The market remained in a strong uptrend with the benchmark indices hitting fresh record highs on November 10, backed by banking and financials and consistent FII inflow. Positive global cues following further progress on the COVID vaccine front also lifted sentiment.

The BSE Sensex surged 680.22 points or 1.60 percent to end at a record closing high of 43,277.65, while the Nifty50 rallied 170.10 points or 1.37 percent to 12,631.10 and formed a bullish candle on the daily charts. The indices climbed over 8 percent in seven consecutive sessions.

"Though Nifty placed at the new all-time high of 12,643 levels, there is no indication of any reversal pattern yet at the highs, as per daily and intraday timeframe chart. This is a positive indication and one may expect further upside in the market in short term," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"Daily RSI has moved above 70 and there is some room left for this indicator to top out and weekly RSI is now moving above 60 levels. This action of RSI could signal some more upside for the market ahead," he said.

"The next upside level to be watched is around 12,800 for the next few sessions. Immediate support is now placed at 12,550," he added.

However, the broader markets continued to underperform frontliners as the Nifty Midcap index was up 0.3 percent and Smallcap ended flat with a negative bias.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 12,522.9, followed by 12,414.7. If the index moves up, the key resistance levels to watch out for are 12,691.6 and 12,752.1.

Nifty Bank

The Bank Nifty sharply outperformed the Nifty50, jumping 1071.90 points or 3.89 percent to 28,606 on November 10. The important pivot level, which will act as crucial support for the index, is placed at 28,081.1, followed by 27,556.2. On the upside, key resistance levels are placed at 28,966.7 and 29,327.4.

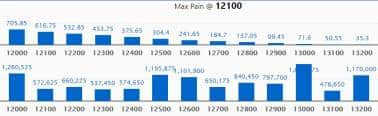

Call option data

Maximum Call open interest of 16.77 lakh contracts was seen at 13,000 strike, which will act as crucial resistance level in the November series.

This is followed by 12,000 strike, which holds 12.60 lakh contracts, and 12,500 strike, which has accumulated 11.95 lakh contracts.

Call writing was seen at 13,500 strike, which added 9.95 lakh contracts, followed by 13,200 strike which added 8.47 lakh contracts and 13,100 strike which added 2.63 lakh contracts.

Call unwinding was seen at 12,900 strike, which shed 4.37 lakh contracts, followed by 12,500 strike which shed 3.38 lakh contracts and 12,400 strike which shed 2.22 lakh contracts.

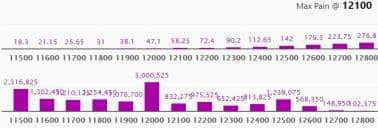

Put option data

Maximum Put open interest of 30 lakh contracts was seen at 12,000 strike, which will act as crucial support in the November series.

This is followed by 11,500 strike, which holds 23.16 lakh contracts, and 11,600 strike, which has accumulated 13.02 lakh contracts.

Put writing was seen at 12,500 strike, which added 6.57 lakh contracts, followed by 12,600 strike, which added 4.87 lakh contracts and 12,000 strike which added 2.65 lakh contracts.

Put unwinding was seen at 11,500 strike, which shed 1.84 lakh contracts, followed by 11,600 strike, which shed 32,625 contracts and 12,200 strike which shed 20,850 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

38 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

20 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

33 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

45 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

(For more bulk deals, click here)

Results on November 11

Coal India, Aurobindo Pharma, Aban Offshore, Abbott India, Ansal Housing, Apollo Hospitals Enterprise, Ashapura Minechem, Ashoka Buildcon, Astra Microwave Products, Bharat Forge, Computer Age Management Services, GIC Housing Finance, Godrej Industries, Garden Reach Shipbuilders & Engineers, GSPL, Indiabulls Housing Finance, IFCI, Indraprastha Gas, ITI and LIC Housing Finance are among 628 companies to declare their quarterly earnings on November 11.

Stocks in the news

Raymond: The company reported a loss at Rs 136.6 crore in Q2FY21 against a profit of Rs 86.2 crore, revenue fell to Rs 674.2 crore from Rs 1,883.2 crore YoY.

Tata Power: The company reported a higher profit at Rs 370.9 crore in Q2FY21 compared to Rs 338.5 crore, revenue rose to Rs 8,289.8 crore from Rs 7,677.8 crore YoY.

Future Consumer: The company reported a loss at Rs 146.8 crore in Q2FY21 against a loss of Rs 16.7 crore, revenue fell to Rs 238.9 crore from Rs 1,120.8 crore YoY.

Aarti Industries: The company reported a lower profit at Rs 143.5 crore in Q2FY21 compared to Rs 151.8 crore, revenue increased to Rs 1,330.4 crore from Rs 1,076.8 crore YoY.

Bata India: The company reported a loss at Rs 44.3 crore in Q2FY21 against a profit at Rs 71.3 crore, revenue plunged to Rs 367.9 crore from Rs 722 crore YoY.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 5,627.32 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 2,309.19 crore in the Indian equity market on November 10, as per provisional data available on the NSE.

Stock under F&O ban on NSE

One stock - Jindal Steel & Power - is under the F&O ban for November 11. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!