The Nifty 50 continued to consolidate below the psychological 23,000 mark, while the buying interest at lower levels helped the index take support at 22,800 on a closing basis for the third consecutive session on February 18. If the index sustains above 22,800 on a closing basis, the possibility of a sharp rebound can’t be ruled out, which can open doors for targets at the 23,200 and 23,500 zones. However, falling decisively below 22,800 can take the index down toward 22,600, according to experts. If the Bank Nifty sustains above 49,000 on a closing basis, an attempt to move toward 49,500 (20-day EMA) and then 49,800 (50-week EMA) can be possible. But a decisive close below 49,000 can drag the index toward 48,500 (the low of the current week).

On Tuesday, February 18, the Nifty 50 closed at 22,945, down 14 points, while the Bank Nifty dropped 172 points to 49,087, with the market breadth favouring bears. About 2,006 shares saw a correction against 601 shares advancing on the NSE.

Nifty Outlook and Strategy

Dhupesh Dhameja, Derivative Research Analyst at Samco Securities

The Nifty has gradually transitioned from a sideways movement to a bullish inclination as it continues to respect its crucial support level, with persistent buying emerging from lower levels. On the daily chart, a series of bullish reversal candlestick formations suggests a potential rebound, driven by increasing accumulation. Additionally, lower timeframes highlight a well-defined base formation, coupled with a positive RSI (Relative Strength Index) divergence on the daily chart, reinforcing the presence of a strong demand zone.

Despite these promising technical cues, the index remains below its short-term moving averages, making it vulnerable to intermittent volatility. The 22,800 level has established itself as a significant demand zone, acting as a cushion for the ongoing recovery attempt. However, a decisive breakout beyond the 23,200 resistance remains essential for sustained upside momentum, as renewed Call writing and key technical barriers could pose challenges. As long as the Nifty holds above the 22,800 support, the probability of a pullback remains high, making a ‘buy on dips’ strategy an attractive approach.

Key Resistance: 23,200, 23,500, 23,700

Key Support: 22,750, 22,500, 22,300

Strategy: Traders can implement a Bull Put Spread by buying the 23,000 strike Put at Rs 156.75 and selling the 23,150 strike Put at Rs 259.60 for the February 20 expiry. In case of a stop-loss, the strategy can be held until expiry, with the maximum loss capped at Rs 3,532. In case of a target, hold the strategy till expiry for a maximum profit of Rs 7,717, or consider booking profits once the mark-to-market (MTM) profit crosses Rs 3,500.

Preeti K Chabra, Founder, Trade Delta

The Nifty 50 has been closing below the important psychological level of 23,000 for the last three trading days. It touched an intraday low of 22,801 on Tuesday and gained some momentum in the later half of the trading day, closing at 22,945. Out of the last 10 trading days, the Nifty has closed 9 times below its previous day's closing. Nifty is trading below the important Fibonacci level of 23,189 and facing rejection in this zone. The index is currently trading in a bearish channel, and any positive close above 23,235 will give some pullback in Nifty. On the lower end, Nifty is testing the support zone of 22,777 multiple times and bouncing back from there.

On the Relative Strength Index (RSI), the Nifty is trading at 38.72 with a negative crossover suggesting a bearish scenario. However, in the past, we have seen the RSI take support at this level, so some consolidation can happen in the index. In the near-money options, we see heavy writing at the 23,000 strike Call and 23,100 strike Call as resistance and 22,900 strike Put and 22,800 strike Put acting as support.

Key Resistance: 23,235

Key Support: 22,777

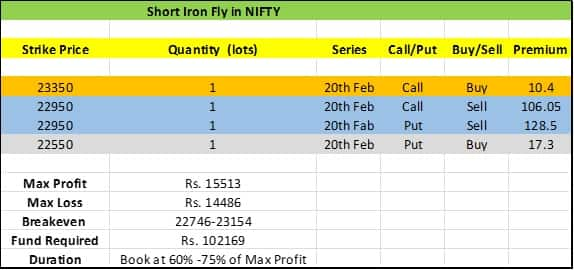

Strategy: We expect the Nifty to consolidate this week before taking any further direction. To take profit from this scenario, we can deploy a short straddle or Iron Butterfly spread.

In a short straddle, the trader sells a Call and a Put at the same strike price to receive the premiums on both the short Call and short Put positions. We deploy this strategy when we expect the underlying to consolidate in a range before taking any further direction. The straddle selling is usually advised for expert traders, and for conservative traders, it is best to buy hedges for protection, thus converting the straddle into an Iron Butterfly.

Ashish Kyal, CMT, Founder and CEO at Waves Strategy Advisors

On the daily chart, the Nifty faced resistance from the downward sloping trendline on February 5, and since then, we have seen a fall of more than 4% within 10 trading sessions. Currently, Nifty is struggling near the previous swing low of 22,786. A close below it can further accelerate selling pressure. As per open interest data, 22,800 followed by 22,700 strikes have the highest open interest, which can act as crucial support for this week. On the Call side, the 23,000 strike has the highest open interest, which can act as a short-term hurdle.

In summary, the Nifty formed a neutral candle but protected the previous day’s high on a closing basis for the 10th consecutive session. A breach above 23,030 can result in a short-term pullback toward the 23,150 levels, whereas a break below 22,780 is a must for selling to continue with the targets of 22,700 followed by 22,630 levels.

Key Resistance: 23,150

Key Support: 22,630

Strategy: Short positions can be created below 22,780 with 22,870 as a stop-loss and a target of 22,690 followed by 22,630.

Bank Nifty - Outlook and Positioning

Dhupesh Dhameja, Derivative Research Analyst at Samco Securities

The Nifty Bank is showing initial signs of transitioning from a sideways consolidation to a bullish bias, as it continues to defend its critical support zone while attracting steady buying interest. On the daily chart, a consistent formation of bullish reversal candlesticks hints at a potential rebound, backed by increasing accumulation at lower levels. Additionally, lower timeframes illustrate a well-defined base formation, while the RSI sustains above the 40 level on the daily chart, reinforcing the presence of a strong demand zone.

Despite these encouraging technical signals, the index remains below its short-term moving averages, leaving it prone to bouts of volatility. The 48,600 level has established itself as a crucial demand zone, acting as the foundation for the ongoing recovery. However, a decisive break above the 50,000 resistance remains vital for sustained upside momentum, as fresh Call writing and technical hurdles could challenge further gains. As long as the Nifty Bank holds above the 48,600 support, the chances of a pullback increase, making a ‘buy on dips’ strategy an appealing approach.

Key Resistance: 49,700, 50,000, 50,300

Key Support: 49,000, 48,700, 48,500

Strategy: Traders can consider buying Nifty Bank February Futures if the price crosses above 49,450–49,500, setting a stop-loss above 49,300. Profit-taking can be considered once the index reaches 49,800–48,900.

Preeti K Chabra, Founder, Trade Delta

The Bank Nifty has been trading in a downward trending channel and is unable to close above the high of the previous day for the last 10 trading days. It is trading below the important Fibonacci level of 49,300 and facing rejection in this zone.

The Bank Nifty is trading with a Relative Strength Index (RSI) of 43.78 with a bearish crossover and sloping downward, suggesting negative momentum. In the option chain, we see unwinding happening at In The Money (ITM) Puts, suggesting a bearish scenario. Thus, to take advantage of the bearish scenario, we advise traders to sell Bank Nifty on rises.

Key Resistance: 49,300, 49,600

Key Support: 48,700, 48,500

Strategy: Sell Bank Nifty Futures when facing rejection in the zone of 49,300 for a target of 48,800 with a stop-loss of 49,600.

Ashish Kyal, CMT, Founder and CEO at Waves Strategy Advisors

Since February 5, the Bank Nifty has protected the previous day's high on a closing basis, which suggests that the overall bias still looks weak as long as we do not see a close above the prior day's high. Over the past 10 sessions, the index has shown a fall of nearly -3.9%, and a major contributor to this fall has been PSU banks. Prices have retraced 61.8% of the prior rise that started on January 27. We expect it to retrace 78.6% of the prior rise, and the target as per this comes near the 48,400–48,300 levels. Currently, the index is trading near the important support level of 48,730 levels. A breach below it can extend selling toward 48,400 followed by 48,000 levels.

In summary, the trend for Bank Nifty is still bearish. A breach below 48,730 can drag the price lower toward 48,400 followed by 48,000. On the upside, 49,350 is the crucial resistance. A break above it can trigger short covering.

Key Resistance: 49,350

Key Support: 48,000

Strategy: Short positions can be created below 48,730 with targets of 48,400 followed by 48,000 and a stop-loss of 49,060 levels.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.