Highlights - Significant improvement in passenger growth and yield - Lower fuel cost helped company post profit - Oil prices need to be carefully watched out for - Accumulate as valuations are reasonable --------------------------------------------------

The waning competitive intensity due to the departure of Jet Airways has led to significant improvement in yield within the industry, thus helping the incumbents post strong improvement in the financial performance in Q4 FY19. Further, the decline in fuel cost in the quarter gone by has helped companies further expand their margin.

Against this backdrop, InterGlobe Aviation, the parent company of IndiGo, has reported a strong set of numbers for January-March. Year-on-year (YoY), net revenue saw significant growth, driven by passenger revenue uptick. Operating profitability too expanded significantly.

We have very high comfort in the business and we believe changing industry dynamics would help company cope up with rising oil prices. We advise investors to accumulate the stock for the long term on any weakness arising out of volatility in crude prices.

Quarterly snapshot

Key positive Net revenue from operations jumped 35.9 percent YoY, driven by 25 percent growth in revenue passenger kilometres (RPK). What came as a positive surprise is the improvement in yield, which grew 11.8 percent.

With significant improvement in yield and fall in the fuel cost, the company posted a YoY growth of 81.6 percent in earnings before interest, tax, depreciation, amortisation and rental (EBITDAR) as the EBITDAR margin swelled 656 bps in Q4.

Load factor at 86 percent is lower by 290 bps than that of the same quarter last year, primarily due to major capacity addition (up 29.2 percent) by the carrier.

OutlookYields have improved in a big way Fever pitch competition had put yields under pressure, which looked up considerably, after Jet Airways departed the sky due to cash problems and the supply fell. The management mentioned that the benefit has already come in and it would, in fact, fade away from June as supply addition picks up. However, expectations are such that yields will not fall to previous levels.

Oil prices need to be monitored closely The escalating trade war between the US and China, coupled with geo-political tensions, have led to rise in volatility in oil prices, leading to a spike in the past few months. We need to carefully monitor the oil price graph as the sensitivity of IndiGo’s profitability is very high.

Aggressive capacity addition In the three months to March, the company added nine aircraft to its fleet, taking the fleet count to 217. Capacity grew 29.2 percent YoY in Q4, which the management thinks will grow by 30 percent (YoY) in the final quarter of FY20.

In light of a likely strong pick-up in growth in Indian aviation, the company has placed huge orders, the delivery of which will help IndiGo retain its leadership position. Most of these additions would be of the fuel-efficient A320neo aircraft.

Foray into the international market The airliner continues to focus on expanding its footprint in the long-haul international market. It has recently got into a codeshare agreement with Turkish Airline, adding many new international destinations during the quarter. In fact, it allocated half of the new capacity added towards international markets.

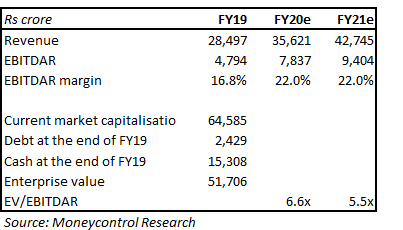

Valuation – At reasonable levels On the expectation of improvement in yield and industry dynamics, the stock has witnessed a significant upmove. We believe that IndiGo has all the right ingredients that are required to retain its leadership position in the Indian aviation sector. Investors need to carefully monitor the oil prices and passenger growth. We advise investors to accumulate it in staggered manner.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.