The Union Cabinet made amendments to the Mines and Minerals (Development and Regulation) Act on July 12, which allow commercial mining of lithium and five more minerals. Earlier this year the Geological Survey of India (GSI) found 5.9 million tonnes of lithium deposits in the Reasi district of the Union territory of Jammu and Kashmir.

As the commercial mining of lithium gets a green flag from the government, here are five points on why India's newly found lithium deposits could potentially be an important find.

Also Read: Tata Group lines up Rs 13,000 crore for setting up lithium-ion cell facility in Gujarat

Why do we need lithium?Lithium is the main element required to make lithium-ion batteries, a critical input for electric vehicles (EVs). So far, all of India’s lithium-ion battery requirements are met through imports. In 2020-21, India imported lithium-ion worth Rs 8,811 crore, with more than 95 percent of it coming from Hong Kong and China, government data shows.

India has an EV Vision 2030, where the government has targeted 30 percent electric vehicle penetration by 2030. India’s EV ambitions coupled with its ‘self-sufficiency’ approach make it vital to ensure lithium security. A lithium-ion battery pack for a single electric car is estimated to contain about 8 kilograms of lithium. To put that requirement in context with inferred resources, one tonne is 1,000 kg. The Economic Survey this year also highlighted the need for a strategic mineral reserve. In short, lithium is critical from a new-energy security point of view.

Also Read: What Rajasthan’s lithium reserves mean for India

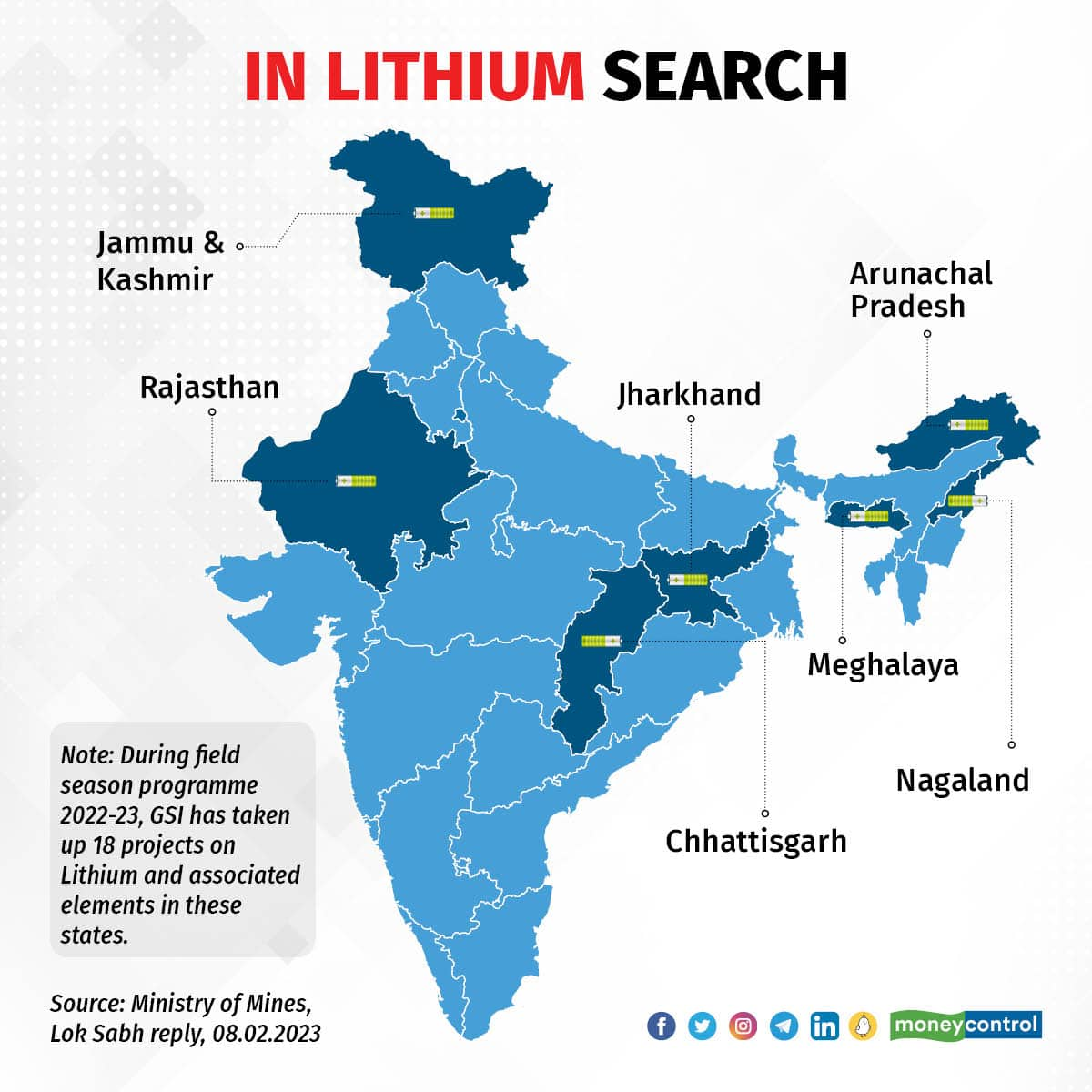

What is India doing to source lithium?India has adopted a two-pronged approach to source lithium – scout domestically and acquire internationally. On the domestic front, GSI has taken up 18 projects on lithium and associated elements in Arunachal Pradesh, Chhattisgarh, Jammu & Kashmir, Jharkhand, Meghalaya, Nagaland and Rajasthan during its field season programme 2022-23. The lithium find is its first success.

The government has also set up a joint venture company namely Khanij Bidesh India Ltd (KABIL) to identify and acquire overseas mineral assets of critical and strategic nature to ensure supply-side assurance. KABIL has initiated engagement with several state-owned organisations in countries like Argentina and Australia to acquire mineral assets overseas, including lithium.

Australia, Chile and China produced 90 percent of the World’s lithium in 2021. In terms of reserves, Chile, Australia and Argentina top the chart, with 9.3 MT, 6.2 MT and 2.7 MT reserves, according to United States Geological Survey data. India’s latest inferred resource of 5.9 MT is significant in the context of the known reserves of the top three countries.

What is the demand-supply scenario?As the world moves to embrace net-zero targets and meet emission targets, demand for electric mobility and lithium-ion batteries is on a rise. According to World Economic Forum, global lithium production surpassed the 100,000-tonne mark in 2021. The international body expects demand for lithium to reach 1.5 MT of lithium carbonate equivalent (LCE) by 2025 and over 3 MT by 2030. Based on the above demand projections, production needs to triple by 2025 and increase nearly six-fold by 2030. Demand-supply projections suggest demand growth will place tremendous pressure on the supply side to match up.

What's next from India’s latest find?Details about the accessibility and purity of the inferred resources would be of material importance. If both factors are favourable, the find in addition to catering to India’s new-energy security will also spark a boom in the domestic lithium-based industrial value-chain, including refining and battery manufacturing.

At present, India’s lithium-ion battery market is largely assembly and fragmented with several players including Coslight India, Okaya and Exicom. From mine to batteries, lithium also needs to move through a complex supply chain, with refiners playing a crucial part. US-based Albemarle and Chile-based SQM are industry leaders in lithium and lithium derivatives. A definite find of lithium in India may attract interest from India’s large energy companies, which already have new-energy plans in place.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.