Jitendra Kumar GuptaMoneycontrol Research

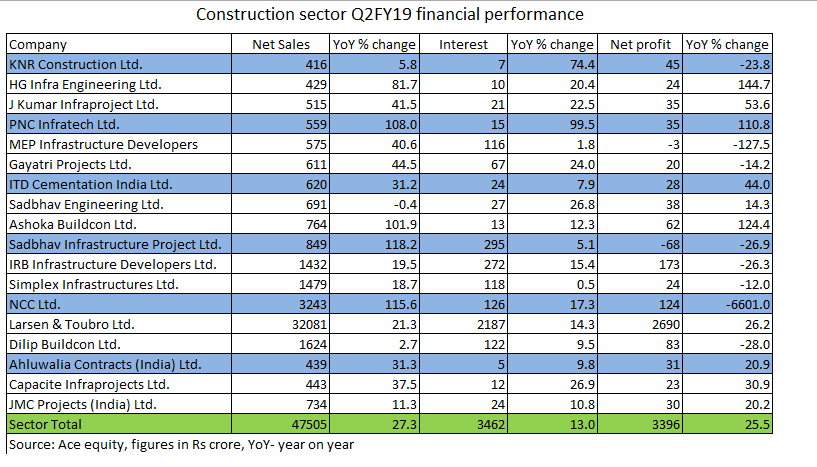

With elections approaching, the construction sector has seen an increased traction on improved execution. On an aggregate basis, 18 companies that we cover reported strong 27.3 percent year-on-year (YoY) net revenue growth. While a strong order book has been the key driver, most companies believe the execution of projects has significantly improved as key flagship government projects reach the completion stage.

This is well reflected in performance as four out of the 18 companies in the study delivered more than 100 percent growth in revenues. Companies like NCC, which has been under stress in the past, reported robust 116 percent revenue growth as a result of strong execution of its key projects in Andhra Pradesh. NCC reported a net profit of close to Rs 124 crore in Q2FY19 as against a loss of Rs 2 crore in the corresponding quarter last year. Moreover, the overall push is also seen to compensate for the likely slowdown in the second half of the current financial year on account of the elections.

Operating performance

While higher sales should have reflected in better operating profits the cost pressures have led to a drop in operating margin of most companies. While material cost is up, diesel prices, machine hiring charges and labour cost have gone up in the recent past and that had an impact on profitability.

Companies in the study have reported 25 percent growth in operating profits which is about 200 basis points less than the growth in sales. During the quarter, operating margins for these companies stood at 19.3 percent as against 19.6 percent in the corresponding period last year.

Interestingly, the companies which owned assets or projects such as IRB Infra, Dilip Buildcon, Sadbhav Infrastructure, Ashoka Buildcon and MEP Infrastructure Developers have been able to control interest cost. For instance, in the case of Ashoka Buildcon, with revenue growth of 102 percent saw a mere 12.2 percent growth in interest cost. This is a good trend as this will lead to higher earnings and companies most in the BOT assets would see their coverage ratios improving.

However, on the construction side, companies like HG Infra, KNR Construction, Sadbhav Engineering, J Kumar and others have witnessed an increase in interest cost indicating that working capital has increased as a result of growth in sales. Some of these companies have also seen increase in borrowings because of the working capital requirements.

On a growth trajectory

While the markets worry about the elections and its impact on growth over the next two quarters, most of the companies are optimists on the back of strong order book. Companies in the study are sitting on order book to sales of about 2.5-3 times which is historically high.

NCC is sitting on an order book of close to Rs 33,000 crore on an annual sales turnover of about Rs 7,000 crore. Ashoka Buildcon has an order book of close to Rs 10,000 crore or four times its FY18 sales. It is possible the earnings growth might slow in the second half of the current fiscal, but the trajectory remains strong as most of them are expected to deliver double- digit earnings growth over the next two years. Interestingly, valuations too, have become attractive.

Stocks to watch

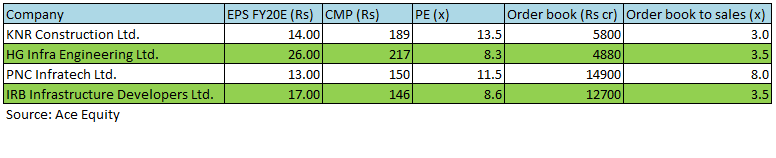

Most of the companies are trading below their normalised valuations. Companies are trading 8-10 times their FY20 estimated earnings. Among companies we like is PNC Infratech. PNC is sitting on an order book of close to Rs 14900 crore, or eight times its sales with the highest visibility in the sector. We also like IRB Infrastructure, largely because of the valuations. It is currently trading at less than its book value despite having a strong road portfolio, execution capabilities and good balance sheet.

In the small cap construction space, HG Infra and KNR could be good candidates considering the earnings growth in excess of 25 percent over the next two years. Besides, these two companies have a good balance sheet and strong execution capabilities. HG Infra has a strong order book of about four times its sales. It has a strong balance sheet and generating one of the best returns in the sector.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!