The market saw some profit-booking on September 18, after rallying consistently since the start of September to hit a historic high last Friday, which was on expected lines. The overall sentiment may remain positive as long as the Nifty50 holds the 20,000-19,900 levels, which experts feel is expected to be a crucial support area. On the higher side, 20,220 is going to be an immediate resistance and, once Nifty50 breaches this level, it may head towards 20,300-20,500 points.

The BSE Sensex declined 242 points to 67,597, while the Nifty50 slipped 59 points to 20,133 and formed bearish candlestick pattern minor upper shadow on the daily timeframe.

Technically, the current chart pattern indicates 'Bearish Tri-Star' kind of candlestick pattern, which is a bearish reversal pattern, but not a classical one. Further weakness from here could confirm short term top reversal for the Nifty at 20222 levels, Nagaraj Shetti, technical research analyst at HDFC Securities said.

He feels the underlying short-term trend of the Nifty placed at the verge of reversal on the downside.

A decisive move below the immediate support of 10-day EMA (exponential moving average) at 19,940 levels could confirm further weakness in the near term, however, sharp selling momentum is ruled out, he said, adding that the immediate resistance is placed at 20,220 levels.

The broader markets also saw profit-taking with the Nifty Midcap 100 and Smallcap 100 indices falling 0.4 percent and 0.5 percent on weak breadth. About two shares declined for every rising share on the NSE.

The market remained shut on September 19 for Ganesh Chaturthi.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may be taking support at 20,118, followed by 20,099 and 20,068. On the higher side, 20,179 can be an immediate resistance, followed by 20,197 and 20,228.

On September 18, the Bank Nifty also traded in line with the Nifty50, forming bearish candlestick pattern with minor upper shadow, which resembles Bearish Tri-Star kind of pattern on the daily scale but not exactly one. The index failed to surpass its previous record high of 46,370 (July 21) and fell 252 points to 45,980.

"The Bank Nifty has an immediate support zone in the range of 45,800 to 45,700. This level is crucial, and a breach below it could trigger further selling pressure in the index," Kunal Shah, senior technical & derivative analyst at LKP Securities said.

Despite the profit-booking, he feels, the overall sentiment for the Bank Nifty remains bullish, as long as the mentioned support levels are held on a closing basis. This suggests that there is still confidence in the upward trajectory of the index, he said.

As per the pivot point calculator, the banking index is expected to take support at 45,914, followed by 45,833 and 45,701. On the upside, the initial resistance is at 46,179, then 46,260 and 46,393.

The PSU bank sector emerged as a clear outperformer in the index which rallied over 3 percent. This outperformance is expected to continue in the near term, potentially driven by positive sentiment or specific factors affecting PSU banks, Kunal said.

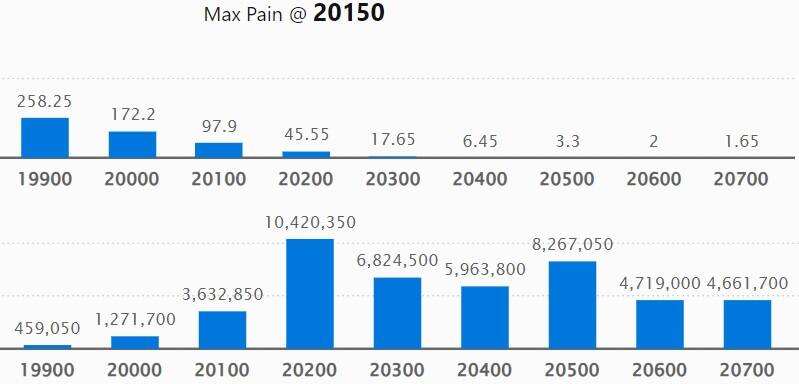

As per the options data, the maximum weekly Call open interest (OI) was at 20,200 strike, with 1.04 crore contracts, which can act as a key resistance for the Nifty. It was followed by 20,500 strike, which had 82.67 lakh contracts, while 20,300 strike had 68.24 lakh contracts.

The meaningful Call writing was seen at 20,200 strike, which added 38.34 lakh contracts, followed by 20,500 and 20,400 strikes, which added 32.68 lakh and 20.28 lakh contracts.

The maximum Call unwinding was at 19,900 strike, which shed 2.43 lakh contracts, followed by 20,000 strike and 19,700 strike, which shed 66,900 contracts, and 13,150 contracts.

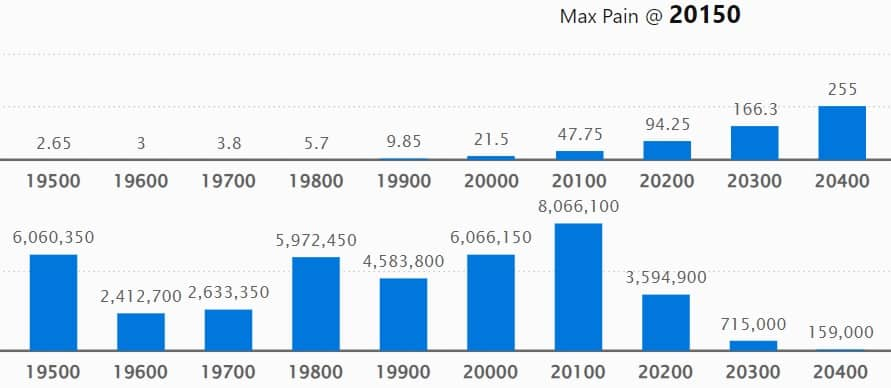

On the Put side, the maximum open interest remained at 20,100 strike, with 80.66 lakh contracts. This can be an important support for the Nifty in the coming sessions.

It was followed by 20,000 strike comprising 60.66 lakh contracts, and 19,500 strike with 60.6 lakh contracts.

The meaningful Put writing was at 19,500 strike, which added 17.09 lakh contracts, followed by 19,900 strike and 19,800 strike, which added 16.74 lakh and 16.65 lakh contracts.

Put unwinding was at 20,200 strike, which shed 10.04 lakh contracts followed by 19,700 strike and 19,400 strike, which shed 6.14 lakh and 5.1 lakh contracts.

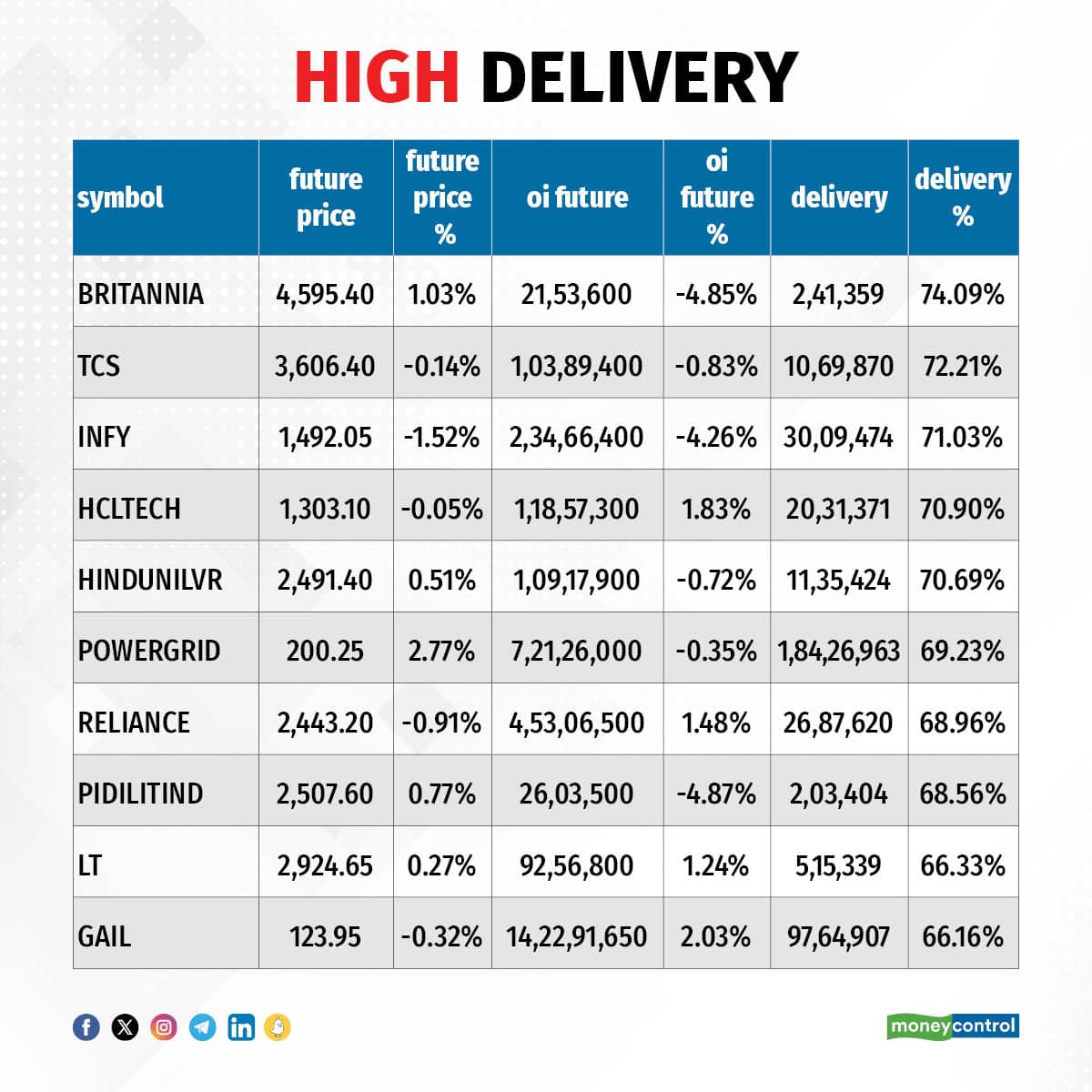

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Britannia Industries, Tata Consultancy Services, Infosys, HCL Technologies, and Hindustan Unilever have seen the highest delivery among the F&O stocks.

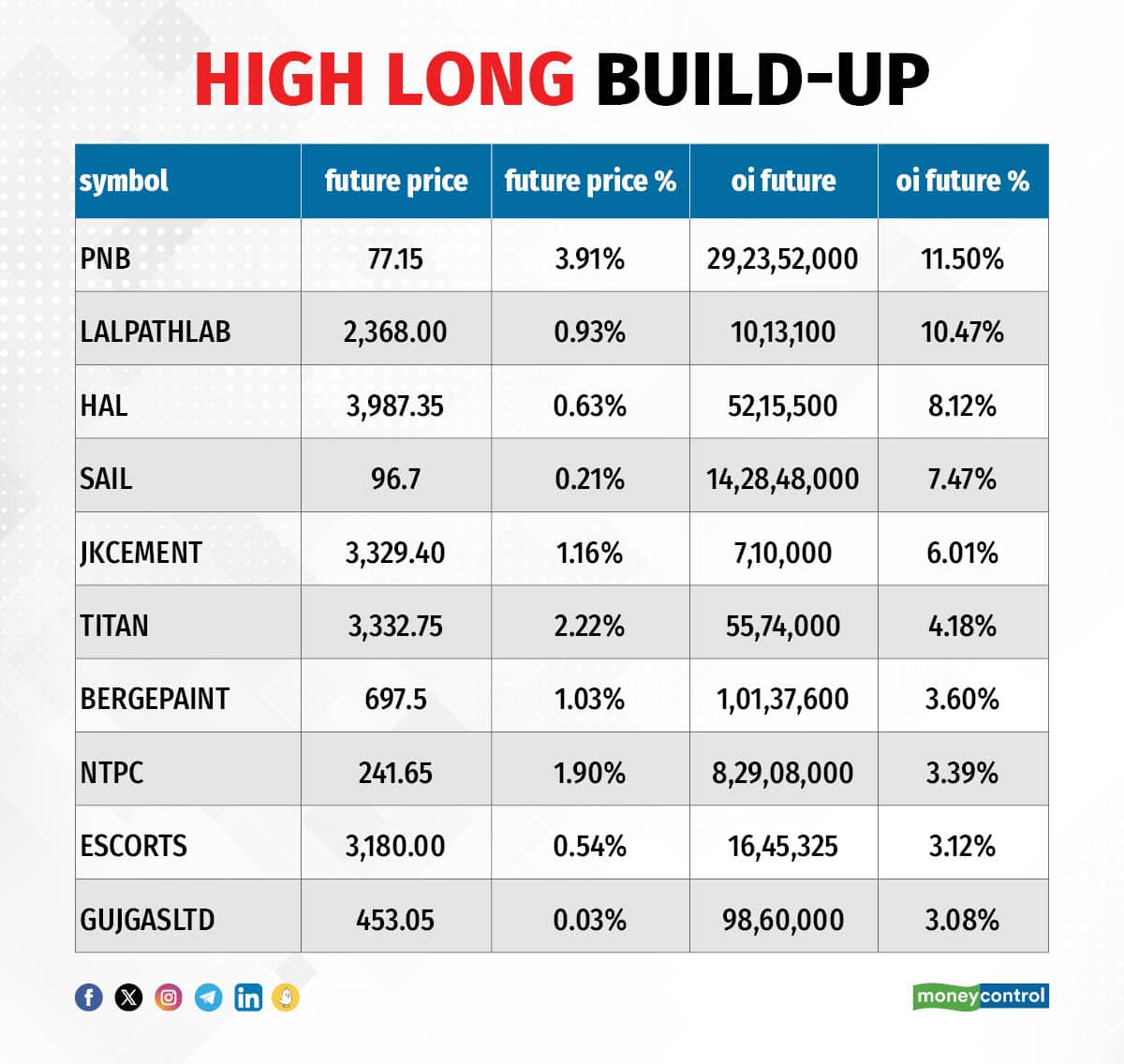

The long build-up was seen in 32 stocks on Monday, including Punjab National Bank, Dr Lal PathLabs, Hindustan Aeronautics, SAIL, and JK Cement. An increase in open interest (OI) and price indicates a build-up of long positions.

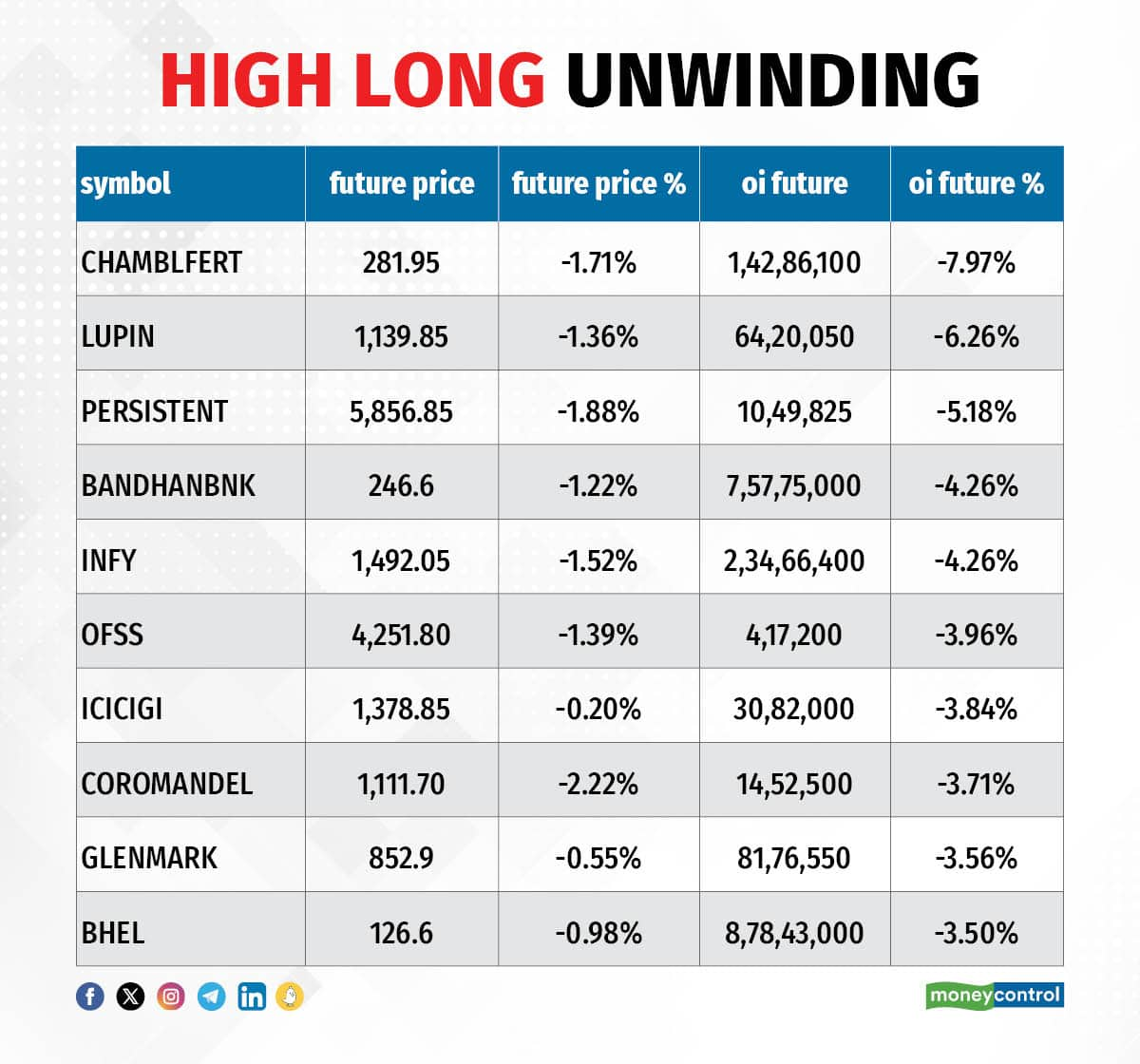

Based on the OI percentage, a total of 49 stocks including Chambal Fertilizers & Chemicals, Lupin, Persistent Systems, Bandhan Bank, and Infosys, saw long unwinding. A decline in OI and price indicates long unwinding.

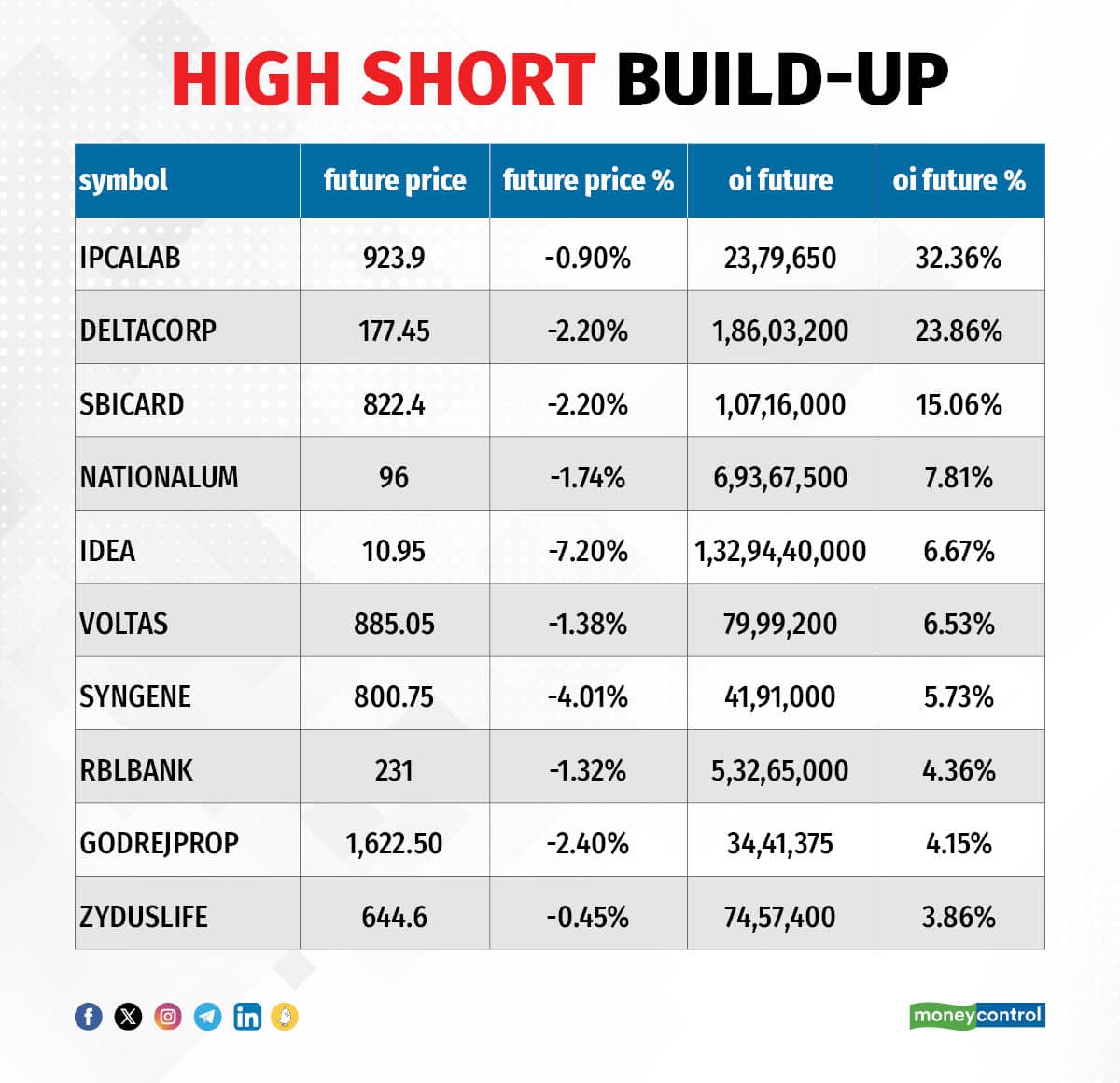

79 stocks see a short build-up

Short build-up was seen in 79 stocks, including Ipca Laboratories, Delta Corp, SBI Card, NALCO and Vodafone Idea. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 27 stocks were on the short-covering list. These included REC, Container Corporation of India, Pidilite Industries, Britannia Industries, and HDFC Life Insurance Company. A decrease in OI along with a price increase is an indication of short-covering.

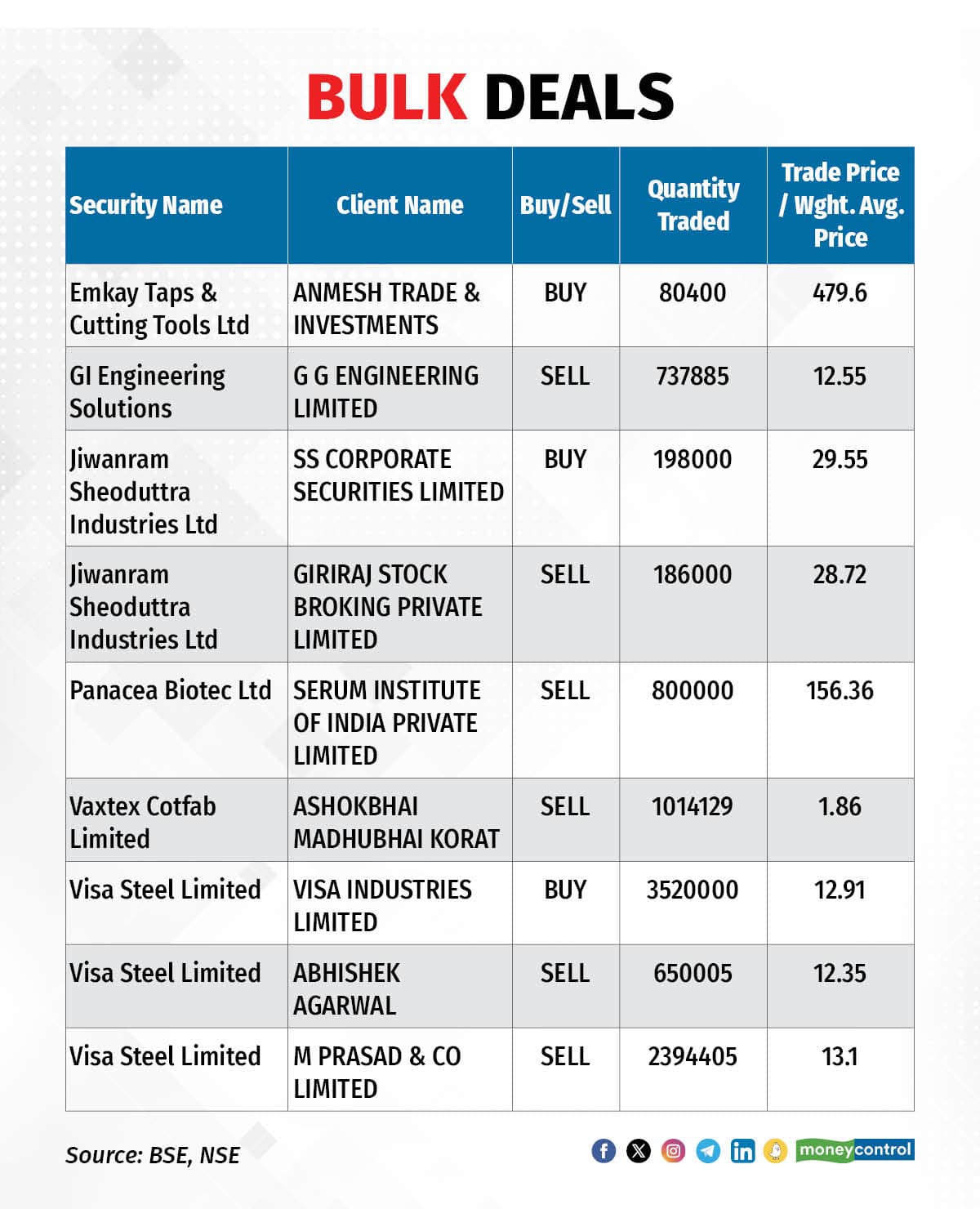

Panacea Biotec: Serum Institute of India sold 8 lakh shares in the pharma company, via open market transactions at an average price of Rs 156.36 per share.

(For more bulk deals, click here)

Investors meeting on September 20

Stocks in the news

Tata Motors: India’s largest commercial vehicle manufacturer will increase prices of its commercial vehicles up to 3 percent, effective October 1. The price increase is to offset the residual impact of the past input costs, and will be applicable across the entire range of commercial vehicles.

Biocon: The biopharmaceuticals company has received approval from the Board for the appointment of Peter Bains as the Group Chief Executive Officer (CEO), with effect from September 18. He will be reporting directly to Biocon Group Chairperson, Kiran Mazumdar-Shaw. Bains has stepped down from his role on the Biocon board as an Independent Director with immediate effect, to assume this strategic executive responsibility.

RR Kabel: The wires and cables manufacturer is going to debut on the bourses with effect from September 20 and becoming the first company to list in the T+2 timeline after closing the IPO. The issue price has been fixed at Rs 1,035 per share.

Amber Enterprises India: Subsidiary ILJIN Electronics (India), and Gurgaon-based Nexxbase Marketing entered into a joint venture agreement for manufacturing, assembling and designing of wearables and other smart electronics products.

Blue Star: The air conditioners maker has opened the qualified institutions placement issue on September 18, to raise up to Rs 1,000 crore. The floor price has been fixed at Rs 784.55 per share.

Prakash Industries: The Ministry of Environment, Forest and Climate Change, Government of India has granted environmental clearance (EC) for company's Bhaskarpara commercial coal mine in Chhattisgarh. The mining lease is likely to be executed by the next quarter.

BL Kashyap and Sons: The civil engineering and construction company has secured new order worth Rs 167 crore, from Delhi International Airport. The order includes civil and structure works for SAM project. The total order book as on date stands at Rs 3,005 crore.

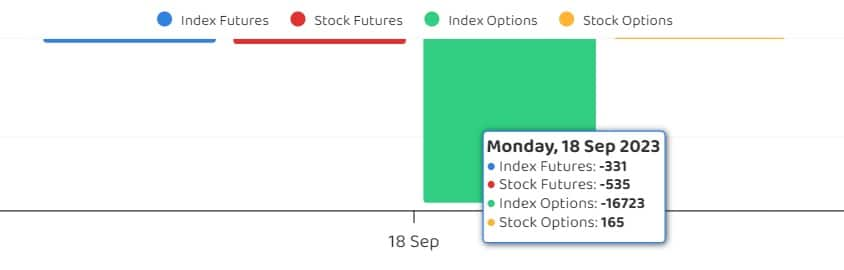

Fund Flow (Rs Crore)

Foreign institutional investors (FII) sold shares worth Rs 1,236.51 crore, while domestic institutional investors (DII) purchased Rs 552.55 crore worth of stocks on September 18, provisional data from the National Stock Exchange (NSE) showed.

Stocks under F&O ban on NSE

The NSE has added Delta Corp, and Punjab National Bank to its F&O ban list for September 20, while retaining Balrampur Chini Mills, BHEL, Chambal Fertilizers & Chemicals, Indiabulls Housing Finance, Indian Energy Exchange, Manappuram Finance, REC and Zee Entertainment Enterprises. Two stocks - Hindustan Copper, and India Cements removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!