Frontline pharmaceutical majors Cipla, Sun Pharma and Dr Reddy’s have had bumper earnings over the last few quarters, thanks to the high-margin blockbuster cancer drug Revlimid.

But that effect could soon wear off in the coming quarters because of the high base effect and the impending entry of peers like Aurobindo Pharma who will be allowed to sell the drug. The patent for Revlimid will eventually expire in January 2026.

That means the Big 3 of the Indian pharmaceutical industry will need to have other tongs in the fire to maintain the growth in earnings.

The Revlimid factor

Revlimid sales make up a significant chunk of overall revenue and profit margins for companies like Dr Reddy's Labs, Cipla, Sun Pharma and Zydus Life.

HDFC Securities estimates Dr Reddy’s to earn $372 million from Revlimid out of the expected US revenue of $1,159 million for FY24.

Strong contribution from Revlimid not only helped Cipla report its highest quarterly US revenue for the third straight time in Q3, but will round up around $165 million in sales for FY24 and $185 million for FY25 according to Elara Capital.

For Sun Pharma, however, the opportunity is quickly diminishing due to loss of market share and its strategy to focus on specialty rather than generics.

Also Read | Revlimid overdose boosts Dr Reddy's Q3 earnings, but turns brokerages cautious

Dr Reddy's game plan

To make up for the loss of Revlimid contribution along with divestment of certain domestic brands, Dr Reddy's is looking at acquiring other companies with complementary portfolios. The company has Rs 5,910 crore in its kitty, and is said to be eyeing opportunities in US, India, Europe, and other markets.

Faster product filings is the other strategy. The firm has identified 25-30 material product launches for FY25-30, HDFC Securities said. Meanwhile, the drugmaker also sees its recently acquired Mayne portfolio scaling up and gaining volume in the US.

However, analysts worry that the increasing competition in key products will hurt volumes and market share loss, and keep base business growth under pressure in the near term.

Cipla’s trump cards

Cipla is banking on two major launches, respiratory drug Advair and cancer drug Abraxane, both commanding a $700 million revenue opportunity each to make up for the loss of Revlimid sales.

However, the twist is that both these launches have faced repeated delays due to regulatory issues at two of Cipla's manufacturing units - Goa and Pithampur, where the drugs were to be manufactured. Due to these delays, the full effect of these launches can now only be seen from FY26 instead of FY25.

Regardless, the management has hinted towards a significant undisclosed peptide product launch in Q1 of FY25 which according to Elara Capital can more than offset the delay in Advair and Abraxane.

Also Read | Delayed drug launches to hurt Cipla’s earnings in FY24

Sun Pharma’s specialty bet

Sun Pharma is looking to bet heavily on global specialty products and reduce dependence on US generics. This could hit near-term earnings, believes Nomura.

On the other hand, upsides from product-specific opportunities in generics and specialty will be realised only with a lag, according to Nomura.

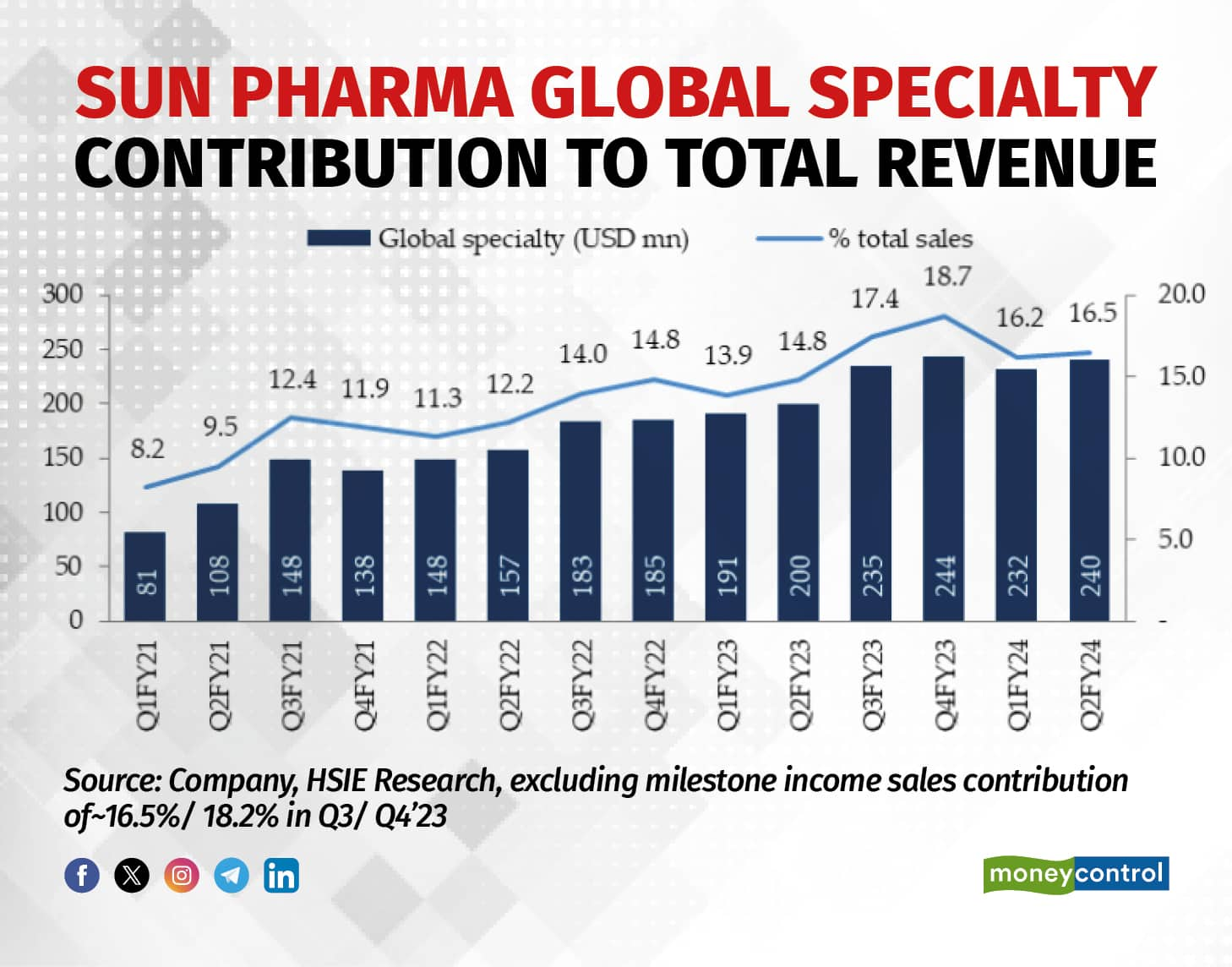

Sun Pharma’s global specialty sales have rose 29 percent on year to $871 million in FY23, going from making just 7 percent of total sales in FY18 to the current 16 percent.

Nonetheless, Sun Pharma still has the expected launch of Deuruxolitinib, filed recently for alopecia areata which could aid its momentum in the second half of FY25. The firm discovered the molecule by applying its recently acquired Concert Pharma's deuterium chemistry technology. As per Elara Capital's estimate, the product could become a $200 million opportunity, exclusively for Sun Pharma in the next couple of years.

The drugmaker also recently launched Sezaby, which is the first and only product approved in the US for treating seizures in neonatal patients. Factoring that in, HDFC Securities expects momentum to continue for Sun Pharma in the near term with traction in existing specialty products like Ilumya, Winlevi, Cequa (prescription growth in H1 FY24) and the recently launched Sezaby.

"Sun Pharma's pipeline (five molecules under clinical phase), Concert acquisition (deuruxolitinib), M&A (strong balance sheet), and in-licensing (has commercial infrastructure in a few large markets) will drive long-term growth," the firm believes.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.