The market rebounded nicely in the last hour of trade and continued its uptrend for a second consecutive session on June 20, as buying interest was seen in most of the key sectors.

The BSE Sensex climbed 159 points to 63,328, while the Nifty50 rose 61 points to 18,817 and formed a bullish candlestick pattern with a long lower shadow on the daily charts.

"The overall trend appears positive as the Nifty closed above the 18,800 mark. The momentum indicator, relative strength index (RSI), indicates a bullish crossover, suggesting increasing buying pressure," Rupak De, Senior Technical at LKP Securities said.

Looking ahead, he believes that resistance levels are expected around 18,850-18,900 on the higher end, indicating potential price barriers.

On the lower end, the support is placed at 18,700, indicating a level where the stock may find buying interest, he said.

The Nifty Midcap 100 and Smallcap 100 indices continued their upward journey, rising half a percent each on positive breadth.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support, resistance levels on Nifty

According to the pivot point calculator, the Nifty may find support at 18,704, followed by 18,662 and 18,593. If the index advances, then 18,841 will be the key resistance, followed by 18,883 and 18,951.

The Bank Nifty also behaved similarly, climbing 133 points to 43,767 and forming a bullish candlestick pattern with a long lower shadow on the daily scale.

"The index has held on to the support level of the lower boundary of 43,400 and has witnessed a buying interest," Jatin Gedia, Technical Research Analyst at Sharekhan by BNP Paribas said.

On the upside, he feels the 20-day moving average (43,967) is the immediate hurdle and once that is crossed, one can expect a further upside till 44,500 in the short term.

"The daily momentum indicator still has a negative crossover and hence we can expect rangebound action going ahead. The range of consolidation is likely to be 43,400 – 44,500," Gedia said.

As per the pivot point calculator, the Bank Nifty is expected to find support at 43,463, followed by 43,350 and 43,167, while the resistance is likely to be at 43,828, followed by 43,941 and 44,123.

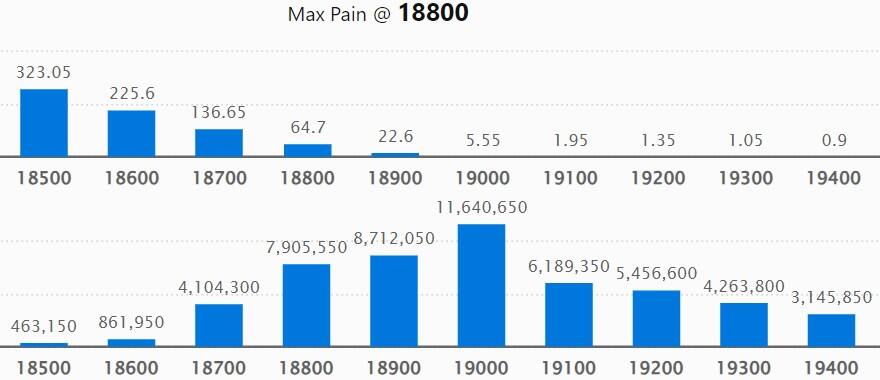

As per the weekly options data, the maximum Call open interest (OI) was at 19,000 strike, with 1.16 crore contracts, which is expected to be a crucial resistance level for the Nifty.

This was followed by 87.12 lakh contracts at 18,900 strike, and 18,800 strike which has 79.05 lakh contracts.

The maximum Call writing was at 19,000 strike, which added 11.74 lakh contracts, followed by 19,500 strike and 19,100 strike, which added 3.71 lakh contracts, and 2.72 lakh contracts, respectively.

Maximum Call unwinding was at 18,800 strike, which shed 24.22 lakh contracts, followed by 19,700 and 20,000 strikes, which shed 15.04 lakh and 14.79 lakh contracts, respectively.

On the Put side, we have seen the maximum open interest at 18,700 strike, with 1.22 crore contracts, which is expected to be a crucial support level for the Nifty50 in the coming sessions.

This was followed by the 18,800 strike, comprising 99.56 lakh contracts, and the 18,600 strike, which has 75.59 lakh contracts.

Put writing was seen at 18,800 strike, which added 34.41 lakh contracts, followed by 18,700 and 18,600 strikes, which added 27.44 lakh contracts and 18.92 lakh contracts, respectively.

Put unwinding was seen at 18,300 strike, which shed 5.85 lakh contracts, followed by 17,700 strike and 18,100 strike, which shed 3.88 lakh contracts, and 2.53 lakh contracts, respectively.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in HDFC AMC, Maruti Suzuki India, Indian Hotels, Larsen & Toubro and TCS among others.

An increase in open interest (OI) and price indicates a build-up of long positions. Based on the OI percentage, 76 stocks including Hindustan Copper, HDFC AMC, HCL Technologies, Max Financial Services and Metropolis Healthcare saw a long build-up.

A decline in OI and price generally indicates a long unwinding. Based on the OI percentage, 34 stocks including Hindustan Aeronautics, MRF, Zee Entertainment Enterprises, SBI Card and Abbott India saw a long unwinding.

26 stocks see a short build-up

An increase in OI along with a price decrease indicates a build-up of short positions. Based on the OI percentage, 26 stocks including Container Corporation of India, PVRInox, Intellect Design Arena, LTIMindtree and Alkem Laboratories saw a short build-up.

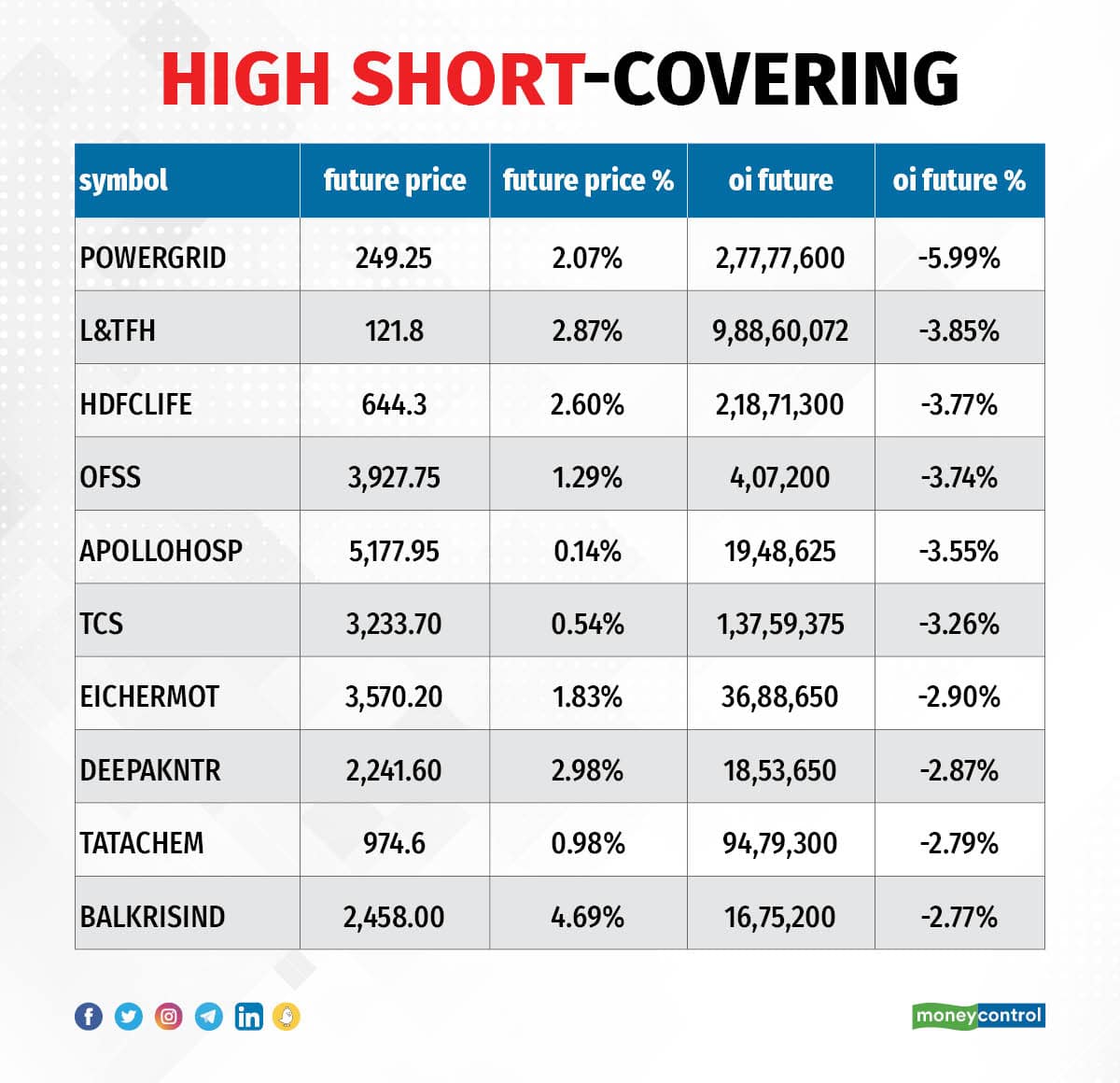

A decrease in OI along with a price increase is an indication of short-covering. Based on the OI percentage, 54 stocks were on the short-covering list. These included Power Grid Corporation of India, L&T Finance Holdings, HDFC Life Insurance Company, Oracle Financial and Apollo Hospitals Enterprises.

(For more bulk deals, click here)

Investors Meetings on June 21

Stocks in the news

Shriram Finance: Piramal Enterprises is likely to sell the entire 8.34 percent stake or 3.12 crore shares in Shriram Finance via block deals, reports CNBC-TV18 quoting sources. The floor price is likely to be Rs 1,483 per share, a 5 percent discount to the closing price on June 20. Morgan Stanley is the broker for this deal.

HDFC Life Insurance Company: The Competition Commission of India (CCI) has approved a proposed combination involving the acquisition of additional shareholding of HDFC Life Insurance Company by Housing Development Finance Corporation (HDFC).

Aptech: Anil Pant, Managing Director & CEO, informed the company on June 19 that on account of the sudden deterioration of his health, he would be proceeding on indefinite leave with effect from June 20.

Shilpa Medicare: The pharma company said the board members will meet on June 23 to consider a fundraising proposal via the rights issue of equity shares.

Rail Vikas Nigam: The company in its clarification note to exchanges said the news with respect to the breaking of a joint venture between RVNL and Transmashholding (TMH) is factually incorrect. The MoU between both the parties is still valid as none of the parties have terminated the same. The bank guarantee will be deposited well within the permissible time limits as per the tender condition. Further deliberations on the terms of the MoU are underway.

Gujarat Mineral Development Corporation: Hasmukh Adhia, the Principal Advisor to Chief Minister of Gujarat, has been appointed as the Director and Chairman of GMDC with immediate effect. Adhia is a Gujarat Cadre officer of Indian Administrative Services belonging to the 1981 batch.

Fino Payments Bank: Rakesh Bhartia has withdrawn his nomination as part-time chairman of the bank citing personal reasons and other official commitments. He will continue to hold the position as an independent director of the bank. In November 2022, the bank had approved the appointment of Rakesh Bhartia as part-time chairman.

Fund Flow

Foreign institutional investors (FII) sold shares worth Rs 1,942.62 crore, whereas domestic institutional investors (DII) bought shares worth Rs 1,972.51 crore on June 20, provisional data from the National Stock Exchange shows.

Stocks under F&O ban on NSE

The National Stock Exchange has added BHEL and Hindustan Copper to its F&O ban list for June 21 and retained Delta Corp, Hindustan Aeronautics, Indiabulls Housing Finance, India Cements and L&T Finance Holdings on the list. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!