A big-bang announcement of Rs 20 lakh crore stimulus by Prime Minister Narendra Modi lifted market sentiment on May 13 as the Sensex and the Nifty closed 2 percent higher each.

The Finance Minister announced the first tranche of the mega stimulus package on May 13 and said that the remaining details of the Rs 20 lakh crore stimulus package will be disclosed in the next few days.

The Indian equity market may trade in positive territory on May 14, supported by select pockets such as PSU banks and NBFCs after the Finance Minister Nirmala Sitharaman's announcement regarding the NBFCs, MSMEs and real estate, experts said.

Experts, however, added that a clear picture will emerge only after the FM is done with all announcements and the market till then may trade in a balanced way.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-months data and not of the current month only.

Key support and resistance level for Nifty

According to pivot charts, the key support level for Nifty is placed at 9,294.93, followed by 9,206.32. If the index moves up, key resistance levels to watch out for are 9,528.33 and 9,673.12.

Nifty Bank

The Nifty Bank closed 4.09 percent higher at 19,634.95. The important pivot level, which will act as crucial support for the index, is placed at 19,335.8, followed by 19,036.7. On the upside, key resistance levels are placed at 20,028.1 and 20,421.3.

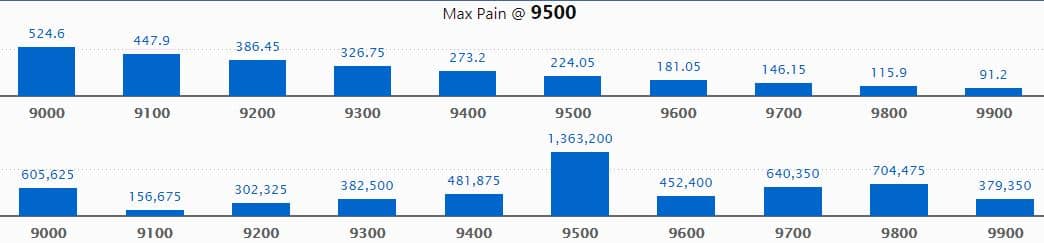

Call option data

Maximum call OI of 13.63 lakh contracts was seen at 9,500 strike, which will act as crucial resistance in the May series.

This is followed by 9,800, which holds 7.04 lakh contracts, and 9,700 strikes, which has accumulated 6.40 lakh contracts.

Significant call writing was seen at the 9,800, which added 1.33 lakh contracts, followed by 9,700 strikes that added 94,875 contracts.

Call unwinding was witnessed at 9,500, which shed 1.84 lakh contracts. It was followed by 9,200, which shed 1.4 lakh contracts and 9,300 strike which shed 85,950 contracts.

Source: MyFNO

Source: MyFNO

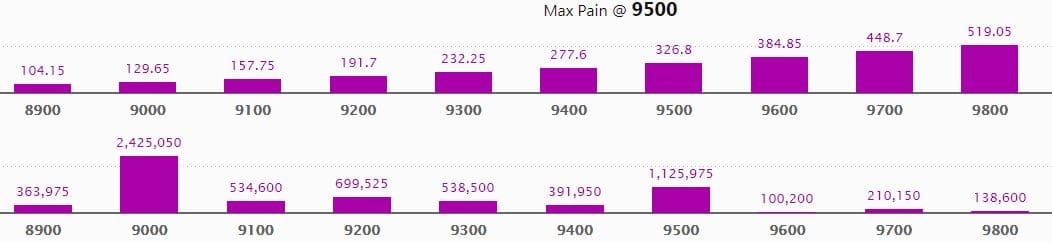

Put option data

Maximum put OI of 24.25 lakh contracts was seen at 9,000 strike, which will act as crucial support in the May series.

This is followed by 9,500, which holds 11.26 lakh contracts, and 9,200 strikes, which has accumulated nearly 7 lakh contracts.

Significant Put writing was seen at 9,400, which added 1.88 lakh contracts, followed by 9,500 strikes, which added 1.16 lakh contracts.

Put unwinding was seen at 9,000, which shed 52,425 contracts, followed by 9,700 strikes that shed 8,550 contracts.

Source: MyFNO

Source: MyFNO

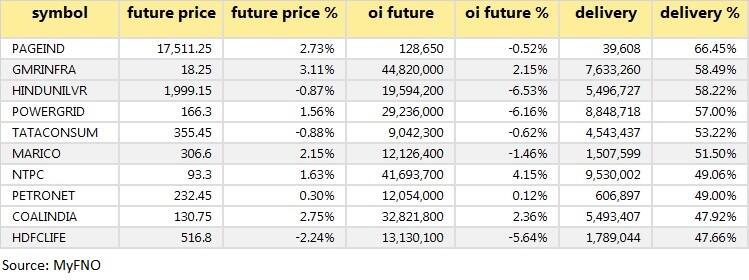

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

75 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

14 stocks saw long unwinding

13 stocks saw short build-up

An increase in the OI, along with a decrease in price, mostly indicates a build-up of short positions.

43 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

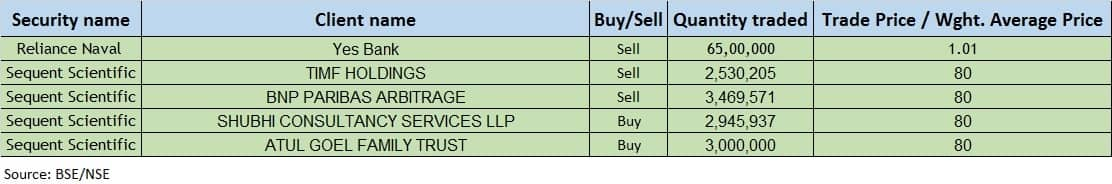

Bulk deals

(For more bulk deals, click here)

Results on May 14

Biocon, Escorts, Indiabulls Real Estate, Mahindra Lifespace, Manappuram Finance, Tata Consumer.

Stocks in the news

NBFCs, MFIs: Govt provided Rs 30,000 crore liquidity facility for NBFC/HCs/MFIs, Rs 45,000 crore Partial Credit Guarantee Scheme 2.0 for NBFC.

Real Estate: Govt provided an extension of 6 months in registration and completion date of real estate projects under RERA.

ABB India Q1: Profit fell to Rs 66 cr versus Rs 89 cr, revenue declined to Rs 1,522 cr versus Rs 1,850 cr YoY.

Godrej Consumer Products Q4: Profit dropped to Rs 230 cr versus Rs 935 cr, revenue fell to Rs 2,154 cr versus Rs 2,453 cr YoY.

Siemens March quarter: Profit fell to Rs 176 cr versus Rs 284 cr, revenue dipped to Rs 2,838 cr versus Rs 3,578 cr YoY.

Schaeffler India March quarter: Profit fell to Rs 78.35 cr versus Rs 106.2 cr, revenue declined to Rs 928.54 cr versus Rs 1,172 cr YoY.

Future Lifestyle: CARE downgraded the credit rating for short term bank facilities to A1 from A1+.

Future Consumer: Board to consider rights issue of equity shares on May 16.

Hercules Hoists: Company partially resumed operations at Raigad plant.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) sold shares worth Rs 283.43 crore, while domestic institutional investors (DIIs) bought shares worth Rs 232.65 crore in the Indian equity market on May 13, provisional data available on the NSE showed.

Stock under F&O ban on NSE

Vodafone Idea and BHEL are under the F&O ban for May 14. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!