The country is expected to get a normal monsoon this year, which is expected to boost income in rural India that contributes 53 percent to the GDP. The forecast of a normal monsoon, the lifeblood of Indian agriculture, has been supporting the market. The Nifty50 has gained 5 percent from recent lows, though it is still some distance from the record highs seen in February.

A good harvest would go a long way in taming inflation, which has been a growing concern as the second coronavirus wave rips through the country threatening the nascent economic recovery, say experts.

"It should be good for crops and thus the economy as a whole, especially given the current backdrop of the second wave of COVID-19 cases," brokerage Motilal Oswal said.

Tractors, two-wheelers, auto, rural financing, agrochemical and select FMCG companies are likely to benefit from a good monsoon, the brokerage said.

India Meteorological Department (IMD)has said the monsoon will be "normal" at 98 percent of the Long Period Average (LPA) for CY21. The state-run weather office considers as normal rainfall between 96 percent and 104 percent of the 50-year average of 88 cm for the four-month season beginning June.

"If the predictions turn out to be true, this will be the third consecutive year of normal monsoon. Even as per the private weather forecasting agency, Skymet, the monsoon is expected to be normal at 103 percent of the LPA," said Siddhartha Khemka, Head-Retail Research at Motilal Oswal Financial Services.

The timely onset of the monsoon season from June 1 and the likely normal rainfall projects a strong outlook for the kharif sowing season, which is critical at such a challenging time, he added.

As the rain distribution is likely to be good, barring the east and the north-east, the production of a majority of the kharif crops is expected to be robust and farmers may expand the acreage, he said.

Gaurav Garg, Head of Research at CapitalVia Global Research, said a bumper harvest would ease supply-side constraints and also help in curbing inflation.

The Reserve Bank of India largely expects CPI inflation at around 5 percent in the current financial year, 5.2 percent in Q2FY21, 4.4 percent in Q3FY21 and 5.1 percent in Q4FY21, which is still within the range of 4 percent (+/-2 percent) target set by the central bank.

"We expect the set of restrictive measures to impact near-term economic recovery till cases stabilise. However, key government authorities and policymakers have ruled out national lockdown. Meanwhile, vaccinations are gradually beginning to accelerate. As vaccination picks up further with approvals for more vaccines now in place, we expect the focus to shift back to growth," said Khemka.

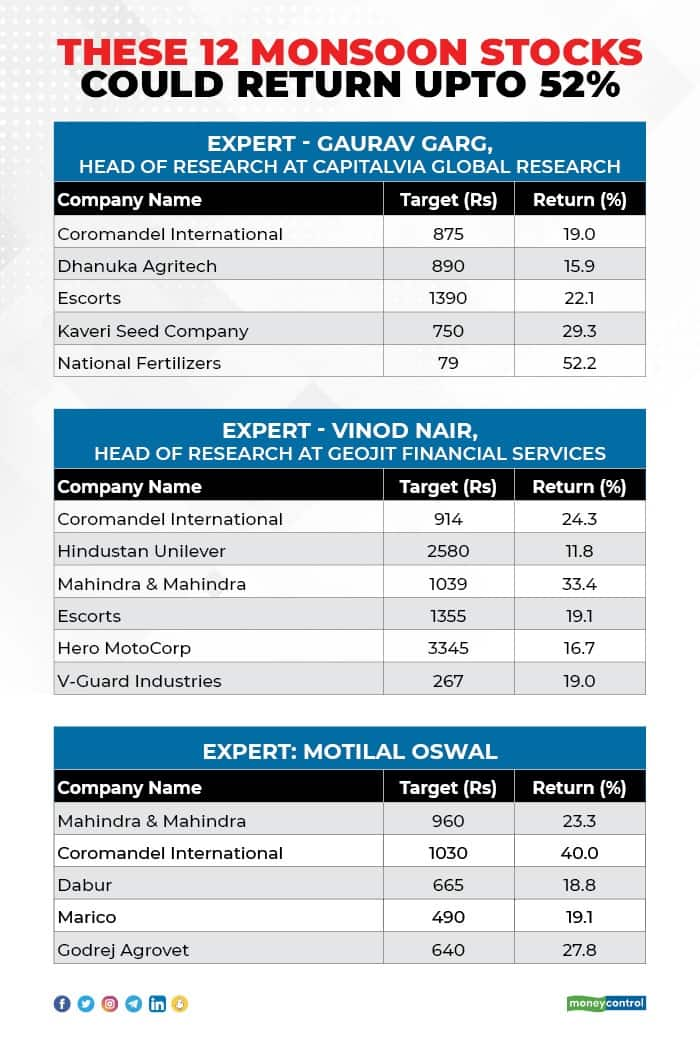

Here are 12 stocks that are likely to be benefitted from a healthy monsoon:

Coromandel International: Buy | Target: Rs 865-875

The Murugappa Group's Coromandel, which is the second-largest producer of fertilisers and other agri-input segments, has a strong presence in the South Indian states of Andhra Pradesh (AP) and Telangana. Rising rural demand and normal monsoon will benefit the company.

Dhanuka Agritech: Buy | Target: Rs 890

A debt-free company with pan-India presence is a manufacturer of more than 300 products of agro-chemicals like herbicides, insecticides, fungicides, plant growth regulators in various forms liquid, dust, powder and granules.

Escorts: Buy | Target: Rs 1,380-1,390

Escorts is engaged in the business of agricultural machinery, tractors and other farm equipment. A good monsoon will boost the sales of the company.

Kaveri Seed Company: Buy | Target: Rs 740-750

A debt-free company engaged in research, production, processing and marketing of various high-quality hybrid seeds. A good monsoon will increase the demand of hybrid seeds, which will benefit the company.

National Fertilizers: Buy | Target: Rs 79

The state-run company NFL has a strong presence in the bio-fertilizer and urea segment. It may see a demand push if June-September rains are good.

Expert: Vinod Nair, Head of Research at Geojit Financial ServicesCoromandel International: Buy | Target: Rs 914

The forecast of normal rainfall will help the company increase its volumes in both the fertilizer and crop-protection segments, which have grown significantly over the last two-three years. The company is looking to increase its revenue share from the high-margin crop protection business with new launches and a diversified product portfolio. The increase in subsidy allocation by the Centre will improve its working capital cycle and generate higher free cashflows in the future.

Hindustan Unilever: Buy | Target: Rs 2,580

A good monsoon is positive for FMCG companies like HUL on account of potential strong demand due to increased farm production and higher disposable income. HUL gets a majority of its revenue from rural India and increased rural income will boost growth. Reduced input costs due to increased farm production is positive on the margin front.

Mahindra & Mahindra: Buy | Target Rs 1,039

Escorts: Buy | Target: Rs 1,355

Normal monsoon leads to surplus reservoir which results in farm production and increased demand from rural areas. Volumes in tractor sales are likely to benefit M&M & Escort. We have a target price of Rs 1,355 (20x FY23 EPS) on Escorts and Rs 1,039 (23x FY23 EPS) for M&M. Currently on a one year forward basis, Escorts is trading at 24x, while M&M at 17x, which seems attractive.

Hero MotoCorp: Buy | Target: Rs 3,345

The third year of normal monsoon with increased government spending is good news for auto companies, such as Hero MotoCorp with large rural market share. We have a buy rating on the stock with a target price of Rs 3,345(19x FY23 EPS). The stock is at and 16x on a one year forward basis which seems attractive.

V-Guard Industries: Buy | Target: Rs 267

A strong agriculture season led by good monsoon and improved yield is expected to drive demand for consumer discretionary products in rural areas. Further, higher rural income will drive demand for housing, electrification and other discretionary products.

Exper: Siddhartha Khemka, Head-Retail Research at Motilal Oswal Financial ServicesMahindra and Mahindra: Buy | Target: Rs 960

Mahindra & Mahindra's Q3FY21 performance was driven by good performance in both the tractors and autos businesses. Furthermore, it has guided for an almost 90 percent reduction in international subsidiary losses in FY22, driven by the completion of phase-1 of the capital allocation exercise.

M&M has twin levers of core business recovery as well as benefits of tightening capital allocation for EPS growth and re-rating. We upgrade FY21 and FY22 EPS by 14 per cent and 20 per cent to reflect volume upgrade in tractors & autos, tighter cost control, lower depreciation, and higher other income. Maintain buy.

Coromandel International: Buy | Target: Rs 1,030

We believe key levers would drive growth for Coromandel, including: (i) focusing on increasing penetration in existing markets, (ii) debottlenecking to increase capacity, (iii) undertaking efforts to lower raw material cost (rock), while maintaining the same level of quality, and establish an alternative sourcing destination (which would aid in cost savings), (iv) launching three–four molecules in the crop protection segment, (v) exploring inorganic growth opportunities, and (vi) focusing on profitable growth in the Retail business by reorganizing retail stores depending on the consumption pattern.

Additionally, the company is likely to generate cash flow from operations (CFO) of Rs 4,130 crore in FY21, aided by the release of subsidies by the government. Thus, the company’s capex plan would be a key monitorable, in our view. Maintain buy.

Dabur: Buy | Target: Rs 665

The investment case for Dabur is being supported by: (a) focus on the core, (b) power brand strategy, (c) a spate of new launches, (d) an increasing direct distribution reach, (e) the narrowing gap on analytics v/s domestic peers, and (f) cost savings, which are being plowed back into the business in the form of higher advertisements.

The structural and medium-term narrative on topline growth is turning highly attractive – led by strong traction in the profitable Healthcare business and an attractive rural growth outlook (around 48 percent of domestic sales from rural). Volume growth of 18 percent in Q3FY21 was impressive. Maintain buy.

Marico: Buy | Target: Rs 490

Led by domestic volume growth of 15 percent, its highest in 34 quarters, Marico exceeded expectations on the sales front, a trend that is likely to continue for the next few quarters, with all key segments doing well and a weak base in the next couple of quarters.

Strong momentum in key segments, increased confidence, and new launches in foods led us to forecast around 12 percent revenue CAGR between FY21-FY23, much higher than the 5 percent witnessed over FY15-20. Ongoing volume growth momentum in each of its core segments and significantly high growth targets in the foods portfolio is encouraging. Maintain buy.

Godrej Agrovet: Buy | Target: Rs 640

GOAGRO's Q3FY21 revenue decreased by 14 percent YoY due to a 23 percent, 17 percent and 10 percent decline in the animal feed (AF), palm oil and dairy segments, respectively.

Margin expansion was witnessed in AF and processed foods and dairy, but contracted in palm oil and crop protection (CP). Volume growth in the palm oil segment is likely to return in FY22.

Godrej Agrovet's crop protection business is likely to do well due to: a) product launches in the standalone CP segment, b) strong performance in Astec owing to its expertise in triazole chemistry, and c) commencement of a new herbicide plant. Maintain buy.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.