The market consolidated in a narrow range throughout the session before ending with moderate losses and also remained within the previous day's trading range on October 16. For the Nifty50, 19,700 which coincides with the 20-day EMA (exponential moving average) can be an immediate support followed by 19,600, whereas on the higher side, 19,800-19,850 will remain a key resistance area for further upside going ahead, experts said, adding the market may be awaiting the speech by the Federal Reserve Chair Jerome Powell later this week.

The BSE Sensex fell 116 points to 66,167, while the Nifty50 declined 19 points to 19,732 and formed a Doji or High Wave kind of candlestick pattern on the daily scale, indicating the indecisiveness among bulls and bears about the future market trend.

"On the daily charts, the Nifty makes the extremes of the range of the previous day candle crucial levels from short-term perspective. In this case, the extremes of the range are 19,805 and 19,635. A breach of this on either side shall lead to a trending move in that direction," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

The daily and hourly momentum indicators provide divergent signals, and in such a scenario, consolidation appears to be highly probable, he feels.

"Contraction of the Bollinger bands also supports our sideways outlook on the index. The range of consolidation is likely to be 19,500 – 20,100 from a short-term perspective," he said.

However, the broader markets outperformed benchmarks, as the Nifty Midcap 100 and Smallcap 100 indices gained 0.2 percent and 0.4 percent respectively, while the India VIX, which measures the expected volatility for next 30 days in the Nifty50, jumped by 5 percent to 11.07 levels.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may be taking support at 19,701, followed by 19,680 and 19,645. On the higher side, 19,769 can be an immediate resistance, followed by 19,790 and 19,824.

On October 16, the Bank Nifty also remained in consolidation mode before ending the session marginally lower by 62 points at 44,226, while taking the support at 44,000 mark on an intraday basis. The index has formed a Doji kind of candlestick pattern on the daily scale and continued higher tops, higher bottoms for yet another session.

"The Bank Nifty remained sideways as market participants stayed on the sidelines ahead of the scheduled Fed Chairman speech later this week. In the near term, weakness may persist in the banking sector as the index has stayed below the critical short-term moving average," Rupak De, senior technical analyst at LKP Securities said.

Over the short term, he feels the index might maintain a negative to sideways trend as long as it remains below 44,700. The support is situated at 44,000-43,800, he said.

As per the pivot point calculator, the banking index is expected to take support at 44,090, followed by 44,016 and 43,897. On the upside, the initial resistance is at 44,328, then at 44,402 and at 44,522.

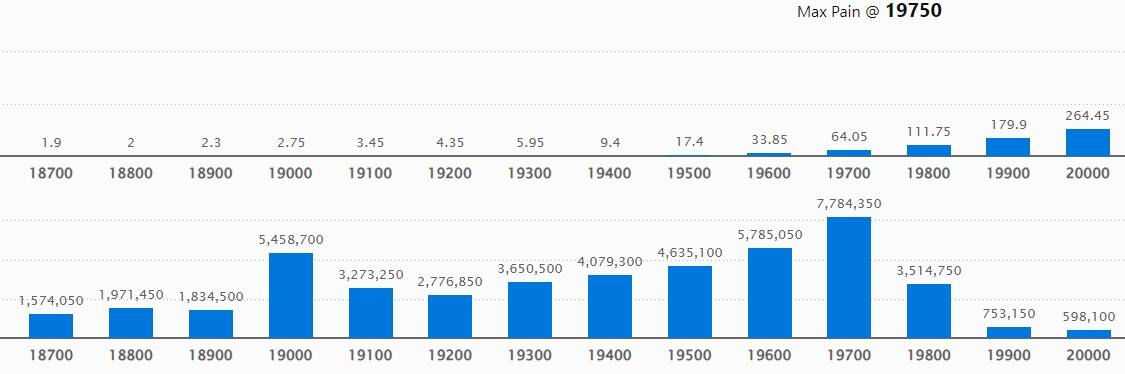

The weekly options data suggested that the maximum Call open interest (OI) remained at 19,800 strike with 83.34 lakh contracts, which can act as a key resistance for the Nifty. It was followed by the 20,000 strike, which had 74.16 lakh contracts, while 20,200 strike had 69.73 lakh contracts.

Meaningful Call writing was seen at 20,200 strike, which added 24.53 lakh contracts followed by 20,000 and 19,800 strikes, which added 22.02 lakh and 20.42 lakh contracts.

Maximum Call unwinding was seen at 20,800 strike, which shed 44,950 contracts, followed by 19,400 and 20,700 strikes, which shed 24,500 and 7,900 contracts.

On the Put side, the maximum open interest remained at 19,700 strike with 77.84 lakh contracts, which can act as immediate support for the Nifty50 in coming sessions.

It was followed by 19,600 strike, comprising 57.85 lakh contracts and 19,000 strike with 54.58 lakh contracts.

The meaningful Put writing was at 19,700 strike, which added 13.25 lakh contracts, followed by 19,600 strike and 19,200 strike, which added 7.16 lakh and 6.49 lakh contracts.

Put unwinding was at 19,000 strike, which shed 2.93 lakh contracts, followed by 18,800 strike and 18,700 strike, which shed 2.17 lakh and 1.96 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Power Grid Corporation of India, Max Financial Services, Atul, Dabur India, and Coromandel International saw the highest delivery among the F&O stocks.

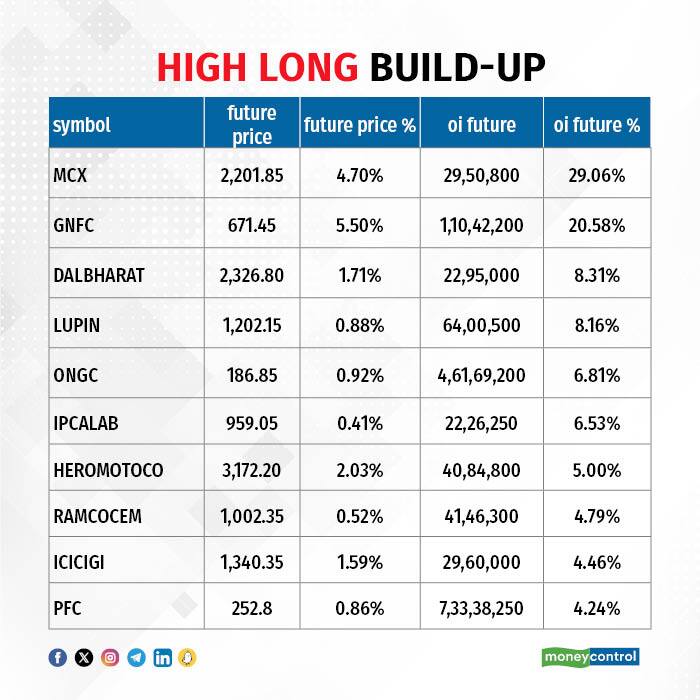

A long build-up was seen in 50 stocks including MCX India, GNFC (Gujarat Narmada Valley Fertilisers & Chemicals), Dalmia Bharat, Lupin, and ONGC. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, a total of 23 stocks, including Delta Corp, Grasim Industries, Tata Motors, Syngene International, and DLF saw a long unwinding. A decline in OI and price indicates long unwinding.

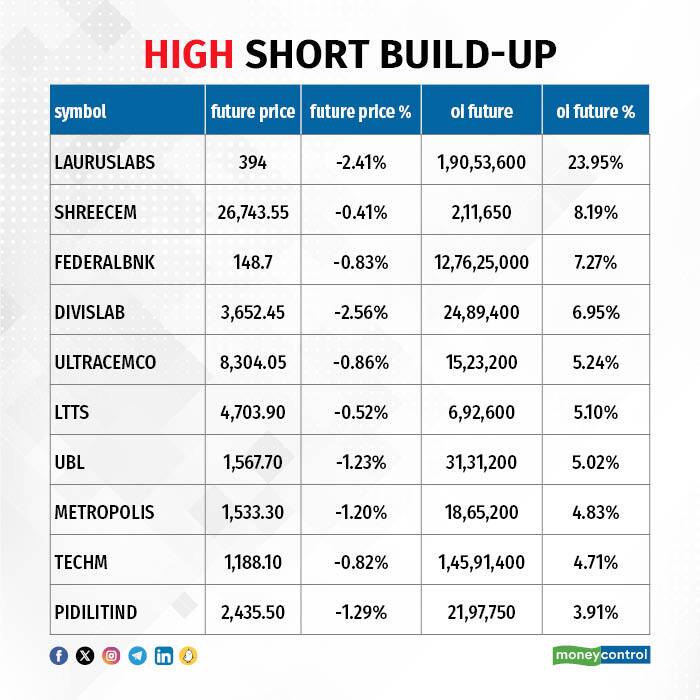

50 stocks see a short build-up

A short build-up was seen in 50 stocks, including Laurus Labs, Shree Cement, Federal Bank, Divis Laboratories, and UltraTech Cement. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 64 stocks were on the short-covering list. These included Sun TV Network, Torrent Pharma, Balkrishna Industries, Bosch, and ABB India. A decrease in OI along with a price increase is an indication of short-covering.

For more bulk deals, click here

Stocks in the news

HDFC Bank: India's largest private sector lender has recorded a standalone profit at Rs 15,976 crore for the quarter ended September FY24, up 50.6 percent over the year-ago period, beating analysts' estimates. Net interest income grew by 30.3 percent at Rs 27,385 crore, with a core net interest margin of 3.65 percent and a reported net interest margin of 3.4 percent for the quarter. Numbers are not comparable on YoY as well as QoQ due to the merger. Gross advances and total deposits increased by around Rs 1.1 lakh crore YoY to Rs 23.54 lakh crore and Rs 21.72 lakh crore respectively.

ICICI Securities: The company reported healthy numbers for the quarter ended September FY24, with profit growing 41 percent on-year to Rs 423.6 crore and revenue increasing 45.5 percent to Rs 1,249 crore compared to the year-ago period. On the operating front, EBITDA (earnings before interest, tax, depreciation and amortisation) grew by 54.8 percent YoY to Rs 810 crore with margin expanding 390 bps to 64.9 percent for the quarter. The firm has approved an interim dividend of Rs 12 per share.

Jio Financial Services: The financial services company has registered healthy growth for the quarter ended September FY24, with profit rising 101.3 percent quarter-on-quarter to Rs 668.18 crore and revenue from operations growing 46.8 percent QoQ to Rs 608.04 crore. Meanwhile, the board has appointed AR Ganesh as Group Chief Technology Officer of the company with effect from October 16.

CEAT: The tyre company recorded consolidated profit at Rs 208 crore for the quarter ended September FY24, increasing significantly compared to Rs 7.8 crore in the same period last year, supported by healthy operating numbers with a fall in input cost. In Q2FY23, profit was also impacted by an exceptional loss of Rs 23.7 crore. Revenue from operations grew by 5.5 percent YoY to Rs 3,053.3 crore for the quarter.

Cyient DLM: The electronic manufacturing services and solutions company has reported a massive 106.4 percent on-year growth in profit at Rs 14.6 crore for the quarter ended September FY24, driven by other income and topline. Revenue from operations surged 71.5 percent YoY to Rs 291.8 crore for the quarter.

KEC International: The RPG Group company has secured new orders worth Rs 1,315 crore across its various businesses including transmission & distribution projects in India, the Middle East, Australia and the Americas.

Tata Power: Subsidiary Tata Power Renewable Energy has signed a power delivery agreement (PDA) with auto component manufacturer Endurance Technologies through a special purpose vehicle (SPV) TP Green Nature, for the development of 12.5MW AC captive solar plant. The plant will be set up at Aachegaon in Maharashtra and will generate 27.5 million units (MUs) of electricity every year.

Fund Flow (Rs Crore)

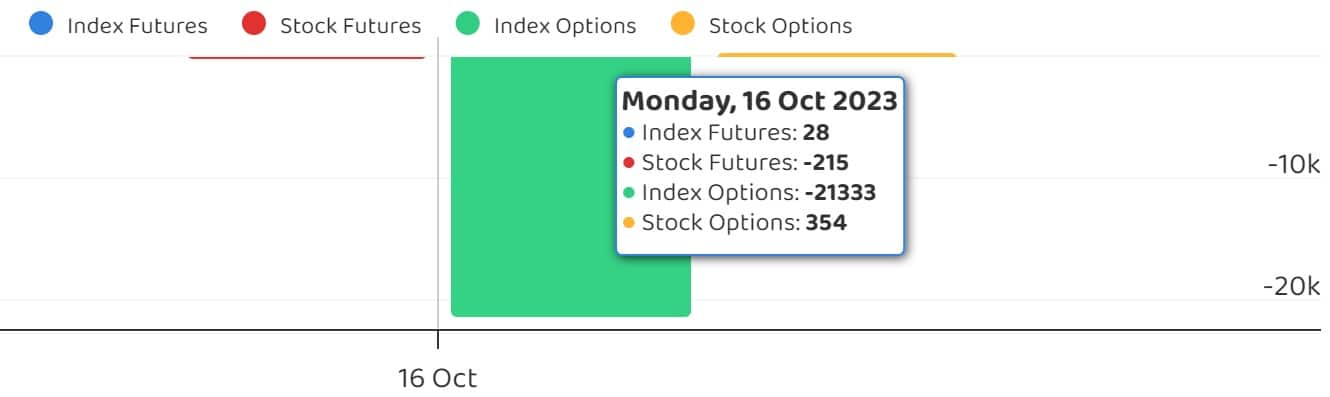

Foreign institutional investors (FII) sold shares worth Rs 593.66 crore, while domestic institutional investors (DII) bought Rs 1,184.24 crore worth of stocks on October 16, provisional data from the National Stock Exchange (NSE) showed.

Stocks under F&O ban on NSE

The NSE has added GNFC, and MCX India to its F&O ban list for October 17, while retaining Balrampur Chini Mills, BHEL, Delta Corp, Hindustan Copper, Indiabulls Housing Finance, India Cements, Manappuram Finance, Punjab National Bank, SAIL, and Sun TV Network to the said list. L&T Finance Holdings was removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!