The market corrected by more than one percent for another session and hit a nearly five-month low on November 13, with the overall breadth remaining in the control of bears. A total of 2,222 shares declined, while 266 shares gained on the NSE. The downward pressure may persist in the market, given the strong control exerted by bears over Dalal Street. Below are some trading ideas for the near term:

Vidnyan S Sawant, Head of Research at GEPL CapitalBharti Hexacom | CMP: Rs 1,426

On the weekly chart, Bharti Hexacom shows a strong price structure, staying consistently above its 12-week EMA (Exponential Moving Average). Recently, the stock experienced a bullish mean reversion, with the RSI (Relative Strength Index) momentum indicator holding firm above 60. Additionally, a bullish crossover on the daily chart further strengthens the positive momentum.

Strategy: Buy

Target: Rs 1,590

Stop-Loss: Rs 1,340

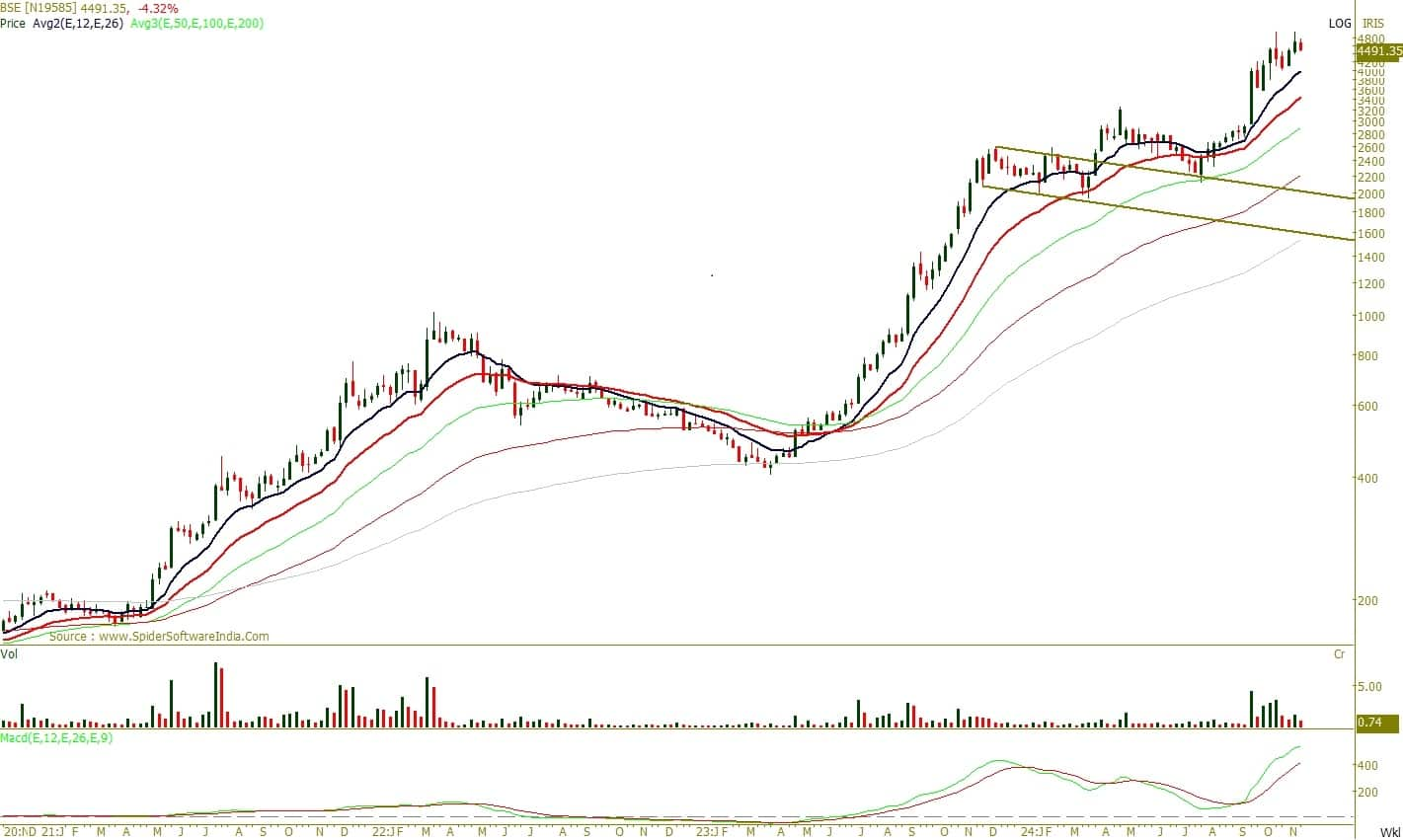

BSE | CMP: Rs 4,492

Despite current market uncertainty, BSE has demonstrated strong resilience relative to the broader market, indicating high relative strength. The stock remains well above key moving averages (12, 26, 50, 100, and 200-week EMAs), supporting its uptrend. Positive momentum is further confirmed by the MACD (Moving Average Convergence Divergence) indicator.

Strategy: Buy

Target: Rs 5,165

Stop-Loss: Rs 4,220

HCL Technologies | CMP: Rs 1,865

The Nifty IT sector has shown resilience during the current market correction, with HCLTech displaying a bullish structure on the weekly chart. Since the polarity shift in June 2024, the stock has maintained an upward trajectory, staying firmly above the key 12- and 26-week EMAs. The MACD study, trending higher, reinforces the positive momentum.

Strategy: Buy

Target: Rs 2,126

Stop-Loss: Rs 1,750

Innova Captab | CMP: Rs 961

Innova Captab displays a robust chart structure and high relative strength on the weekly scale. The stock is in a rising trend and remains well-positioned above its key 12- and 26-week moving averages, indicating a positive trend. The MACD indicator remains in buy mode, reinforcing the stock's bullish sentiment.

Strategy: Buy

Target: Rs 1,113

Stop-Loss: Rs 884

Jatin Gedia, Technical Research Analyst at Sharekhan by BNP ParibasGrasim Industries | CMP: Rs 2,503

Grasim Industries has witnessed a decline towards the Rs 2,500 level, where support from the 40-week average is placed. On the daily charts, the stock has formed a Hammer candlestick pattern, which has bullish implications. Positive divergence is visible on the hourly timeframe, suggesting that the selling pressure is declining. Therefore, the stock has a high probability of reversing from current levels and pulling back towards Rs 2,630, where the 20-day average is placed. A stop-loss of Rs 2,470 should be maintained for long positions.

Strategy: Buy

Target: Rs 2,630

Stop-Loss: Rs 2,470

Dr Lal PathLabs | CMP: Rs 2,957

Dr Lal PathLabs has broken down from a Symmetrical Triangle pattern on the daily charts and has now started the next leg of its decline, which could take the stock down to the Rs 2,840 level, near the weekly lower Bollinger Band. A stop-loss of Rs 3,028 should be set for short positions.

Strategy: Sell

Target: Rs 2,840

Stop-Loss: Rs 3,028

Shitij Gandhi, Senior Technical Research Analyst at SMC Global SecuritiesHDFC Life Insurance Company | CMP: Rs 685

HDFC Life has been trading lower, with the formation of lower highs and lower lows on short-term charts. After a period of consolidation in the range of Rs 700-740, the stock has broken down below its key support zone on broader charts. The negative price action, along with the channel breakdown, suggests further downside potential. Therefore, one can consider short-selling the stock on any rise in the range of Rs 700-705, with an expected downside to Rs 670-665 levels.

Strategy: Sell

Target: Rs 670, Rs 665

Stop-Loss: Rs 725

Granules India | CMP: Rs 532

In recent weeks, Granules India has been consolidating in a broad range of Rs 540-620, with prices facing selling pressure on every rise. Technically, the stock has given a fresh breakdown below the neckline of the Head & Shoulders pattern after a prolonged consolidation phase. Negative divergences on secondary oscillators also support the possibility of further downside in the stock. Therefore, one can short-sell the stock in the range of Rs 540-550, targeting an expected downside to Rs 490-485 levels.

Strategy: Sell

Target: Rs 490, Rs 485

Stop-Loss: Rs 575

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.