Mazhar Mohammad

Market participants were delighted when Narendra Modi returned to power with an absolute majority, resulting in the euphoric upmove at the bourses and the new milestone of 12000 levels on the Nifty.

But, the euphoria didn’t last long. The dichotomy between earnings and market outperformance increasingly became wider since 2014 and to most of our fundamental fraternity, earnings recovery consistently remained two-three quarters away since 2015.

We are in 2019 and there is no reason to believe that earnings will turn the corner in the next six months, especially when the global economy appears to be staring at a recession.

With an absolute majority, market participants expected bold reforms from the government but budget appears to have disappointed on this front.

Moreover, super-rich tax that also hit foreign portfolio investors (FPIs) and a proposal for equity dilution norms up to 35 percent in favour of public appear to have spooked the sentiment apprehending more supply of stock from large caps where promoter holdings are highest.

In between, NBFC crisis deepened with some contagion impact as companies such as DHFL, Essel Group subsidiaries, Cox & Kings, Reliance Home, Sintex Industries started defaulting on debt obligations.

Meanwhile, a slump in auto sales, fall in the savings rate and a rise in unemployment are some of the factors hinting at a slowdown.

Why investors may remain cautious

Though Modi has come back with a bigger mandate, investors may remain cautious in his second innings. In 2014, markets grandly welcomed the change of leadership at the Centre, looking at the “Gujarat model” of development.

But, in his first innings, he hit the market participants with demonetisation, scratchy implementation of GST and brought back long-term capital gains tax, making his economic moves somewhat unpredictable.

Controversy surrounding growth statistics of the government, which are not capturing ground-level realities, have only made investors cagey.

Hence, investors may rightly wait to see earnings recovery with strengthening investment cycle, as corporate profits since 2014 have remained almost flat while GDP slowed down on a year-on-year basis.

Largecaps to lead next leg of fall?

Our analysis of ‘Time Cycles’ is suggesting that markets may be stuck in a prolonged sideways phase and the best of the rallies may not be witnessed till March 2020 quarter.

Till then, we may see a range-bound move with negative bias. In terms of levels 10,850–10,740, as of now, looks like a strong support zone on the long-term charts.

A major part of the market—between 60-70%—is in a bear phase from the highs of 2018. Hence, if markets break down further then largecaps are likely to come under pressure which are trading at expensive valuations as there is uncertainty about growth.

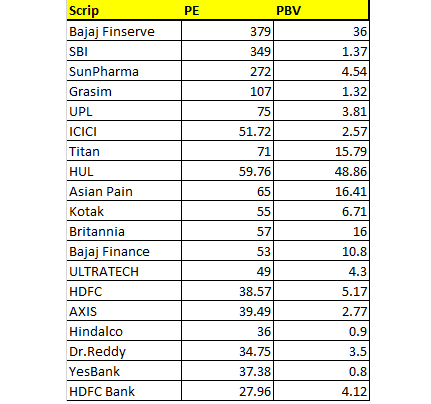

Market favourites like Bajaj twins, consumption stocks like HUL, Asian Paints etc. are trading well above 50x PE ratio without giving any valuation comfort. Our analysis of Nifty components shows:

a. Three stocks are trading with 3 digit earnings multiple i.e. with a PE of more than 100x

b. Three stocks are trading with a PE between 70-99x

c. Six stocks are trading with a PE between 50-69x

d. Six stocks are trading with a PE between 30-49x

Eighteen of the 50 companies in the Nifty50 may remain more vulnerable for a fall as valuation comfort is clearly missing.

Sample illustration:

Near term trends

If the market stabilises above 11,200 levels then a pullback can be witnessed towards 11,600 kind of levels in the best case.

Contrary to this, a breach of 11,200 will eventually drag down the indices towards the strong support zone of 10,850-10,740 on the long-term charts.

Overall, as the upsides look limited to the zone of 11,500–11,600 levels, traders are advised to prune their portfolios by making use of this rally.

(The author is Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in)

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.