The global financial markets exhibited a predominantly bullish trend during the week, with notable exceptions in India and Japan. India's market faltered, dropping nearly one percent due to a combination of foreign institutional investor (FII) withdrawals, rising interest rates, and underwhelming corporate results.

Across Indian sectors, the IT sector bore the brunt, plunging 6 percent following Infosys's disappointing performance. Realty stocks declined by 2.5 percent, while Healthcare, Media, and FMCG sectors each shed approximately 2 percent. In a surprising twist, PSU Banks and Metal stocks bucked the trend, gaining around 3 percent.

FIIs demonstrated their bearish outlook by selling Rs 25,218.60 crore during the week, bringing January's total outflow to Rs 46,576.06 crore.

In the bond market, 10-year US Treasury yields climbed over 100 basis points above their September lows despite the Federal Reserve's ongoing policy rate reduction. A JP Morgan report says it's unusual, as in the previous seven cutting cycles by the Federal Reserve going back to the 1980s, the yield on the 10-year Treasury was lower by 100 percent of the time 100 days after the first rate cut. The report attributes the difference to rising uncertainty and stronger growth expectations.

US markets rebounded from the previous week's sell-off, with major banking stocks like JPMorgan Chase, Goldman Sachs, Citigroup, and Wells Fargo leading the rally. This upward trend persisted despite a slight increase in inflation, with futures markets predicting unchanged rates at the Fed's January meeting.

European markets staged a remarkable recovery, with the STOXX 600 index rising 2.37 percent. Major indices across France, Germany, Italy, and the UK posted significant gains, ranging from 3.11% to 3.75%. This optimism prevailed even as Germany's economy contracted by 0.2% in 2024, marking its second consecutive year of decline.

In contrast, Japan's Nikkei 225 fell 1.9% as Bank of Japan officials signalled potential interest rate hikes. The Japanese Yen strengthened against the dollar, responding to Governor Kazuo Ueda's hints at rate increases if economic conditions improve.

China defied the trend, with markets closing 2.31% higher, driven by strong fourth-quarter GDP growth of 5.4%. A better-than-expected GDP number of 5.4% in the fourth quarter from a year ago, higher than a 4.6% growth in the third quarter, resulted in a rally in equity markets. Metal stocks in India also reacted positively to the growth numbers.

Even the troubled real estate sector showed signs of stabilization, reflecting the impact of recent government stimulus measures.

As the financial world anticipates Donald Trump's presidency, global markets remain vigilant, ready to analyse his initial actions to indicate future economic policies. The stage is set for a potentially transformative week in the global financial landscape.

A sell on rise marketThe Nifty index closed lower for the second consecutive week, remaining below its 40-week exponential moving average (40WEMA). Momentum indicators continue to signal a bearish trend, suggesting further declines in the coming weeks. While domestic headwinds persist in driving prices down, global markets are holding near their highs.

As Donald Trump prepares to take office next week, markets are poised to react to his new policy measures as they are announced. The prevailing uncertainty is likely to deter buyers from entering the market.

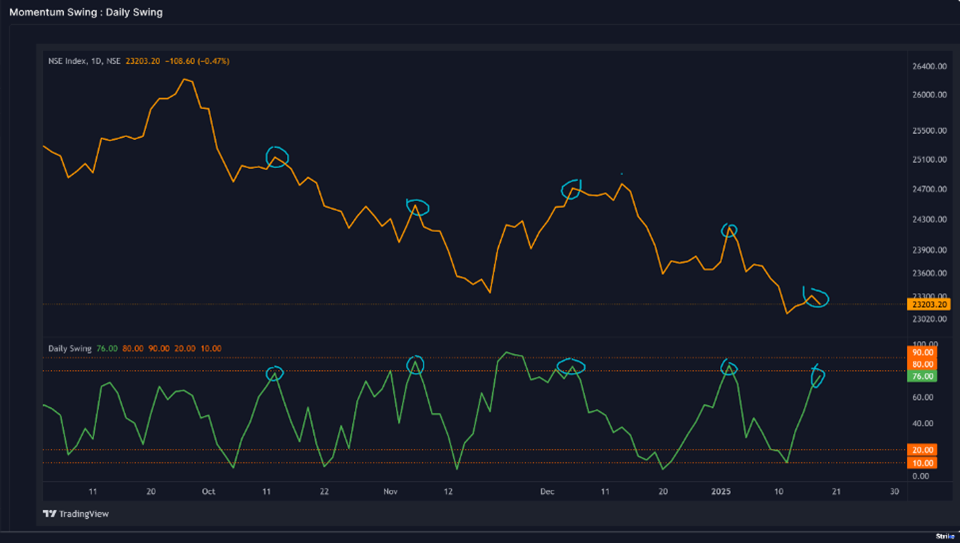

The daily swing, which measures market momentum breadth, has been a reliable market sentiment indicator. In bullish markets, readings below 10 typically signalled extremely oversold conditions and presented buying opportunities. However, the opposite holds true in bear markets, such as the one observed since October 2024. During this period, each time the swing approaches 80, it has coincided with a market top followed by a sell-off. This pattern characterizes the current "sell on rise" market environment.

Friday's reading of 76 on the daily swing indicator suggests that the market may once again be approaching a short-term top, potentially setting the stage for another downturn.

Source: web.strike.money

Foreign institutional investors (FIIs) have significantly increased their short positions in index futures over the past month. The number of short contracts has surged from just over 37,000 to a substantial 320,000, approaching levels typically associated with market bottoms in recent years.

The chart indicates a critical threshold at 340,000 contracts, represented by an orange line at the bottom. This level has historically signalled potential market reversals. Given the current positioning, the market appears poised for one more potential dip before a possible rally driven by short covering.

Source: web.strike.money

The futures open interest in the market is a total of index futures and stock futures. After adjusting that number for the rise in Nifty, we get to know if traders are adding positions or cutting them back significantly with market trends. The chart above shows this with the green indicator.

The indicator ended at an all-time high at the end of the week. This happened even as midcap and smallcap stocks were falling.

This indicates that traders in futures markets are not selling their positions and maybe buying the dip. Usually, when the market decline is coming to an end, we see capitulation among traders that square off a significant position. That has not happened. In a nutshell, the market has not fallen enough to shake out the leveraged speculator.

Source: web.strike.money

Sector RotationThe Nifty on the weekly chart ended with just a 1% loss. The range was also very narrow, forming a Doji candlestick pattern, which indicates uncertainty.

Source: web.strike.money

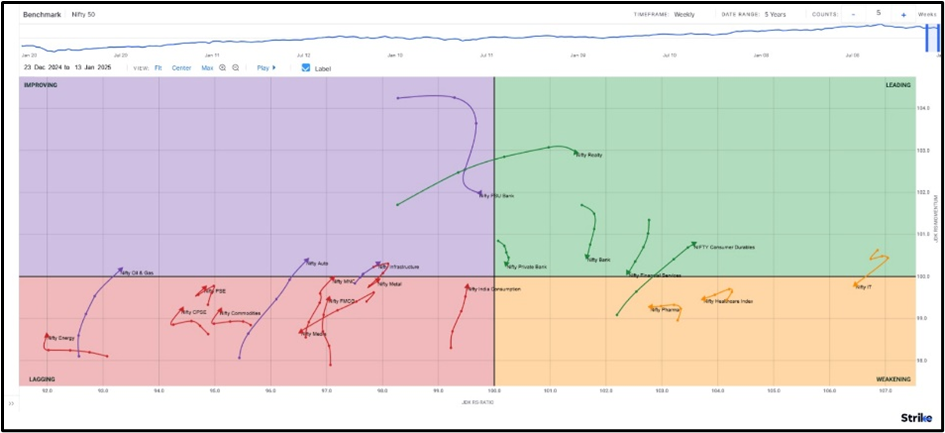

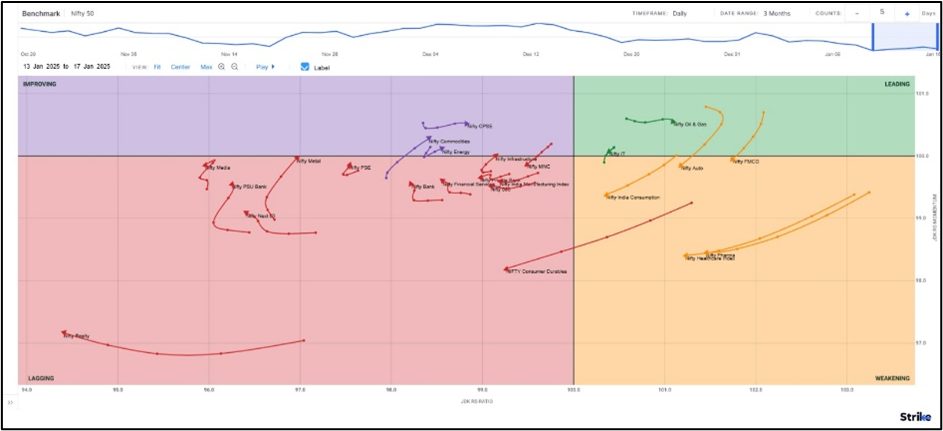

Nifty Oil & Gas, on the weekly time frame, has entered into the Improving quadrant from Lagging, whereas on the daily time frame, it's already in the Leading quadrant, showing signs of strength.

Nifty Infrastructure, on the weekly time frame, has also entered into Improving from the Lagging quadrant, and on the daily time frame, it's about to enter into Improving; this is showing signs of a turnaround.

Nifty Auto has also entered the Improving quadrant in the weekly time frame, but in the daily time frame, it has entered the Weakening quadrant. We need to check if it takes a 'U' Turn on the daily time towards Leading or entering into Lagging. It will be Bullish if it takes a 'U' turn.

Nifty IT, on the weekly time frame, has entered into the Weakening quadrant from the Leading, indicating a loss in momentum in this sector, and just behind it, Nifty Private Bank, Nifty Bank & Nifty Financial Service; these indices are headed towards the Weakening quadrant from the Leading.

Source: web.strike.money

Stocks to watchAmong the stocks expected to perform better during the week are BSE, India Cements, SRF, Lloyds Metal and BLS.

Among the stocks that can witness further weakness are Astral, Asian Paints, KPIT Tech, Hero MotoCo, BSoft, PVR Inox, Bata India, Nestle, Tata Chem, Britannia, IndusInd Bank and RBL Bank.

Cheers, Shishir AsthanaDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.