The market recouped morning losses in afternoon but failed to sustain those gains in last hour of trade due to selling pressure at higher levels and finally settled with moderate losses amid consolidation on September 7. Nifty IT, Metal, Pharma and PSU banks stocks pulled the market lower.

The BSE Sensex fell 17.43 points to 58,279.48, while the Nifty50 declined 15.70 points to 17,362.10 and formed bearish candle on the daily charts as the closing was lower than opening levels.

"On the daily chart, the index has formed a bearish candle with long shadows on either side, indicating extreme volatility at higher levels. The index is moving in a Higher Top and a Higher Bottom formation on the daily chart indicating a sustained up trend," said Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

He further said the chart pattern suggests that if Nifty crosses and sustains above 17,400 level, it would witness buying which would lead the index towards 17,500-17,600 levels. However, the if the index breaks below 17,350 level, it would witness selling which would take the index towards 17,300-17,230, he added.

He said, "Nifty is trading above its 20 day SMA which indicates a positive bias in the short term. Nifty continues to remain in an uptrend in the medium and long term, so buying on dips continues to be our preferred strategy."

The broader markets also closed in negative terrain. The Nifty Midcap 100 index was down 0.25 percent and Smallcap 100 index declined 0.09 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,287.23, followed by 17,212.37. If the index moves up, the key resistance levels to watch out for are 17,436.73 and 17,511.37.

Nifty Bank

The Nifty Bank fell further, down 123.55 points to close at 36,468.80 on September 7. The important pivot level, which will act as crucial support for the index, is placed at 36,185.16, followed by 35,901.53. On the upside, key resistance levels are placed at 36,719.16 and 36,969.53 levels.

Call option data

Maximum Call open interest of 17.57 lakh contracts was seen at 17500 strike, which will act as a crucial resistance level in the September series.

This is followed by 17400 strike, which holds 14.71 lakh contracts, and 17300 strike, which has accumulated 13.98 lakh contracts.

Call writing was seen at 17400 strike, which added 1.35 lakh contracts, followed by 18000 strike, which added 73,600 contracts and 17800 strike which added 52,300 contracts.

Call unwinding was seen at 17200 strike, which shed 1.1 lakh contracts, followed by 17000 strike, which shed 78,525 contracts, and 17100 strike which shed 72,800 contracts.

Put option data

Maximum Put open interest of 36.01 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the September series.

This is followed by 16500 strike, which holds 27.26 lakh contracts, and 17200 strike, which has accumulated 16.75 lakh contracts.

Put writing was seen at 17400 strike, which added 1.77 lakh contracts, followed by 17000 strike which added 1.37 lakh contracts, and 17500 strike which added 1.17 lakh contracts.

Put unwinding was seen at 16500 strike, which shed 2.47 lakh contracts, followed by 16800 strike which shed 46,600 contracts and 16700 strike which shed 44,650 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

30 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

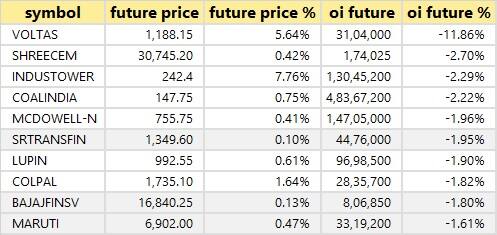

65 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

57 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

21 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

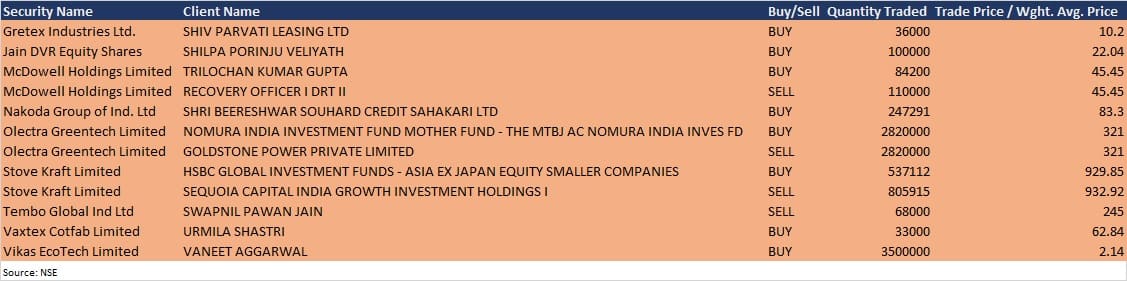

Bulk deals

McDowell Holdings: Recovery Officer I DRT (Debt Recovery Tribunal) II continued to offload shares in the company, selling additional 1.1 lakh equity shares in the company at Rs 45.45 per share. However, Trilochan Kumar Gupta acquired 84,200 equity shares in the company at Rs 45.45 per share on the NSE, the bulk deals data showed.

Olectra Greentech: Nomura India Investment Fund Mother Fund - The MTBJ AC Nomura India Investment FD bought 28.2 lakh equity shares in the company at Rs 321 per share. However, Goldstone Power sold 28.2 lakh equity shares in the company at Rs 321 per share on the NSE, the bulk deals data showed.

Stove Kraft: HSBC Global Investment Funds - Asia Ex-Japan Equity Smaller Companies acquired 5,37,112 equity shares in the company at Rs 929.85 per share. However, Sequoia Capital India Growth Investment Holdings I sold 8,05,915 equity shares in the company at Rs 932.92 per share on the NSE, the bulk deals data showed.

International Conveyors: Promoter entity IGE (India) acquired over 3.23 lakh equity shares in the company via open market transaction, increasing shareholding to 63.34% from 62.86% earlier.

(For more bulk deals, click here)

Analysts/Investors Meeting

Adani Enterprises: The company's officials will meet investors in Elara Capital Virtual Conference on September 9.

Tube Investments of India: The company's officials will meet analysts and institutional investors on September 8, September 9, September 14, September 20, and September 22.

Stocks in News

PSP Projects: The company is in receipt of Letter of Intent(s) for projects worth Rs 132.57 crore towards industrial and precast segment from different clients in Gujarat.

ICRA: Life Insurance Corporation of India sold more than 2.07 lakh equity shares in the company via open market transaction, reducing shareholding to 5.81% from 7.96% earlier.

Pil Italica Lifestyle: Promoter entity Dawood Investment sold 46 lakh equity shares in the company via open market transaction, reducing shareholding to 52.50% from 54.46% earlier.

EID Parry India: The company has approved the setting up of a 120 KLPD grain/sugar syrup/molasses based Distillery at Sankili unit in Andhra Pradesh.

Bajaj Consumer Care: ICICI Prudential Asset Management Company sold 1.5 lakh equity shares in the company via open market transaction, reducing shareholding to 3.83% from 3.93% earlier.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 145.45 crore, while domestic institutional investors (DIIs) net offloaded shares worth Rs 136.57 crore in the Indian equity market on September 7, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Indiabulls Housing Finance and NALCO - are under the F&O ban for September 8. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!