Nitin Agrawal

Moneycontrol Research

Highlights:

- Strong volume growth both in domestic and international markets

- Operating margin continues to be under pressure

- Business outlook for the company is weak for short-term, positive for long-term

- Accumulate in staggered manner

--------------------------------------------------

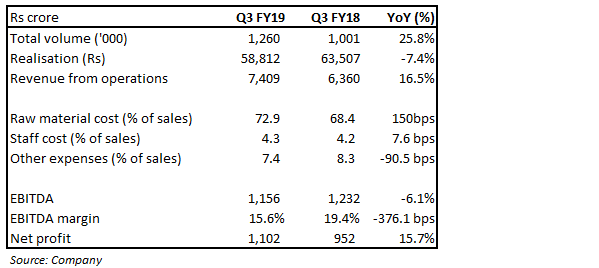

Bajaj Auto's quarterly result was a mixed bag wherein topline continued to witness a strong growth and operating margin posted significant decline. The operating margin performance was marred by adverse raw material (RM) prices and the price cut taken by the company on the entry level motorcycle segment. Further, export markets have been doing well and posted a strong volume growth. We continue to like the business given rupee depreciation, positive growth outlook in export market, strong demand in India and reasonable valuations.

Quarter in numbers:

Key positives

Volume – on an uptrend

In terms of volume performance, Bajaj Auto registered an overall year-on-year (YoY) volume growth of 25.8 percent, helped by 27.5 percent YoY growth in domestic market and 23.5 percent growth in export markets.

Volume growth in the domestic motorcycle segment was on the back of price cut taken by the company in entry segment and strong demand for mid executive and premium segment. The 3W segment, on the other hand, witnessed a decline, primarily, due to large base of last year.

Further, both motorcycle and 3W segment continue to do well in the export market.

Strong volume growth led to net operating revenue registering a strong growth of 16.5 percent.

Key negative

In line with the new strategy of gaining market share in entry level motorcycle segment, the company has taken price cut on that segement. This coupled with unfavorable product mix led to YoY decline of 7.4 percent in realisation. Further, rise in the raw material prices have impacted the earnings before interest, tax, depreciation and amortisation (EBITDA) margin negatively which came at 15.6 percent, down 376.1 bps on YoY basis.

Outlook

Aggressive focus on market share

The company’s current strategy to gain market share by aggressive pricing in entry level segment is working well as it has recorded a growth of 38 percent in motorcycle segment as against 11 percent industry growth. This has led to further expansion in market share which stood at 20.3 percent at the end of Q3 FY19 as against 18.6 percent in Q2 FY19 and 16.3 percent in Q3 FY18.

Bajaj gained market share across all 2W segments. In the entry segment, its market share improved to 37 percent as against 31.7 percent in Q3 FY18. In the sports segment. Bajaj continues to maintain its dominance with market share of 45.7 percent as against 40.5 percent in Q3 FY18. The company’s management has achieved its target of achieving 20 percent market share in motorcycle segment and has a long-term target of 24 percent.

New products

The management has highlighted that the next leg of growth will be coming in from new variants of existing products or new products. In light of this, the management has indicated that they are focusing on launching new products. New Platina 110CC and Pulsar Neon are also gaining good traction.

Operating margin – product mix, forex to give respite

EBITDA margin has come off from around 20 percent levels it achieved in last few quarters owing to negative pricing actions taken by the company in the entry level bike segment. However, the management has indicated that the negative pricing action could be offset by margin of its premium segment. In fact, the management mentioned that Platina is doing well in entry level segment and has been profitable for the company. Also, strong traction in sports segment bikes and new launches in premium segment is expected to aid margin.

Further, recent rupee depreciation is expected to aid margins. The management indicated that they would be able to realise above Rs71 per dollar in Q4 FY19 as compared to Rs68.9 per dollar which it realised in Q3 FY19.

No permit regime for alternate fueled 3Ws

The 3W segment witnessed a decline of 17.3 percent in its volume, primarily, due to the high base of last year. However, the overall market continues to gain. The government’s announcement of abolishing permit regime for 3W fuelled by alternate fuel augurs well for the company, given its 86 percent market share in the space.

Improving export markets

The overall export markets seem to be stabilising and are expected to benefit Bajaj Auto as it generates more than 40 percent of its volume from those markets. It currently has 45 percent market share in Africa (68 percent market share in Nigeria) and that may go upto 50 percent in years to come.

Reasonable valuationAmid subdued demand sentiments, the stock price has witnessed 40 percent fall making the valuation very reasonable. The company is currently trading at 15.4 times and 13.4 times FY19 and FY20 projected earnings, respectively.

For more research articles, visit our Moneycontrol Research Page.

(Moneycontrol Research analysts do not hold positions in the companies discussed here)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!