March was a roller coaster month for investors but fund managers with schemes attributed towards small & midcaps space created fortunes. Around 50 percent of the Portfolio Management Schemes (PMSes) managed to beat Sensex in March and most of them were from the broader market space.

Of the 213 schemes PMSBazaar.com looked at, 153 (72 percent) generated positive returns in March. Five of the top 10 funds were from the multicap space, four from mid and small-cap space and one was a thematic fund.

Portfolio Management Services (PMS) cater to wealthy investors with portfolio sizes exceeding Rs 50 lakh. The professional fee structure is also different from a regular mutual fund (MF).

Nifty50 and Sensex rose by about 1 percent compared to the 1.02 percent rise seen in the S&P BSE Midcap, and the 2.4 percent rally in the S&P BSE Smallcap index in March.

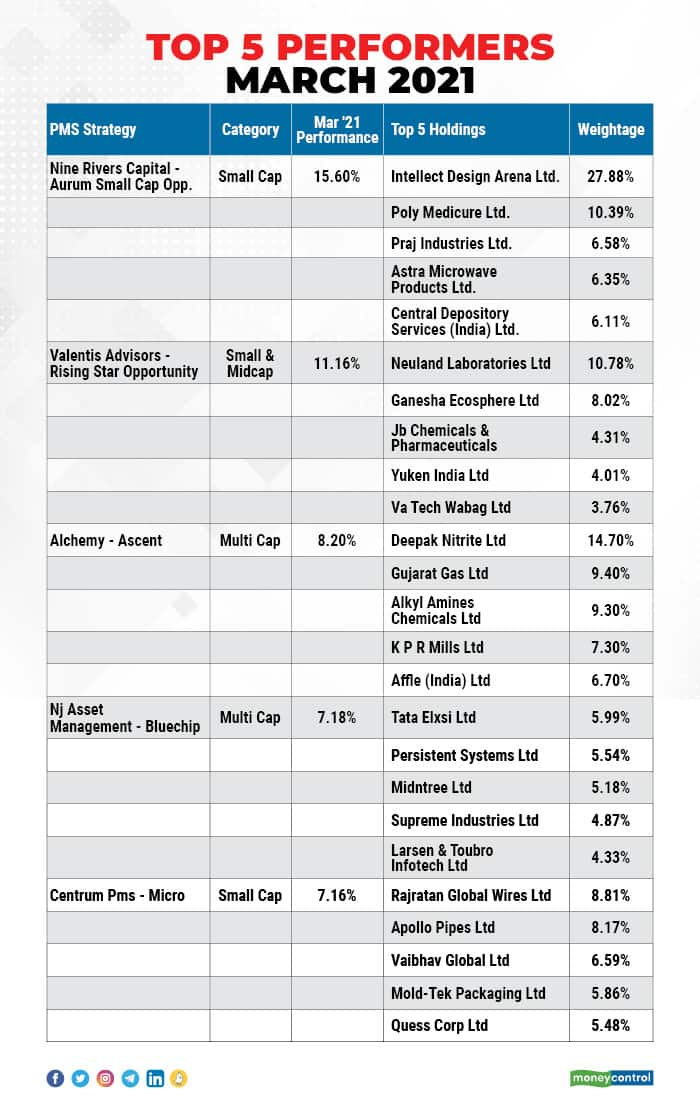

Riding the momentum in the small & midcap space, the top five funds that outperformed the Nifty50 were from smallcap, midcap as well as multicap category.

Nine Rivers Capital Aurum Smallcap Opportunities was the top-performing scheme, rising 15.6 percent month-on-month (MoM). The smallcap fund, managed by Sandeep Daga and Vivek Ganguly, focuses on companies with a market capitalisation of less than Rs 3,500 crore and a low turnover.

Valentis Advisors Rising Star Opportunity (11.16 percent), Alchemy Ascent (8.2 percent), NJ Asset Management Bluechip (7.18 percent), Centrum PMS Micro (7.16 percent) were the other top performers in March.

We have collated a list of funds that have declared their March stock holdings.

A close look at the top holdings of these funds can give investors some clue as to where the top fund managers are betting their money.

Note: The list should only be considered as a reference to shortlist stocks for individual portfolios and not as buy recommendations.

Top five holdings of Nine Rivers Capital include names like Intellect Design, Poly Medicure, Praj industries, Astra microwave, and Central Depository Services.

What should investors do?

The next big question is how one can select stocks in the broader market space. Well, the thumb rule is to pick the sectoral leaders and companies that have relatively less debt on the books compared to peers and also has a strong growth model.

Some experts compared the rally which was seen in FY 2020-21 with the rally that started prior to the 2014 general elections. That euphoric rally lasted for like 4 years and mid and small caps were real winners.

“This time too we think that mid and small-cap will outperform the markets. However, in the euphoria, don’t forget the fundamentals of the company. Because it's only when the tide goes out that you learn who has been swimming naked,” Divam Sharma, Co-founder at Green Portfolio told Moneycontrol.

“In our opinion, the largecap space will grow at a rate more or less representing the economic growth as we see them facing a mild saturation kind of a situation. However, selected mid and small-cap counters have room to grow disproportionately. We keep looking for companies with lesser debt and growth plans,” he said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.