Since the start of the rate hike cycle in May, 2022, the Reserve Bank of India (RBI) has taken various steps to remove surplus liquidity from the banking system. These steps include introduction of standing deposit facility (SDF), conducting various variable rate reverse repo auctions, and finally announcement of incremental cash reserve ratio (I-CRR).

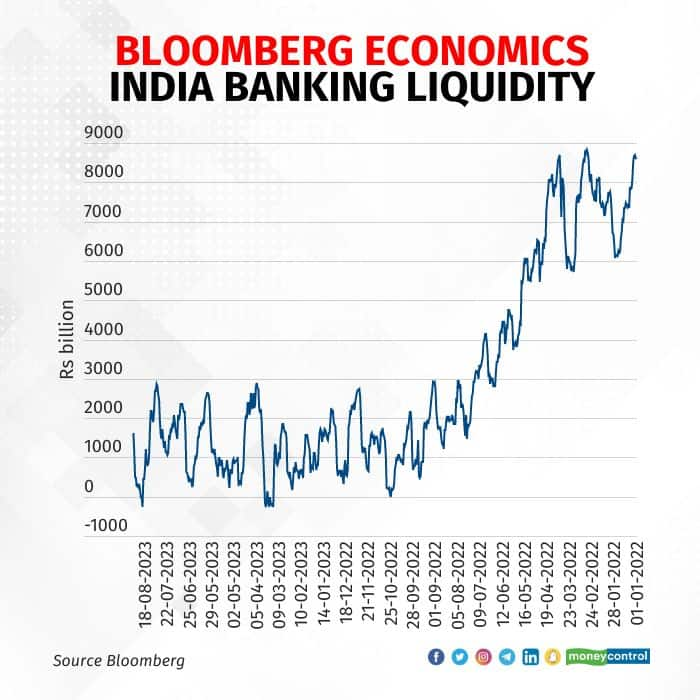

According to a Moneycontrol analysis, these tools helped the RBI reduce excess liquidity in the banking system to Rs 80,233.57 crore as on August 31, 2023, from as high as Rs 7.71 lakh crore as on April 7, 2022.

Out of all the measures, the variable rate reverse repo (VRRR) auctions were the most widely used by the central bank.

“The RBI is watchful of the excess liquidity and as it intervenes more to absorb dollar flows and beef up (foreign exchange) reserves, it will keep adding to liquidity. In order to ensure that excess liquidity is not fuelling inflation, it has been promptly acting by introducing liquidity absorption tools,” said Ajay Manglunia, managing director and head of investment group at JM Financial.

However, during the times when systemic liquidity tightened, the RBI also conducted variable rate repo auction to support liquidity and overnight call money rates.

These were in line with the central bank’s comments in the most of the policies during this period. RBI governor Shaktikanta Das said in most of the monetary policies that the central bank will conduct operations on either side of the liquidity adjustment facility (LAF), depending on the evolving liquidity conditions.

“The Reserve Bank remains committed to flexibility and two-sidedness in liquidity operations,” Das said at the media conference after the December monetary policy meeting last year.

Since the onset of the pandemic, the RBI has maintained ample surplus liquidity to support a speedy and durable economic recovery. And since conditions started improving, the central bank started rebalancing liquidity.

As part of its aggressive withdrawal of excess liquidity from the banking system, the central bank hiked the repo rate by 250 basis points (bps) to combat higher inflation, which was hovering above the upper tolerance band of the RBI.

One basis point is one hundredth of a percentage point.

The central bank held off on rate hikes from April this year as the data suggested a fall in inflation below the upper limit of the tolerance band and other better economic factors.

Also read: Pew Study: India needs to invest further in its foreign policy

The RBI's action planOn April 8, 2022, the RBI announced the introduction of the SDF as the basic tool to absorb excess liquidity under the new monetary policy. The SDF was announced with an aim to help the central bank absorb liquidity (deposits) from commercial banks without giving government securities in return.

When the central bank has to absorb a tremendous amount of money from the banking system through the reverse repo window, it becomes difficult for it to provide the required volume of government securities in return.

Further, to remove excess liquidity, the central bank used its main liquidity management tool, the VRRR auction, multiple times.

As per the Moneycontrol analysis, the central bank conducted 47 VRRR auctions since the start of rate hike cycle in May 2022. And in last one and half years, the RBI conducted repo auctions seven times when the liquidity fell to deficit or near-deficit.

Despite this, liquidity remained in huge surplus due to the withdrawal of banknotes in the Rs 2,000 denomination from circulation. To combat this, the central bank again conducted VRRR auctions, but it did not helped much. Hence, on August 10, the RBI introduced I-CRR.

The central bank said that with effect from the fortnight beginning August 12, scheduled banks will have to maintain an I-CRR of 10 percent of the increase in their net demand and time liabilities (NDTL) between May 19 and July 28.

How did liquidity move in the last one year?The liquidity in the banking system was in huge surplus when the central bank started hiking the repo rate. As on April 7, 2022, it stood at Rs 7.71 lakh crore, which fell to Rs 4.71 lakh crore as on May 6 after the first rate hike on May 4.

Further, on June 6, 2022, the central bank said liquidity absorption under LAF (SDF plus VRRR) stood at Rs 5.5 lakh crore between May 4 and May 31, from Rs 7.4 lakh crore between April 8 and May 3.

In August 2022 monetary policy, the average daily liquidity absorption reduced to Rs 3.8 lakh crore in June-July, from Rs 6.7 lakh crore in April-May.

This reduction of liquidity absorption continued every month till the last policy. As per latest figures available in monetary policy speeches, the daily absorption was Rs 1.7 lakh crore in April-May 2023, compared to Rs 2.9 lakh crore in all of financial year 2022-23.

The weighted average call money rates remained near or below the repo rate on most days since May 2022, due to the massive liquidity surplus in the banking system. However, in some instances, it remained above the repo rate owing to tightened liquidity conditions. Das in the June monetary policy this year said they want the call money rate to align with the repo rate.

“The target of the monetary policy is the policy repo rate, which is 6.5 percent. What we would like to see is that the overnight call rates are also aligned to 6.5 percent. Beyond that, it is a function of day-to-day fluctuation or week-to-week fluctuation in the overall liquidity situation. So we expect and would like the overnight call rates to be aligned with the policy rate,” Das said.

Money market dealers said that going ahead, tight liquidity conditions are likely to keep overnight rates higher than the repo rate. “We may see higher overnight rates if the liquidity in the banking system tightened,” said a call money dealer with a state-owned bank.

Also read: Sundaram Home Finance to enter affordable housing segment, to disburse loans up to Rs 35 lakh

RBI’s take on liquidity overhangIn the August monetary policy, Das said I-CRR is purely a temporary measure for managing the liquidity overhang. Even after this temporary impounding, there will be adequate liquidity in the system to meet the credit needs of the economy, he underlined.

However, RBI deputy governor Michael Patra in the monetary policy committee meeting last month said a risk to the inflation outlook stems from the liquidity overhang in the banking system, according to the minutes of the meeting.

“Withdrawal of excess liquidity should engage primacy in the attention of the RBI going forward as it presents a direct threat to the RBI/MPC resolve to align India’s inflation with the target, besides the potential risks to financial stability,” Patra said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.