The benchmark indices gained more than four-tenths of a percent on January 1, extending their northward journey for another session. The market breadth remained in favour of bulls, with a total of 1,876 shares advancing compared to 637 shares declining on the NSE. Rangebound trading is expected to sustain in the upcoming sessions until the frontline indices give a strong close above all key moving averages. Below are some trading ideas for the near term:

Jatin Gedia, Technical Research Analyst at Mirae Asset SharekhanOil and Natural Gas Corporation | CMP: Rs 237

ONGC has corrected 35% over the last five months and is now showing signs of positive divergence developing on the daily charts, suggesting an exhaustion of selling pressure. The stock has formed an Engulfing Bull Candle pattern followed by an Inside Bar, indicating a likely breakout on the upside in the next few sessions. A run-up is expected, and at current levels, the risk-reward ratio is extremely favourable. One can consider going long.

Strategy: Buy

Target: Rs 265, Rs 274

Stop-Loss: Rs 232

Gland Pharma | CMP: Rs 1,810.1

Gland Pharma has formed a Symmetrical Triangle pattern on the daily charts. The daily momentum indicator has shown a positive crossover, which is a buy signal. A breakout on the upside is expected. Investors can go long on the stock.

Strategy: Buy

Target: Rs 1,930, Rs 2,000

Stop-Loss: Rs 1,740

Vidnyan S Sawant, Head of Research at GEPL CapitalAction Construction Equipment | CMP: Rs 1,552.8

Action Construction Equipment exhibits a strong price structure, highlighted by a breakout from the falling channel, signaling potential upward momentum. The surge in volume above its 10-week average underscores increased buying interest. Additionally, the MACD (Moving Average Convergence Divergence) bullish crossover confirms the continuation of positive momentum.

Strategy: Buy

Target: Rs 1,815

Stop-Loss: Rs 1,426

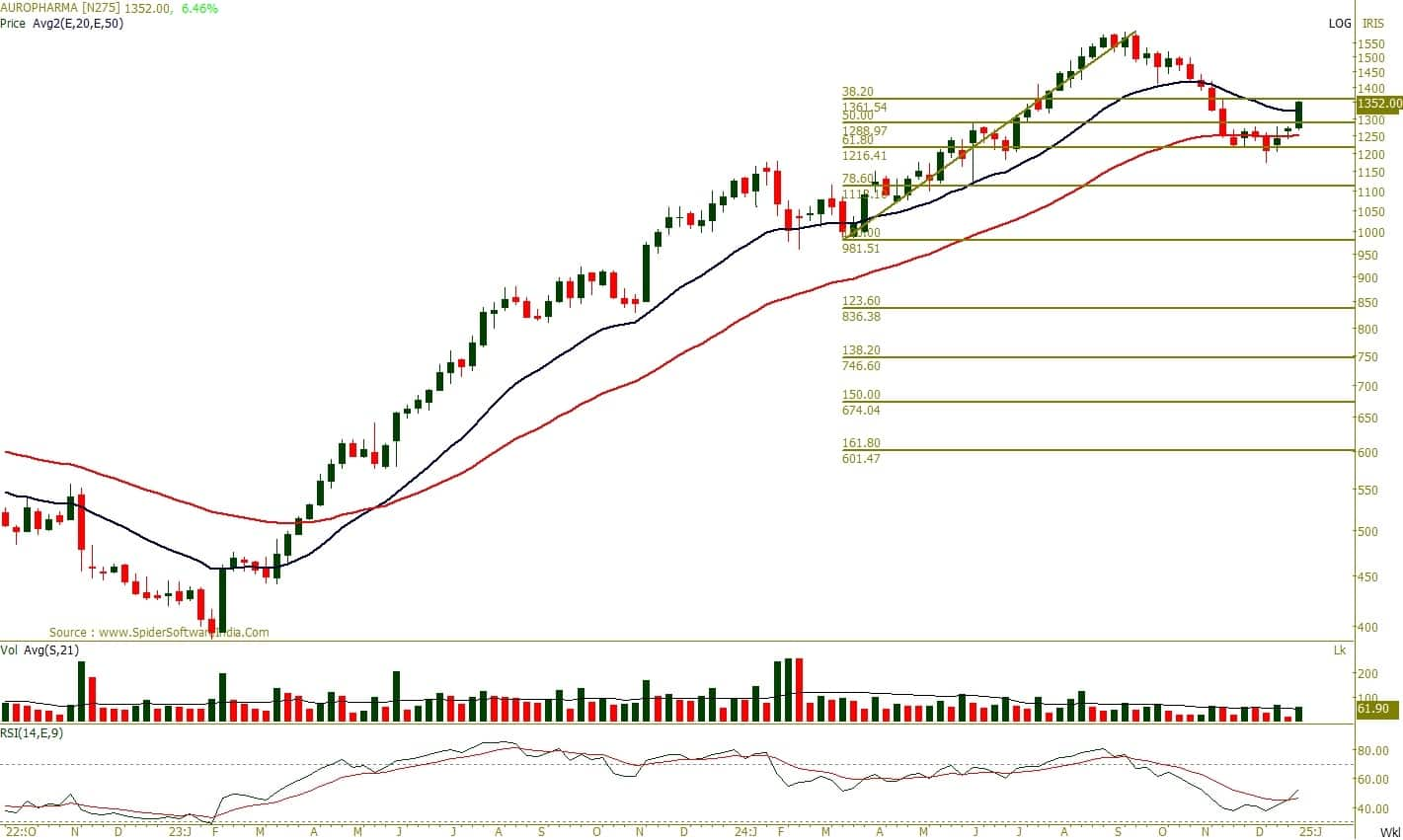

Aurobindo Pharma | CMP: Rs 1,353

Aurobindo Pharma has maintained a bullish structure, forming higher tops and higher bottoms on the weekly chart since 2023. Recently, the stock rebounded from the 61.80% Fibonacci retracement level, further affirming its positive trend. The RSI (Relative Strength Index) has made a bullish crossover and is currently at 51, supporting the upward momentum.

Strategy: Buy

Target: Rs 1,622

Stop-Loss: Rs 1,240

United Spirits | CMP: Rs 1,659.6

United Spirits continues its upward trajectory, maintaining a pattern of higher highs and higher lows while consistently trading above the 12-week and 26-week EMAs. This underscores its bullish momentum. The weekly MACD remains in buy mode, highlighting strong bullish sentiment. On the daily chart, the stock has achieved a base breakout, with sustained prices above Rs 1,647 confirming the continuation of the uptrend.

Strategy: Buy

Target: Rs 1,922

Stop-Loss: Rs 1,540

Jubilant Foodworks | CMP: Rs 739.2

Jubilant Foodworks is forming a classical base on the weekly chart, indicating a strong foundation. On the daily chart, the stock has achieved a Cup-and-Handle breakout, signifying a robust price structure. The MACD has confirmed a bullish crossover, further reinforcing the positive momentum.

Strategy: Buy

Target: Rs 847

Stop-Loss: Rs 685

Shitij Gandhi, Senior Technical Research Analyst at SMC Global SecuritiesBlue Star | CMP: Rs 2,259.8

Blue Star has been maintaining its bullish trend, trading well above its 200-day Exponential Moving Average (EMA) on the daily timeframe. This week, a fresh breakout above the key resistance of Rs 2,200 has been observed, following a prolonged consolidation phase. The rising volume, along with positive price action, suggests further upside in the stock. Investors can accumulate the stock in the range of Rs 2,200–2,250 for an expected upside of Rs 2,550–2,575.

Strategy: Buy

Target: Rs 2,550, Rs 2,575

Stop-Loss: Rs 2,000

Techno Electric & Engineering Company | CMP: Rs 1690.15

Techno Electric has been consolidating within a broader range of Rs 1,400–1,650 over the past few weeks, with prices sustaining well above its 200-day EMA. This week, the stock gave a breakout above the consolidation zone after forming a W pattern on the daily charts around Rs 1,400 levels. Investors can accumulate the stock in the range of Rs 1,650–1,690 for an expected upside of Rs 1,950–1,980.

Strategy: Buy

Target: Rs 1,950, Rs 1,980

Stop-Loss: Rs 1,450

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.