Highlights

Continued momentum in Q3

Cera delivered high double-digit revenue growth in Q3 led by broad-based growth across Sanitaryware, Faucetware, and Tiles segments. Revenues for 9M FY23 jumped 26 percent year on year (YoY) to Rs 1,266 crore on a favourable base.

Rising input costs were a drag on gross margins in the first half of the current fiscal year. However, gross margins in Q3 benefited moderately from the correction of metal and other raw material prices. Still, operating margins were stable at 16 percent on account of higher advertising and marketing spends.

For 9M FY23, almost 55 percent of the top line came from Sanitaryware, 35 percent from Faucetware, while Tiles represented 9 percent and Wellness contributed the remaining 1 percent. Though the revenue share of Sanitaryware has been stagnant around 55 percent for some time, the same for Faucetware has increased from 25 percent to 35 percent in the last 3 years. The company didn’t undertake any price increase during Oct-Dec 22, though its peers have hiked prices during the same period.

Focus on the premium segment

The capacity utilisation in the core business segments continued to be driven by robust end market demand from consumers. The company is focusing on high-end markets wherein it is increasing its focus on premium products, which contributed nearly 45 percent of its top line in Q3. Overall capacity utilisation for Sanitaryware and Faucetware in Q3 stood at 105 percent and 115 percent, respectively.

Faucetware expansion underway

The expansion for Faucetware commenced in July-22. The investment will enhance its capacity by 1 lakh pieces, taking the total manufacturing capacity to 4 lakh pieces (per month) by Q1 FY24. The cost of the project is estimated around Rs 69 crore, being financed by internal accruals.

Besides this, Cera is looking to set up a new greenfield facility for Sanitaryware. The company has already identified land parcels in Gujarat and is conducting a due diligence and feasibility study for the next phase of expansion. Cera will share a detailed road map of the planned capital expenditure in the sanitaryware business once it completes the land acquisition in the next 6-9 months.

Outlook and recommendation

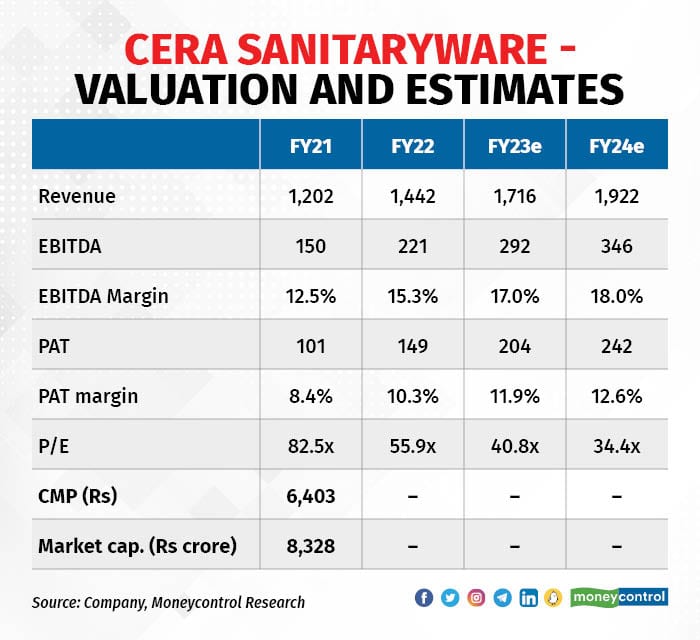

Cera Sanitaryware has a long history of steady growth and profitability, with an established reputation in the home improvement space. It ticks most of the boxes for those looking exclusively for compounders and remains our preferred pick within the sector as the resilience in operational performance through various business cycles reflects strong execution capabilities of the management. Although the stock seems fairly priced at current valuations (34 times FY24 earnings), it would continue to command a premium over its competitors. Long-term investors should keep the stock on the radar for accumulation on every correction.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.