Neha Dave

Moneycontrol Research

The liquidity crunch faced by non-banking finance companies (NBFCs) is one of the three issues over which the Reserve Bank of India and the government are feuding. The other two issues are the government’s requests for easing PCA (Prompt Corrective Action) norms for banks, and for a higher share of the central bank’s reserves.

Tightness in liquidity in the money market has adversely affected NBFCs. This can have repercussions for many segments of the real economy which had become used to cheap funds from NBFCs. Concerned by this, the government is reportedly pushing for additional contingency measures and wants RBI to open a special liquidity window for NBFCs.

The government’s fear of tight liquidity upsetting the broader economy is not entirely baseless. Default by a real estate developer Supertech a few days back morphed into sector-wide concerns for NBFCs and real estate players, leading to a renewed sell-off in their stocks.

The market is worried that NBFCs, in general, are staring at a double whammy of rising bad loans on asset side and difficulty in refinancing debt on the liability side.

Against this backdrop, we looked at the current liquidity scenario. Our assessment of the situation in October so far and the commentary from market participants indicate money markets have started to stabilise after weeks of uncertainty. Liquidity has improved and money market rates have also been coming off its recent highs.

RBI has already announced a series of measures including buying bonds from banks which we believe should help avert a credit contagion.

There is a small risk of a liquidity squeeze for NBFCs, with a large amount of debt papers coming up for redemption between November and March. However, the funding environment for most NBFCs seems to be much better now. NBFCs have been getting loans from banks, reducing credit to select segments, and shoring up liquidity for impending redemptions.

We feel the liquidity is expected to remain constrained in coming days, but a major crisis looks less likely. So a special liquidity window for NBFCs may not be needed for now.

Expect reasonably good inflows in liquid funds in October

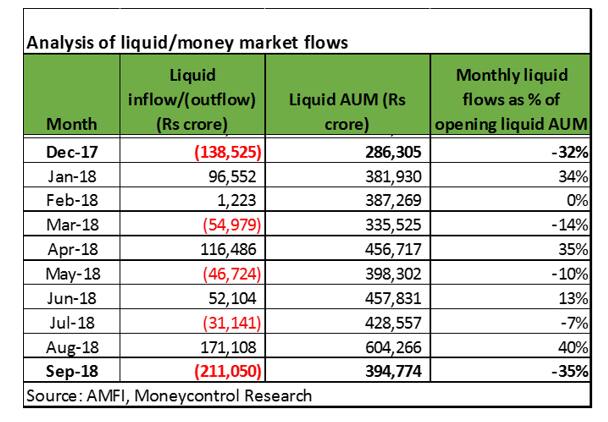

Since the liquid or money market has been at the centre of the recent fall in both equity as well as fixed income markets, we delve deeper into the numbers reported for liquid funds. Liquid or money market funds saw outflows of Rs 2.11 lakh crore in September compared to inflows of Rs 1.71 lakh crore in the previous month.

While the headline number for outflows was eye-catching, on digging deeper, we found the picture was not as gloomy. There was a domino effect of IL&FS episode on liquid fund withdrawals, but only to a limited extent. A large chunk of outflows in liquid funds was a quarter-end phenomenon that included withdrawals to meet advance tax payment deadlines. Read: Large liquid fund outflows not as worrisome as posed by headline numbers

In the quarterly analyst call held a couple of days back, management of HDFC AMC said 60-70 percent of the liquid fund outflows witnessed last month should be back as inflows in the current month.

In fact, if the liquid inflows witnessed by HDFC AMC in October is anything to go by, we can expect to see much more than 60 percent of last month’s outflows back in the system.

HDFC AMC has seen good traction in its liquid funds in the current month. Its liquid assets which generally range between Rs 40,000 -50,000 crore has increased to over Rs 75,000 crore in October to date.

Banking system liquidity in deficit mode but manageable

The banking system liquidity continued to be pressured for the week ended October 26, despite the bond purchases worth Rs 36,000 crore by the RBI this month. The average daily net liquidity deficit in the banking system widened to Rs 121,280 crore for the week compared with Rs 96,077 crore average daily net deficit in the previous week.

The liquidity deficit in the banking system can be attributed to the higher fund requirements by banks for meeting the festive season demand. There has been an uptick in bank credit offtake with deposit growth slightly lagging. The deficit number is further aggravated by month-end cash outflows of excise and GST and increased forex sales (and consequent liquidity removal) by RBI to stem the rupee depreciation. This explains the banking system liquidity deficit. The quantum of the deficit is not a concern at all as it is still around 1 percent of aggregate net demand and time liabilities (NDTL) of the banking system.

2018 is not 2008

The current liquidity scenario is not as precarious as witnessed in 2013 or 2008. The mutual fund industry faced a liquidity squeeze during the 2008 financial crisis following the Lehman bankruptcy, witnessing significant outflows over a short period. Back then, the Reserve Bank had facilitated a short-term liquidity window to mutual funds to help ease liquidity pressure.

The current scenario is slightly different as liquidity crunch has been triggered by homegrown credit issues arising from the default by the IL&FS group companies. The current situation is more a crisis of confidence and not a full-blown liquidity crisis. Hence, a special liquidity window for NBFCs at this point in time can boomerang by denting the confidence of market participants.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.