Sachin PalMoneycontrol Research

Crompton Greaves Consumer Electrical reported a decent topline growth for the fourth quarter of FY18. Operating margins expanded on account of richer revenue mix and operating efficiencies. The company reported a steady revenue growth for the full year helped by market share gain in fans segment. Crompton aims to drive future growth through product innovations within its key categories.

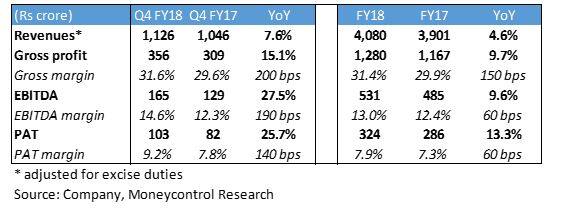

Revenues for the quarter increased 8 percent year-on-year (YoY) to Rs 1,126 crores aided by double-digit growth in the lighting & fixtures segment revenue. Price hikes and one-off warranty provisions aided the improvement in gross margins by 200 bps to 31.6 percent. Q4FY18 EBITDA grew 27 percent YoY to 165 crores from Rs 129 crores in Q4FY17.

Margin improvement across both the segments

Electrical consumer durables (Fans, Pumps, Appliances) segment has considerably higher margins compared to the lighting & fixtures segment. The performance of this segment was driven by an improvement in profitability rather than top line. The like-for-like revenue growth for the segment stood at 10 percent.

Lighting & fixtures contribute around 25-30 percent to the revenues. The margins for the quarter were considerably higher at 11 percent (in Q4FY18) compared to 6 percent (in Q4FY17).

Broadening Product Portfolio through Innovations

Crompton was the first to introduce ‘Anti-dust’ fans around 18 months ago. It witnessed good success since and garnered sales of Rs 200 crores from the fans ‘making it the single largest selling innovation in the market'. Crompton has set a new industry benchmark in the fans category with these anti-dust fans. It has also introduced an ’Air 360’ fan which has 50 percent more breeze coverage area than a traditional fan.

Riding on the success of these new innovative products, Crompton’s market share in the domestic fan market has increased to about 27 percent from 23-24 percent two-three years ago.

During the past one year, Crompton witnessed increased competitive intensity in pumps which impacted it sales in the previous few quarters. To revive the sales growth the company has entered the lower end of pump category with the launch of Crest Mini. The product has received a good response as the pump volumes have increased 25 percent YoY leading to a 13- 14 percent YoY value growth in Q4FY18.

It has also launched a window cooler on a pilot basis with 60 percent superior cooling. This cooler has a 50-litre capacity and has been priced attractively at Rs 12,500.

The company is working on some premium LED products with value-added benefits in the lighting segment. The product development is underway and is expected to be rolled out in the current calendar year 2018.

Crompton aims to introduce 1-2 innovate products in each season across categories.

Rolling Go-to-market strategy in a phased manner

The company is targeting retail expansion through the development of a strong distribution and sales network. To achieve this, Crompton is implementing go-to-market (GTM) strategies on a regional basis by integrating supply with that particular region. This strategy was adopted two years back and has allowed Crompton to manage the risks and gain market presence and visibility in an incremental manner.

While the company’s GTM strategy has witnessed successful implementation across South and West, it continues to face headwinds in North India which has impacted its sales and led to inventory destocking. North India has seen a decline in sales over last 2 quarters as inventory levels continue to settle and attention shifts from wholesale to retail. The company is trying to sort out the issues over the next 3-6 months through a phased rollout in selective branches.

Outlook and Recommendation

Crompton is continuously working on product innovation, diversification, and premiumisation and also gaining market share across segments and products.

Crompton has a strong product portfolio and healthy return ratios and remains well positioned to grow in an improving demand environment. However, the current valuations (CMP: 244 and Market Cap.: 15,370) factor in most of the positives. We advise using market corrections to slowly build positions in the stock.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.