The market rallied more than 1 percent to hit a fresh record high intraday, but the profit booking in the last hour of trade snapped a six-day winning streak on February 9. Auto, metals, pharma, select FMCG and IT stocks pulled the market down.

The S&P BSE Sensex fell 19.69 points to 51,329.08 after more than a 10 percent rally seen in the previous six consecutive sessions, while the Nifty50 declined 6.50 points to 15,109.30 and formed a bearish candle which resembles the Spinning Top kind of pattern on the daily charts.

"The short term uptrend of Nifty seems to have tired at the new highs and there is a possibility of some more profit booking in the short term," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"A decisive move below the support of 15,000 could confirm reversal pattern and that is expected to drag Nifty to further lows. On the other side, a lack of selling interest in the next 1-2 sessions is likely to allow bulls to make a comeback from the lows," he said.

The overall market breadth was negative on Tuesday and the broader market indices like Nifty Midcap and Smallcap 100 indices have closed lower by 0.08 percent and 0.46 percent, respectively.

"The negative divergence has started to form on the daily Nifty/RSI, but we need confirmation of downtick to act on a bearish side," Shetti said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,030.03, followed by 14,950.77. If the index moves up, the key resistance levels to watch out for are 15,222.83 and 15,336.37.

Nifty Bank

The Nifty Bank outperformed Nifty50, rising 72.80 points to 36,056.50 on February 9. The important pivot level, which will act as crucial support for the index, is placed at 35,636.56, followed by 35,216.63. On the upside, key resistance levels are placed at 36,476.77 and 36,897.04.

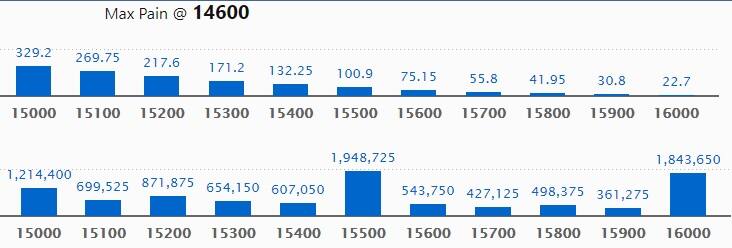

Call option data

Maximum Call open interest of 19.48 lakh contracts was seen at 15,500 strike, which will act as a crucial resistance level in the February series.

This is followed by 16,000 strike, which holds 18.43 lakh contracts, and 15,000 strike, which has accumulated 12.14 lakh contracts.

Call writing was seen at 15,200 strike, which added 1.86 lakh contracts, followed by 16,000 strike which added 1.39 lakh contracts and 15,400 strike which added 1.04 lakh contracts.

Call unwinding was seen at 15,000 strike, which shed 77,100 contracts, followed by 14,900 strike which shed 40,425 contracts and 14,500 strike which shed 33,150 contracts.

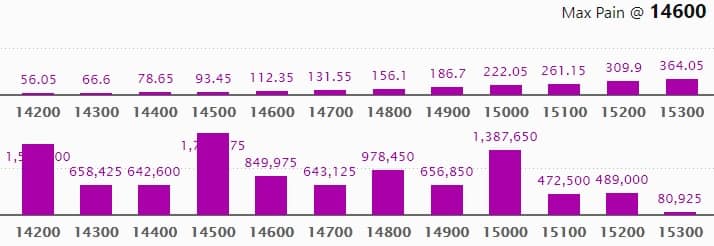

Put option data

Maximum Put open interest of 17.43 lakh contracts was seen at 14,500 strike, which will act as crucial support level in the February series.

This is followed by 14,200 strike, which holds 15.13 lakh contracts, and 15,000 strike, which has accumulated 13.87 lakh contracts.

Put writing was seen at 14,800 strike, which added 2.63 lakh contracts, followed by 15,200 strike, which added 2.55 lakh contracts and 15,100 strike which added 2.21 lakh contracts.

Put unwinding was seen at 14,500 strike, which shed 2.37 lakh contracts, followed by 14,400 strike which shed 30,525 contracts.

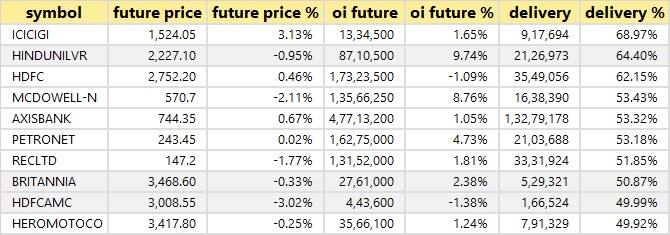

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

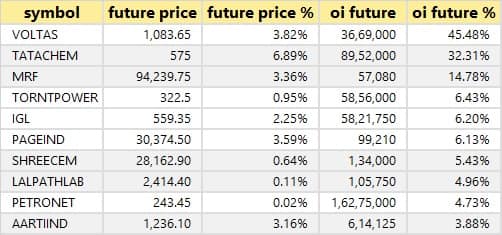

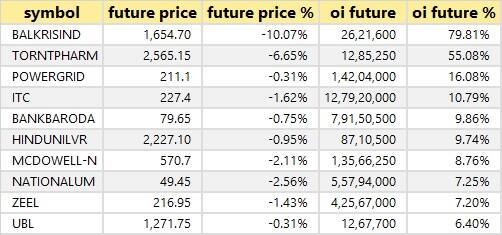

25 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

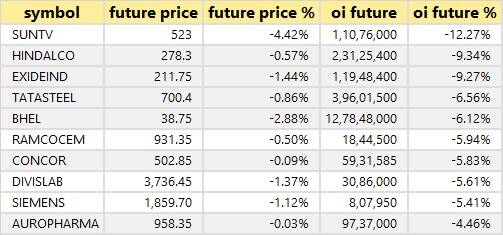

47 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

44 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

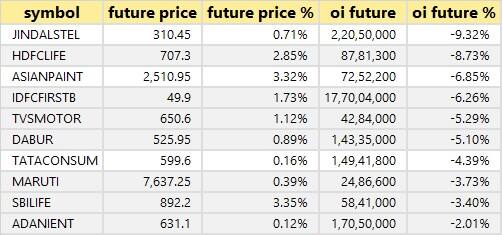

25 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

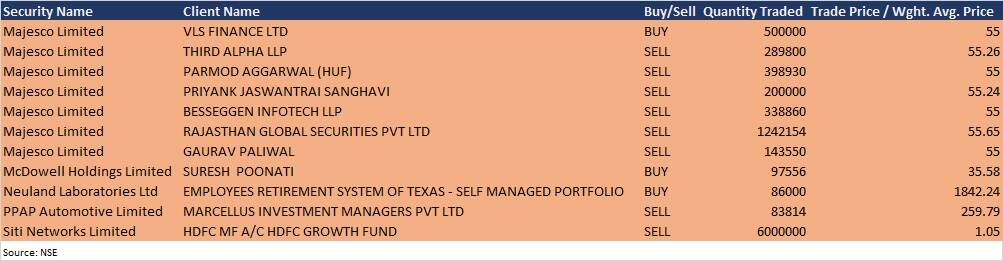

Bulk deals

(For more bulk deals, click here)

Eicher Motors, Titan Company, GAIL India, Hindalco Industries, Aurobindo Pharma, ABB India, Asian Granito India, Bank of India, Bata India, BEML, Gujarat State Petronet, Happiest Minds Technologies, Indraprastha Gas, Metropolis Healthcare, NBCC India, RITES, Shalimar Paints, SpiceJet and Ujjivan Financial Services are among 330 companies that are slated to announce their quarterly earnings on February 10.

Stocks in the news

Mahanagar Gas: The company reported a higher profit at Rs 217.2 crore in Q3FY21 against Rs 186 crore in Q3FY20, revenue fell to Rs 666.4 crore from Rs 744 crore YoY.

Raymond: The company reported lower consolidated profit at Rs 21.7 crore in Q3FY21 against Rs 195.3 crore in Q3FY20, revenue declined to Rs 1,243.4 crore from Rs 1,885.4 crore YoY.

IG Petrochemicals: The company reported a sharp rise in consolidated profit at Rs 62.9 crore in Q3FY21 against Rs 4.5 crore in Q3FY20, revenue jumped to Rs 314.7 crore from Rs 275.6 crore YoY.

Berger Paints: The company reported higher consolidated profit at Rs 274.8 crore in Q3FY21 against Rs 182.3 crore in Q3FY20, revenue jumped to Rs 2,118.2 crore from Rs 1,696 crore YoY.

Tata Steel: The company reported consolidated profit at Rs 3,989 crore in Q3FY21 against loss of Rs 1,166 crore in Q3FY20, revenue increased to Rs 39,594 crore from Rs 35,520 crore YoY.

Gujarat Mineral Development Corporation: The company reported consolidated loss at Rs 2.76 crore in Q3FY21 against profit Rs 28.2 crore in Q3FY20, revenue fell to Rs 329.3 crore from Rs 339.6 crore YoY.

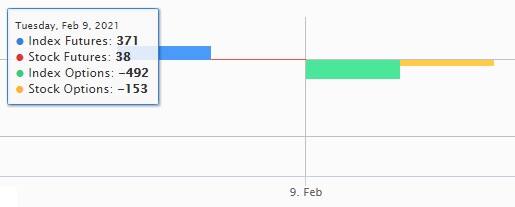

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,300.65 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 1,756.24 crore in the Indian equity market on February 9, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - BHEL and Sun TV Network - are under the F&O ban for February 10. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!