Highlights:-

- Store additions, promotional campaigns and new collections will drive sales

- Premium products and working capital optimisation should help improve margins

- High competitive intensity is a big threat- Price corrections could provide a good buying opportunity to investors

--------------------------------------------------

In the quarter gone by, Bata India maintained its growth momentum, albeit at a slower pace.

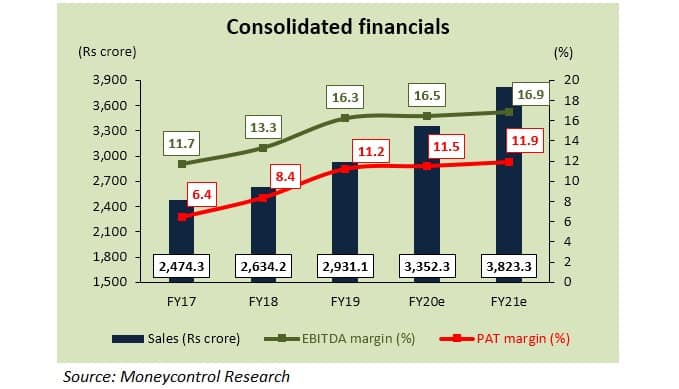

Asset-light network expansion, an improved product mix and a strong thrust on marketing initiatives are expected to be the key drivers for the company. The stock's elevated valuation does not leave much scope for an upside in the near term.

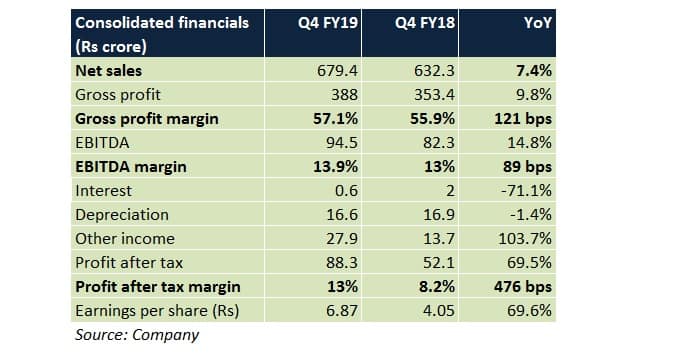

Q4 FY19 review

Positives

- Retail sales, comprising 80-90 percent of turnover, grew 11 percent year-on-year

- Gross margin expanded because of efficiencies

- Bottom-line margin witnessed a sharp uptick on account of tax benefits and a significant increase in other income

Negatives

- Overall revenue growth was modest due to e-commerce regulations and a high base (in Q3 FY18, there was an element of institutional sales to the tune of Rs 21 crore)

- EBITDA margin was flat due to higher operating expenses

Observations

Promotional spends

The management has budgeted an outlay of Rs 100-150 crore each year in FY20 and FY21. In FY19/18/17, the company spent Rs 90/40/24 crore, respectively, on this front.

Consistent success of marketing campaigns undertaken in the past (such as Come and Be Surprised, Find Your Power, Red Label, Bata 9 to 9) is a big positive.

Moreover, store renovations would be undertaken periodically to attract more footfalls.

Network augmentation

Nearly 80-100 new stores will be opened in each financial year in urban markets. To strengthen presence in tier 2, 3 and 4 regions, around 50 franchisee-run stores may be set up every year, which will complement the existing 140 FOFO (franchise run, franchise operated) stores.

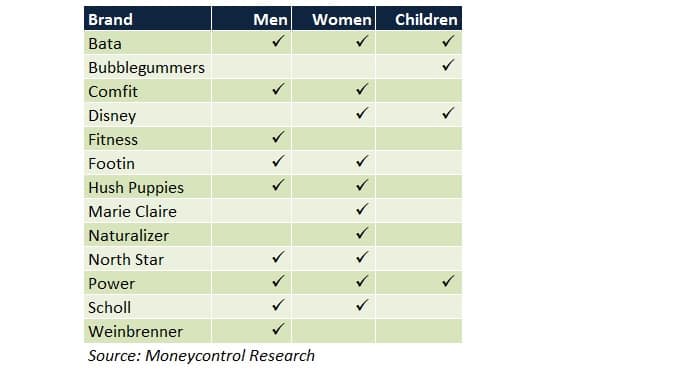

Product launches

Though men's footwear constitutes a major share of Bata's sales pie, the smaller segments (women, youth, sports) are picking up pace, too. This will play a crucial role in helping the company sustain healthy same-store sales growth, which stood at approximately 8 percent in FY19. Most of these new products would be in the premium price range since realisations (and margins) tend to be better.

Cost control

Besides downsizing and closing down the less profitable legacy (Bata) outlets, lease agreements are being renegotiated to curtail overheads. Most of Bata's new stores would be small to mid-sized, especially the ones in smaller towns.

Furthermore, efforts are being undertaken to streamline the inventory cycle, which should have a positive rub-off on cash flows.

Outlook

Since mid-February, the stock, for the most part, has been range-bound (in the Rs 1,200-1,300 range). Bata’s robust fundamentals, consistently improving quarterly numbers in FY19 and strong brand appeal have helped it command rich valuations (37.4 times its FY21 projected earnings). We remain optimistic about the company's ability in terms of top-line traction.

However, considering the high competitive intensity in Indian footwear, it appears unlikely that Bata would be able to sustainably deliver higher margins quarter after quarter or year after year (on an already high base). This is because advertisement spends, discounts, dealer margins and overheads (attributable to new stores) will increase with time as the company focuses on gaining market share and making inroads into new geographies.

Such moderation can provide investors an opportunity to go long on price corrections.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!