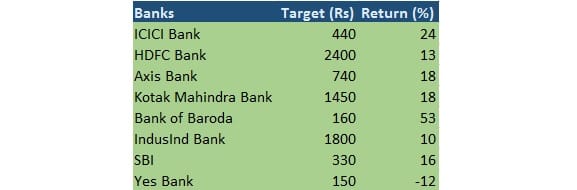

Global brokerage firm UBS expect seven banks including private as well as PSU to give 10-50 percent return over a period of one year on double digit earnings growth ahead, but it remains bearish on Yes Bank on likely NPL recognition.

It remained bullish on largest private banks, but mixed on public sector lenders due to asset quality concerns.

The research house has a buy call on ICICI Bank with a target price at Rs 440, implying 24 percent potential return.

"ICICI provisioning may stay higher in the medium term, but the visibility on resolution under IBC is key catalysts in near term for the bank," it said.

While having a buy call HDFC Bank with a target price at Rs 2,400, UBS said the country's second largest private sector lender is well positioned to gain market share in retail liabilities business and would continue to grow its loan book mid-to-high single digit above industry.

HDFC Bank remains its preferred pick and it sees 26 percent CAGR earnings over FY18-21.

For Axis Bank, the global investment firm said NPL issue is the key near-term driver, though the bank is well placed to gain share in retail & SME segments.

Normalisation of credit costs will drive EPS CAGR of 54 percent over FY19-21 for Axis, said the brokerage house which has a buy call on the stock with a target price at Rs 740, implying 18 percent potential upside.

Kotak Mahindra Bank is uniquely placed among banks given its leadership across financial products; hence UBS said it expects earnings CAGR of 28 percent over FY18-21 for the private sector lender.

While having buy call on Bank of Baroda with a target price at Rs 160 per share, the research house said the lender is better placed than other state-owned banks on higher provision coverage. "We expect its profitability to improve sharply in FY19-20."

IndusInd Bank may continue to report strong growth and its earnings are expected to grow at 20 percent CAGR over FY18-20, the research house said while assigning neutral call on the stock with a target price at Rs 1,800 as NPL risks from its exposure to midsized companies are not fully factored in.

UBS also maintained neutral call on SBI with a price target a Rs 330 as SBI operating metrics may remain weak on low loan growth and falling margin, and its net interest margin is likely to decline due to merger with lower yielding subsidiaries.

However, the brokerage house has sell call on Yes Bank with a target price of Rs 150 (implying 12 percent potential downside) as it believes higher NPL recognition is yet to happen. Downside case target for the bank is at Rs 110, it said.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.