-digit growth rate coming on the back of normal monsoon, market share gains and network reach.

Impact of competition – focusing on brand than discounting

Commenting on the competition’s action on taking the price war to entry level segment, the HMCL’s management mentioned that it will not be going for discounting to buy market share. In fact, the management indicated that the discounting has been going on for more than a year and despite that, the company has been able to expand its market share in the entry-level segment to 60 percent in FY18 from 55 percent in FY17. It believes in building a strong brand and would continue to focus on the same to continue to capture market.

Rejig in portfolio to include premium products

Recognizing the fact that the company is under-represented in the growing premium motorcycle segment, the management has started reworking its product strategy. The management has unveiled two 200cc motorcycles – ‘XPulse’ and ‘Xtreme 200R’ in auto expo 2018. The sales of these model would begin in FY19, ahead of festive season.

In 125 cc segment, the company has launched the new ‘Passion PRO’, ‘Passion XPRO’ and ‘Super Splendor’ to strengthen its leadership in 100-125cc motorcycle segments. Additionally, Hero has forayed into high growth 125cc scooter market by launching Maestro Edge 125’ & Duet 125 at Auto Expo as it believes that the next leg of growth in scooter segment is expected to come from this segment.

Focus on Electric Vehicle (EV) is on

The company continues to strongly focus on electric vehicle and has made an investment of Rs201 crore to acquire 30 percent equity in Ather Energy, a start-up to build EV scooters. The management indicated that Ather will start retailing its smart electric scooter S340 soon.

Expansion plans are on track

The management has earmarked Rs2,500 crores, to be spent over two years, for capacity expansion, technology upgrade and digitization. The company has commenced the construction of its eighth manufacturing facility in Chittoor, Andhra Pradesh and has started commercial production at its second manufacturing facility outside India, in Bangladesh.

Exports gaining momentum

HMCL is focusing on exports and plans to expand presence in fast growing markets of Sri Lanka, Bangladesh and Nepal. It commenced production at its second global manufacturing facility in Bangladesh in May 2017 and was able to garner retail level market share of around 30 percent. The plan is to expand to as many as 50 countries by 2020 from the current 35 countries. The management indicated that they see positive momentum in many countries, going forward.

Valuation at reasonable level

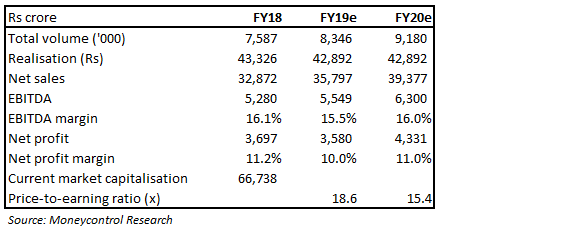

HMCL currently trades at 18.6 times FY19 and 15.4 times FY20 projected earnings. With an efficient execution and transformation strategy in place, the emerging macro tailwinds make HMCL an ideal candidate for accumulation for long-term investors.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!