The market bounced back sharply on October 10 after a day of correction due to geopolitical tensions between Israel and Palestine. The Nifty50 decisively climbed above last week's high on a closing basis and formed a long bullish candlestick pattern on the daily charts. Hence the strong closing above the 19,700-19,800 area in coming sessions can take the index towards the 20,000 mark, with immediate support at 19,600-19,500 levels and Monday's low of 19,333 can be bottom in near term, experts said.

The BSE Sensex climbed 567 points to 66,079, while the Nifty50 jumped 178 points to 19,690, recouping the entire previous day's losses.

"On the hourly chart, the Nifty has broken out of an Inverted Head and Shoulder's pattern. In the short term, the index is expected to maintain its strength," Rupak De, senior technical analyst at LKP Securities said.

He feels a decisive move above 19,700 levels could potentially propel the index towards the range of 19,850 to 19,900. The support level is situated at 19,600, he said.

The Nifty Midcap 100 and Smallcap 100 indices also remained strong on positive breadth, rising 1.4 percent and 1.2 percent respectively. About three shares advanced for every falling share on the NSE.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may be taking support at 19,600, followed by 19,563 and 19,505. On the higher side, 19,716 can be an immediate resistance, followed by 19,752 and 19,810.

On October 10, the Bank Nifty, too, recovered all its previous day's losses and closed 474 points higher at 44,360, forming long bullish candlestick pattern on the daily charts. The index is expected to face resistance at 44,500-45,000 levels in coming sessions.

"The bulls made a strong comeback, defending the support zone of 44,000-43,800, where fresh Put writing is evident. The next immediate hurdle is positioned at 44,500, and a break above this level is expected to trigger further short covering, potentially pushing the index towards the 45,000 mark," Kunal Shah, senior technical & derivative analyst at LKP Securities said.

Additionally, the momentum indicator RSI (relative strength index) has provided a positive crossover, confirming a buy signal, he feels.

As per the pivot point calculator, the banking index is expected to take support at 44,100, followed by 43,986 and 43,801. On the upside, the initial resistance is at 44,468, then at 44,582 and at 44,767.

As per weekly options data, the maximum Call open interest (OI) was seen at 20,000 strike with 85.44 lakh contracts, which can act as a key resistance for the Nifty. It was followed by the 19,800 strike, which had 63.75 lakh contracts, while 19,900 strike had 61.05 lakh contracts.

Meaningful Call writing was seen at 20,100 strike, which added 21.8 lakh contracts followed by 20,000 and 20,200 strikes, which added 12.65 lakh and 11.43 lakh contracts.

Maximum Call unwinding was at 19,600 strike, which shed 35.12 lakh contracts followed by 19,500 strike and 19,800 strike, which shed 29.4 lakh contracts and 13.72 lakh contracts.

On the Put side, the maximum open interest remained at 19,600 strike with 1.17 crore contracts. This can be an important support for the Nifty in the coming sessions.

It was followed by 19,000 strike, comprising 85.26 lakh contracts and 19,500 strike with 84.16 lakh contracts.

The meaningful Put writing was at 19,600 strike, which added 87.14 lakh contracts, followed by 19,700 strike and 19,000 strike, which added 45.75 lakh and 31 lakh contracts.

Put unwinding was at 18,800 strike, which shed 6.3 lakh contracts, followed by 20,000 strike and 20,500 strike, which shed 7,000 and 650 contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Hindustan Unilever, Reliance Industries, Max Financial Services, Larsen & Toubro, and Asian Paints saw the highest delivery among the F&O stocks.

A long build-up was seen in 83 stocks namely, Birlasoft, Chambal Fertilizers, Hindalco Industries, Dalmia Bharat, and Escorts Kubota. An increase in open interest (OI) and price indicates a build-up of long positions.

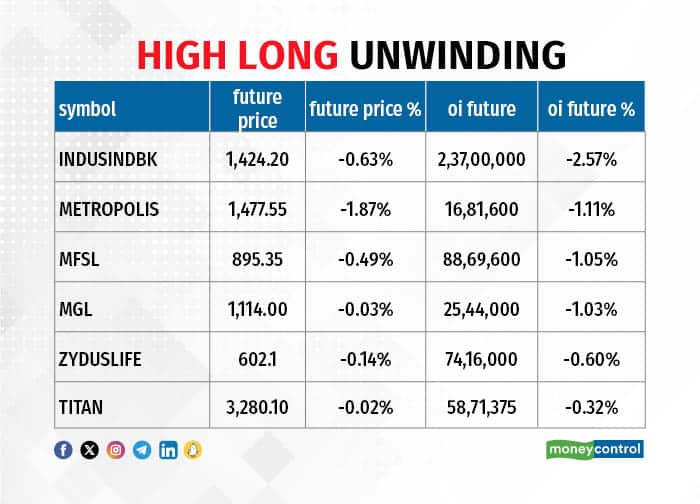

Based on the OI percentage, a total of 6 stocks, including IndusInd Bank, Metropolis Healthcare, Max Financial Services, Mahanagar Gas, and Zydus Lifesciences saw a long unwinding. A decline in OI and price indicates long unwinding.

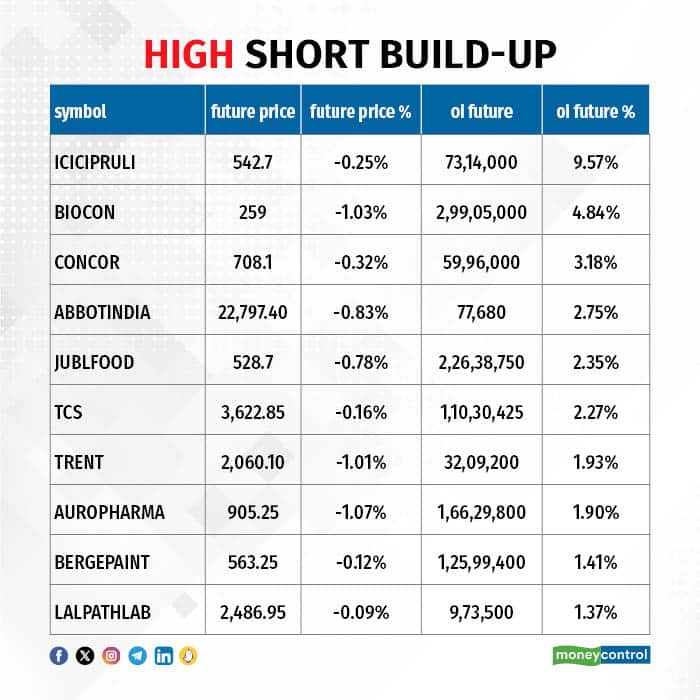

16 stocks see a short build-up

A short build-up was seen in 16 stocks, including ICICI Prudential Life Insurance Company, Biocon, Container Corporation of India, Abbott India, and Jubilant Foodworks. An increase in OI along with a fall in price points to a build-up of short positions.

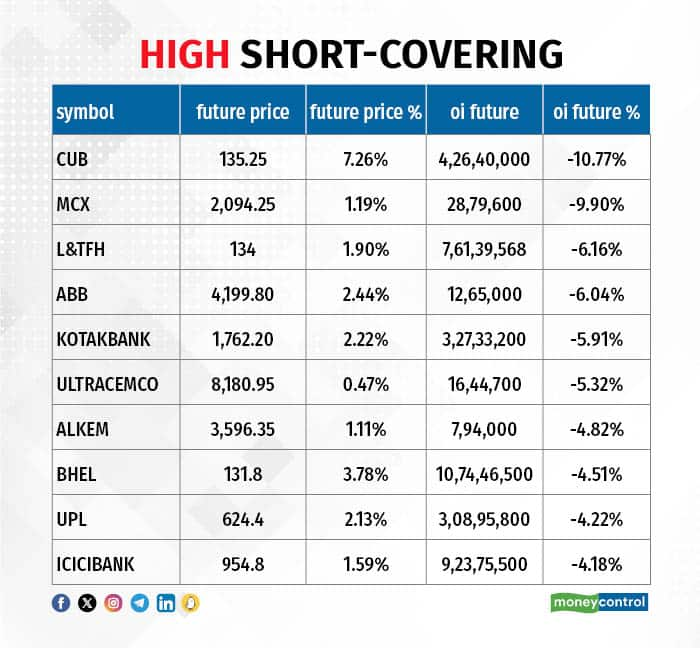

Based on the OI percentage, 82 stocks were on the short-covering list. These included City Union Bank, MCX India, L&T Finance Holdings, ABB India, and Kotak Mahindra Bank. A decrease in OI along with a price increase is an indication of short-covering.

For more bulk deals, click here

Also read: TCS Earnings Preview Q2FY24: Moderate growth to continue despite major deal wins

Stocks in the news

Bank of Baroda: The Reserve Bank of India has directed Bank of Baroda to suspend, with immediate effect, any further onboarding of their customers onto the ‘bob World’ mobile application. This action is based on certain material supervisory concerns observed in the manner of onboarding their customers onto this mobile application.

Titan Company: The jewellery-watch-to-eyewear maker said the Board of Directors will be meeting on October 17, to consider issuance of non-convertible debentures on a private placement basis, within the permissible borrowing limits.

Union Bank of India: Sudarshana Bhat has been elevated to the post of Chief General Manager of Union Bank with effect from October 10. Sudarshana Bhat was the general manager of the bank. Earlier, Lal Singh was the Chief General Manager of Union Bank, who now has been appointed as Executive Director of Bank Of Baroda by the Central Government.

NCL Industries: The company has announced cement production for the quarter ended September FY24 at 6,59,300 metric tonnes (MT), up 9 percent over a year-ago period, and cement dispatches at 6,69,587 MT, up 11 percent YoY, while cement boards production grew by 12 percent YoY to 21,509 MT, and cement board dispatches increased 9 percent to 20,239 MT.

Birla Corporation: The flagship company of the MP Birla Group has received an order from the Office of Collector (Mining), Satna, Madhya Pradesh, imposing a penalty of Rs 8.43 crore for excess production of limestone from the captive mining for the period from 2000-01 to 2006-07, without obtaining environment clearance.

EIH Associated Hotels: Shib Sanker Mukherji has resigned from the office of Chairman and Director of the company due to personal reasons, with effect from October 10.

Fund Flow (Rs Crore)

Foreign institutional investors (FII) offloaded shares worth Rs 1,005.49 crore, while domestic institutional investors (DII) purchased Rs 1,963.34 crore worth of stocks on October 10, provisional data from the National Stock Exchange (NSE) showed.

Stocks under F&O ban on NSE

The NSE has retained Delta Corp, Indiabulls Housing Finance, L&T Finance Holdings, Manappuram Finance, MCX India, and Punjab National Bank to its F&O ban list for October 11. Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!