The market remained strong for yet another session, as the benchmark indices hit fresh all-time highs on July 17 with the help of banking and financial services space which was consolidating for several sessions. Select technology and oil and gas stocks also boosted the rally.

The BSE Sensex climbed 529 points to 66,590, while the Nifty50 jumped 147 points to close above 19,700 for the first time, at 19,712, and formed a long bullish candlestick pattern on the daily charts.

"The chart pattern indicates a sharp upside breakout of the recent sideways range movement in the market. The Nifty is in a sharp up-trended movement and we observe higher high and higher low formation on the daily chart," Nagaraj Shetti, technical research analyst at HDFC Securities said.

He further said the lack of sharp selling participation has been observed during recent higher lows, which reflects the strength of upside momentum in the market.

Having moved decisively above the resistance of 19,500 levels recently, the Nifty is expected to reach the next upper trajectories of 19,800 levels (1.382 percent Fibonacci projection) and the psychological 20,000 mark in the near term, he feels. Important support for trend reversal is placed at 19,500 levels.

The broader markets also gained strength as the Nifty Midcap 100 index was up 0.3 percent and Smallcap 100 index climbed 0.9 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month

Key support, resistance levels on Nifty

The pivot point calculator suggests that the Nifty may get support at 19,604 followed by 19,564 and 19,500. In case of an upside, 19,733 can be a key resistance area followed by 19,773 and 19,838.

On July 17, the Bank Nifty was the star performer among key sectoral indices, as the bulls made a strong comeback in the market and pushed the index higher, surpassing the significant resistance level of 45,000 with notable trading volumes. The index surged 630 points to end at a record closing high of 45,450 and formed a long bullish candlestick pattern on the daily scale.

"This breakout indicates a shift in sentiment towards bullishness. The index is currently in a buy mode, suggesting a positive outlook for the banking sector," Kunal Shah, senior technical & derivative analyst at LKP Securities said.

He believes that the strong support level is identified at 44,700, which is expected to act as a key level for potential pullbacks or market dips. A break above the level of 45,500 is anticipated to drive the index towards new high levels, indicating the potential for further upward momentum, he said.

The pivot point calculator indicates that Bank Nifty is likely to take support at 44,905, followed by 44,701 and 44,372, while 45,563 can be the initial resistance zone followed by 45,766 and 46,095.

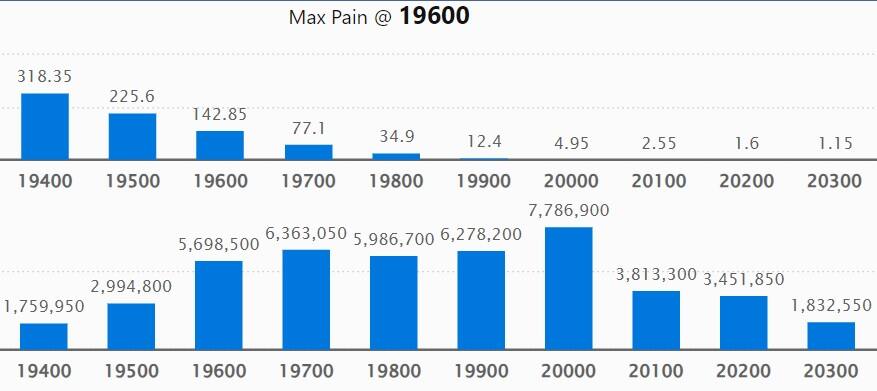

We have seen the maximum weekly Call open interest (OI) at 20,000 strike, with 77.86 lakh contracts, which can act as a resistance for the Nifty in the coming sessions.

This is followed by 63.63 lakh contracts at 19,700 strike, while 19,900 strike has 62.78 lakh contracts.

Meaningful Call writing was seen at 19,900 strike, which added 20.5 lakh contracts, followed by 20,000 and 19,800 strikes, which added 16.39 lakh contracts and 11.77 lakh contracts.

Maximum Call unwinding was at 19,500 strike, which shed 20.36 lakh contracts, followed by 19,400 and 20,500 strikes, which shed 9.96 lakh and 2.57 lakh contracts.

On the Put side, the maximum open interest was at 19,600 strike, with 1.35 crore contracts, which could be an important support for the Nifty.

This was followed by the 19,500 strike, comprising 1.05 crore contracts, and the 19,400 strike, which had 83.13 lakh contracts.

Put writing was seen at 19,600 strike, which added 1.09 crore contracts, followed by 19,700 and 19,000 strikes, which added 35.84 lakh and 31.06 lakh contracts, respectively.

We have seen Put unwinding at 19,200 strike, which shed 7.43 lakh contracts, followed by 19,400 and 19,100 strikes, which shed 5.21 lakh contracts and 4.79 lakh contracts respectively.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in Bharti Airtel, Eicher Motors, UltraTech Cement, Container Corporation, and Indian Hotels among others.

United Spirits, Ashok Leyland, Gujarat Gas, Zee Entertainment Enterprises, and India Cements were among the 62 stocks to see a long build-up based on the open interest (OI) percentage. An increase in open interest and price indicates a build-up of long positions.

Based on the OI percentage, 37 stocks, including Container Corporation of India, Intellect Design Arena, TCS, Escorts, and ONGC, saw a long unwinding. A decline in OI and price indicates a long unwinding.

35 stocks see a short build-up

A short build-up was seen in 35 stocks, including Abbott India, Bandhan Bank, AU Small Finance Bank, Titan Company, and Hindustan Aeronautics. An increase in OI along with a price fall indicates a build-up of short positions.

Based on the OI percentage, 54 stocks were on the short-covering list. These included RBL Bank, Coforge, Hindustan Copper, LTIMindtree, and Mphasis. A decrease in OI along with a price increase is an indication of short-covering.

(For more bulk deals, click here)

Stocks in the news

Reliance Industries: Jio Financial Services will be included in 19 NSE indices with effect from July 20, after the demerger of Reliance Industries' financial services business into Reliance Strategic Investments. Reliance Strategic Investments will be renamed as Jio Financial Services. NSE indices included Nifty50, Nifty 100, Nifty 200, Nifty 500, Nifty Oil & Gas, Nifty Energy, Nifty Commodities, and Nifty Infrastructure.

LTIMindtree: The technology consulting and digital solutions company has recorded 3.4 percent sequential growth in consolidated profit at Rs 1,151.5 crore for the quarter ended June FY24, supported largely by other income and operating margin. Revenue from operations grew by 0.13 percent QoQ to Rs 8,702.1 crore, while revenue growth in constant currency and dollar terms stood at 0.1 percent each QoQ.

Sheela Foam: The polyurethane foam manufacturer has received approval from the board for the acquisition of foam and coir-based home comfort products maker Kurlon Enterprise, and furniture company House of Kieraya (Furlenco). Sheela Foam will acquire a 94.66 percent stake in Kurlon Enterprise for Rs 2,150 crore and the said acquisition is expected to be completed by or before November 30, 2023, while it will buy a 35 percent stake in Furlenco for Rs 300 crore.

Tata Elxsi: The design-led technology services provider has registered a 2.2 percent year-on-year growth in profit at Rs 188.85 crore for quarter ended June FY24, impacted by weak operating margin. Revenue from operations grew by 17.1 percent to Rs 850.3 crore compared to the year-ago period. At the operating level, EBIT increased by 4.1 percent year-on-year to Rs 230.1 crore, but the margin fell 340 bps to 27.1 percent for the quarter.

RPP Infra Projects: The RPP-HSEA joint venture owned by RPP Infra Projects and Hs Engineers Associates, has received a letter of acceptance for a new project in Himachal Pradesh at the cost of Rs 138.24 crore. RPP Infra with 51 percent holding along with its JV partner (49 percent holding) will invest in the project as per their capacity of holding and complete the said project within the decided timeline.

Hindware Home Innovation: The building products maker has received board approval for the appointment of Salil Kappoor as Chief Executive Officer with effect from July 18. Earlier he was leading the appliances division at Orient Electric as the business unit head.

Amara Raja Batteries: Foreign investor Clarios ARBL Holding LP is likely to exit the automotive battery manufacturer via stake sale in a block deal on July 18, reports CNBC-TV18 quoting sources. The floor price has been set at Rs 651 per share. Clarios ARBL Holding LP holds a 14 percent stake or 2.39 crore shares in Amara Raja.

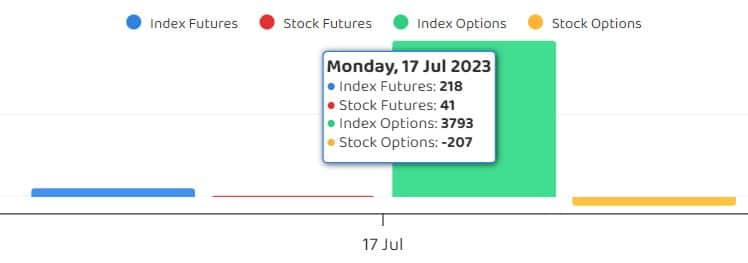

Fund Flow

Foreign institutional investors (FII) have bought shares worth Rs 73 crore, while domestic institutional investors (DII) purchased shares worth Rs 64.34 crore on July 17, provisional data from the National Stock Exchange (NSE) shows.

Stocks under F&O ban on NSE

The NSE has retained Delta Corp, Indiabulls Housing Finance, Manappuram Finance, and RBL Bank on its F&O ban list for July 18. Securities banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!