Nitin AgrawalMoneycontrol Research

Auto component makers are cruising comfortably on strong auto sales being witnessed by major original equipment manufacturers (OEMs). These companies posted stellar earnings for the final quarter of FY18. Most of the companies witnessed strong growth at the topline and expansion in operating margin.

Here are some companies from the space that should be on the radar of investors.

The first company Moneycontrol Research spotted in the segment has progressed on strong growth coming from the commercial vehicle (CV) segment.

Automotive Axles is a manufacturer of drive axles, non-drive axles, front steer axles, specialty and defence axles and drum and disc brakes. It serves segments such as light, medium and heavy commercial vehicles, military and off-highway vehicles, aftermarket and exports.

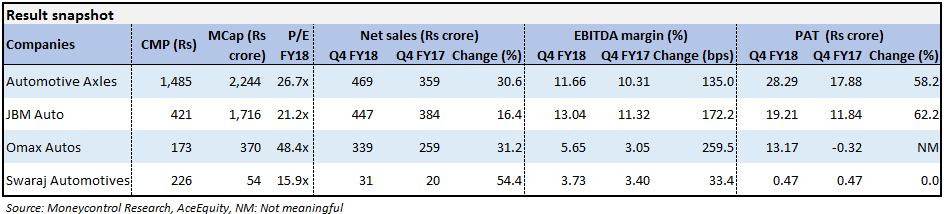

Driving on the growth coming from the CV segment, the company reported a strong year-on-year (YoY) growth of 30.6 percent in its topline and 47.8 percent in its earnings before interest, tax, depreciation and amortization (EBITDA), primarily because of operating leverage. This also led to 135bps YoY expansion in EBITDA margin. Profit-after-tax (PAT) also recorded a strong YoY growth of 58.2 percent.

With a strong clientele and growth in the CV segment on the back of good monsoon, government’s thrust on infrastructure, improved rural sentiments and increased production of BS IV compliant vehicles, the company beckons investors’ attention.

The next company on today’s list is Omax Autos, which manufactures auto and non-auto components. The company specialises in sheet metal components, tubular components and machine components.

Omax posted strong set of numbers with 31.2 percent YoY growth in its topline. Despite a rise in raw material prices, the company witnessed YoY increase of 142.86 percent in its EBITDA and 259.5bps expansion in EBITDA margin. This was driven by fall in employee cost and tight control over operating costs. The company posted PAT of Rs 13.17 crore from a loss of Rs 32 crore in the same quarter last year.

The company is riding on growth coming in from the two-wheeler segment where Hero Motors is its client. The capacity expansion plan of Hero Motors is expected to augur well for the company. Additionally, the company is focusing on the CV segment, which is witnessing a strong uptrend.

The next company is JBM Auto, which is a metal sheet manufacturer. It also manufactures tools, dies, suspension, exhaust systems, air tanks, fuel tanks, and complete cowl assemblies. The company caters to wide a range of customers across four-wheeler, commercial vehicle and farm equipment.

From Q4 FY18 numbers perspective, the company posted a YoY growth of 16.4 percent in net revenues led by 16 percent growth in sheet components and 20 percent growth in tool room division, which got marginally offset by 19 percent fall in the bus business. EBITDA, however, witnessed a YoY growth of 34 percent. This was primarily due to improved operating leverage and tight control over employee cost. This also helped the company achieve 172.2bps YoY expansion in its EBITDA margin. Its PAT grew by 62.2 percent (YoY).

The company is in a sweet spot on the back of growth coming from the passenger vehicle segment (~65 percent of total revenue), and its focus on increasing wallet share from customer. Recently, the company secured a large order for its tool room business which is expected to boost topline.

The last company on the list is Swaraj Automotive, which is a manufacturer of automotive components, seats and agricultural implements.

In terms of result for the final quarter of FY18, the company posted a strong YoY growth of 54.4 percent in net sales. Its EBITDA grew by 69.6 percent (YoY) and its margin witnessed a YoY expansion of 33.4bps. This expansion is despite a rise in raw material price (up 502bps as a percent of net sales) which got offset by operating and employee cost management. Its PAT remained flat on YoY basis due to a fall in other income and rise in effective tax.

With marquee clients in its kitty, and strong growth coming in all automotive segment, investors should keep this company on their radar.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.