The market has taken a breather, falling by four-tenths of a percent on the Nifty 50 on December 16. However, the breadth was in favour of the bulls, with 1,359 shares gaining compared to 1,196 shares that corrected on the NSE. The market is expected to consolidate further before potentially entering a fresh leg of upward movement. Below are some trading ideas for the near term:

Jigar S Patel, Senior Manager - Equity Research at Anand RathiHDFC Life Insurance | CMP: Rs 635

HDFC Life has experienced an 18% correction from its recent peak. Currently, the stock has found support near its previous breakout zone, which aligns with the S3 camarilla pivot support. Additionally, the presence of RSI (Relative Strength Index) bullish divergence on the daily chart further strengthens the case for a potential rebound. Traders are advised to consider going long above Rs 635, with an upside target of Rs 680.

Strategy: Buy

Target: Rs 680

Stop-Loss: Rs 610

Hindustan Unilever | CMP: Rs 2,366.15

Hindustan Unilever has witnessed a sharp correction of 22% from its peak of Rs 3,000, approaching a critical support zone near the previous breakout level, which aligns with the S5 camarilla pivot. On December 13, a Bullish Engulfing candlestick pattern emerged, coupled with a bullish divergence on the daily chart. While the price has made lower lows, the RSI has formed higher lows, signaling a potential trend reversal. Traders are advised to consider going long above Rs 2,370, with an upside target of Rs 2,620.

Strategy: Buy

Target: Rs 2,620

Stop-Loss: Rs 2,250

HDFC Bank | CMP: Rs 1,865.2

HDFC Bank has historically faced strong resistance in the Rs 1,790–1,800 zone, reversing multiple times due to selling pressure. However, the stock has now decisively breached the Rs 1,800 level, displaying bullish momentum and trading near Rs 1,865. This breakout above the R4 camarilla pivot resistance suggests fresh buying interest, signaling further upside potential. Traders are advised to consider going long above Rs 1,860, with an upside target of Rs 2,030.

Strategy: Buy

Target: Rs 2,030

Stop-Loss: Rs 1,770

Anshul Jain, Head of Research at Lakshmishree Investments & SecuritiesPiccadilly Agro Industries | CMP: Rs 946.85

Piccadilly Agro has impressively broken out of a 141-day bullish flat base pattern, with trading volumes nearly doubling the 50-day average. This breakout is noteworthy, as the base formation exhibited a distinctive volume pattern: a significant reduction in volumes on down days and an increase on up days, indicating strong institutional accumulation. This pattern suggests that major investors have been steadily buying shares, adding confidence to the stock's upward trajectory.

The breakout is further bolstered by Piccadilly's stellar performance in the September quarter, enhancing the bullish sentiment. With the accompanying surge in volumes, this breakout is technically robust and signals a potential strong upward movement. Analysts have set an immediate extension target of Rs 1,250, reflecting the positive momentum and strong fundamentals. Investors should keep an eye on Piccadilly, as the current breakout could mark the beginning of a significant upward trend.

Strategy: Buy

Target: Rs 1,250

Stop-Loss: Rs 885

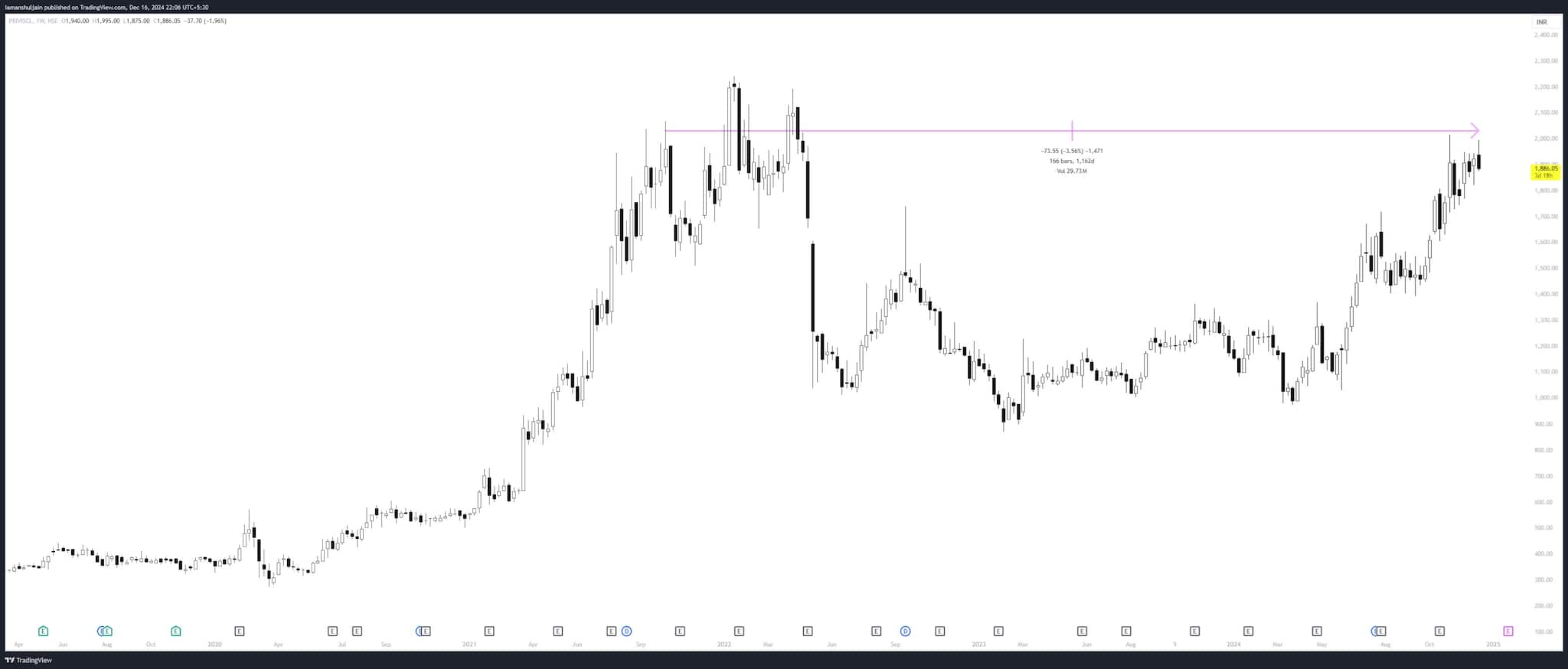

Privi Specialty Chemicals | CMP: Rs 1,886

Privi Specialty Chemicals is forming a bullish 166-week long rounding bottom formation on the weekly charts, characterized by dried-up volumes. This pattern, coupled with low volumes, indicates that the stock is on the verge of a significant breakout. The volume trends suggest strong institutional activity, further substantiated by a notable boost in EPS and sales in the September quarter results, showcasing momentum in the company's performance.

The improved sales and earnings figures are expected to drive the stock's momentum in the coming days. A pre-emptive long position is suggested at the current market price (CMP) of Rs 1,886, with an additional buy recommendation on a breakout above Rs 2,000. The immediate upside target is set at Rs 2,750, reflecting the stock's potential for substantial gains. Investors should watch closely, as Privi Specialty Chemicals is poised for a powerful upward move, driven by strong fundamentals and technical signals.

Strategy: Buy

Target: Rs 2,750

Stop-Loss: Rs 1,795

Jindal Photo | CMP: Rs 986.35

Jindal Photo has broken out of a 117-day Bullish Cup and Handle pattern on the daily charts, marked by a significant volume increase of over 661% against the 50-day average. This surge in volume clearly indicates institutional participation in the breakout. The base formation features approximately six bars of high volumes on up days and multiple days with dried-up volumes, underscoring strong accumulation.

The breakout is further supported by spectacular September quarter results, showcasing a remarkable 150% rise in EPS and around a 30% increase in sales. This resurgence follows three quarters of stagnation, highlighting renewed momentum in the company's performance. Given these robust fundamentals and technical signals, the stock has high potential to reach around Rs 1,350 by the next quarter's results. Investors should consider this breakout a strong buying opportunity, as Jindal Photo appears poised for significant upside in the near term.

Strategy: Buy

Target: Rs 1,350

Stop-Loss: Rs 940

Pravesh Gour, Senior Technical Analyst at Swastika InvestmartWockhardt | CMP: Rs 1,531

Wockhardt is in a classical up move, having given a breakout from long consolidation in the last trading session on robust volumes, and surged above all the important simple moving averages, indicating inherent strength in the counter. The stock will likely witness a strong follow-up move toward Rs 1,600, which will act as a psychological level. Once it breaks above Rs 1,600, Rs 1,750+ will be the next target in the shorter time frame. On the downside, Rs 1,350, around the 20-DMA, acts as a strong support.

Strategy: Buy

Target: Rs 1,764

Stop-Loss: Rs 1,350

SRM Contractors | CMP: Rs 375

SRM Contractors witnessed a breakout from the triangle pattern and closed above the Rs 310 level on the daily chart. The stock is emerging from a long consolidation with strong volume. The overall structure of the counter is very classical on the daily chart. The pattern suggests an immediate target of Rs 400, with the potential to move further upside to Rs 434. On the downside, Rs 345 will act as an immediate support level. The MACD (Moving Average Convergence Divergence) is supporting the current strength, and the momentum indicator RSI (Relative Strength Index) is also positively poised.

Strategy: Buy

Target: Rs 434

Stop-Loss: Rs 345

Capacite Infraprojects | CMP: Rs 441

Capacite Infraprojects is showing strong bullish momentum with multiple positive technical indicators. A recent breakout from both a triangle and a flag pattern on the daily chart, accompanied by significant volume, suggests a potential uptrend. The counter's price action is supported by its position above key moving averages, indicating strong underlying strength. The recent all-time high close above Rs 450 further solidifies this bullish sentiment.

Momentum indicators are also aligned with the uptrend, suggesting that the positive momentum may continue. While the immediate resistance level is around Rs 470, a successful breach could propel the counter towards the Rs 490 level. However, if the momentum falters, the Rs 410 level may act as a strong support zone.

Strategy: Buy

Target: Rs 486

Stop-Loss: Rs 410

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.