The market gained strength after the dovish policy announced by the Reserve Bank of India and closed nearly a percent higher on April 7. The buying was seen across sectors with Nifty Bank, IT and Auto indices rising 1-1.5 percent.

The BSE Sensex rallied 460.37 points to 49,661.76, while the Nifty50 climbed 135.50 points to 14,819 and formed a bullish candle on the daily charts.

"The index has registered a day around 14,880 levels and also retested the past couple of weeks' Multiple Resistance of 14,900 levels. Hence, on the upside, 14,900 is crucial resistance to watch for. The Nifty index is broadly moving within 14,900-14,400 levels indicating sideways consolidation. Hence, any decisive breakout of the above-mentioned range will indicate further direction," Rajesh Palviya, Head - Technical and Derivative Research at Axis Securities, told Moneycontrol.

The index is well placed above its 100-day SMA of 14,206 which remains a major support zone, said Palviya. Any pullback towards 14,750-14,700 should be used as a buying opportunity, he added.

The broader markets also participated in the run with the Nifty Midcap 100 index rising 1.32 percent and the Nifty Smallcap 100 index up 1.71 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,685.93, followed by 14,552.87. If the index moves up, the key resistance levels to watch out for are 14,915.93 and 15,012.87.

Nifty Bank

The Nifty Bank index jumped 489.85 points or 1.51 percent to 32,991.20 on April 7. The important pivot level, which will act as crucial support for the index, is placed at 32,357.96, followed by 31,724.73. On the upside, key resistance levels are placed at 33,408.06 and 33,824.93 levels.

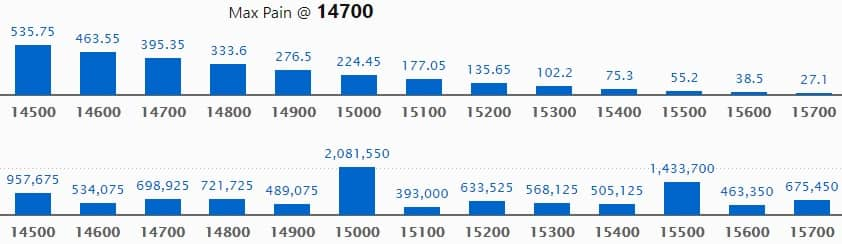

Call option data

Maximum Call open interest of 20.81 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 15,500 strike, which holds 14.33 lakh contracts, and 14,500 strike, which has accumulated 9.57 lakh contracts.

Call writing was seen at 15,300 strike, which added 73,200 contracts, followed by 15,400 strike which added 53,400 contracts and 15,700 strike which added 45,375 contracts.

Call unwinding was seen at 14,800 strike, which shed 91,200 contracts, followed by 14,500 strike which shed 85,875 contracts and 14,700 strike which shed 69,750 contracts.

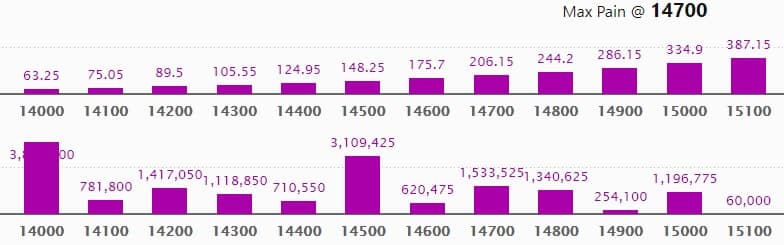

Put option data

Maximum Put open interest of 38.31 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the April series.

This is followed by 14,500 strike, which holds 31.09 lakh contracts, and 14,700 strike, which has accumulated 15.33 lakh contracts.

Put writing was seen at 14,500 strike, which added 2.77 lakh contracts, followed by 14,800 strike which added 89,325 contracts and 14,900 strike which added 68,325 contracts.

Put unwinding was seen at 14,000 strike, which shed 75,600 contracts, followed by 14,100 strike which shed 18,675 contracts.

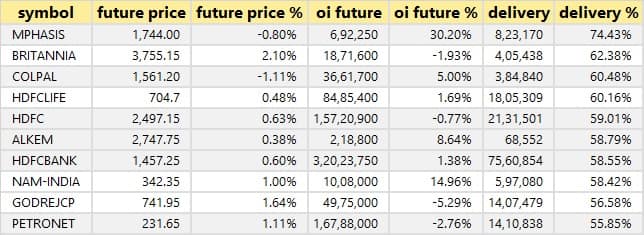

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

62 stocks saw long build-up

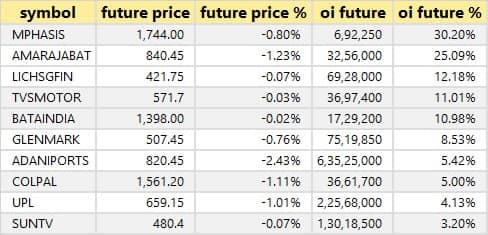

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

Eight stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the eight stocks in which long unwinding was seen.

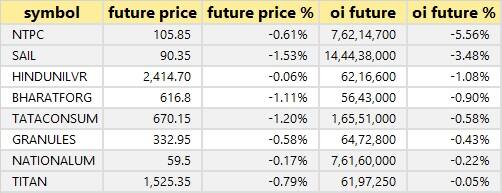

16 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

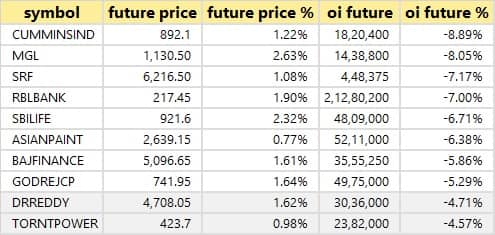

70 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

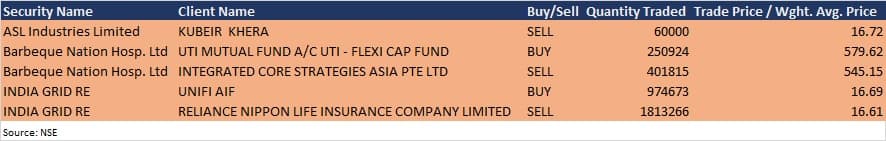

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Indian Overseas Bank: The meeting of the board of directors of Indian Overseas Bank is scheduled for April 12 to consider the issue of equity shares against capital infusion of Rs 4,100 crore.

Avanti Feeds: The company will be attending a one-on-one investor conference to be hosted by Equirus Securities on April 8.

L&T Finance Holdings: The company will hold a conference call with institutional investor(s) / analyst(s) on April 30 to discuss Q4 FY2021 and FY2021 financial performance and provide an update on strategy.

Stocks in the news

Muthoot Finance: Muthoot Finance is planning to raise Rs 1,700 crore through public issue of secured redeemable non-convertible debentures. The issue opens on April 8 and will close on April 29 with an option to close on an earlier or extended date as may be decided by the board of directors or NCD committee.

Hindustan Copper: Hindustan Copper in its BSE filing said the company opened its qualified institutional placement issue for subscription on April 7. The floor price has been fixed at Rs 125.79 per equity share.

Wipro: The IT company said it has appointed Suzanne Dann as senior vice president and sector head for capital markets and insurance, North America Region. It also appointed Subha Tatavarti as Chief Technology Officer.

Prakash Industries: In Q4FY20-21, Prakash Industries achieved the highest-ever sales of around 2,72,142 tonnes of steel, recording a growth of 8.85 percent (QoQ basis) and 31.16 percent (YoY basis). In FY21, the company achieved the highest-ever sales of around 9,54,760 tonnes of steel, a growth of 3.13 percent over FY20 despite disruptions due to the COVID-19 pandemic.

Godrej Consumer Products: In Q4FY21, in India, Godrej Consumer expects to deliver sales growth around the thirties, driven by strong volume growth and calibrated price increases. In Indonesia, it expects gradual recovery with mid-single-digit constant currency sales growth. The company expects sales growth in Latin America business to remain strong in constant currency terms.

UCO Bank: The bank approved the proposal for the issue of equity shares on a preferential basis to the Government of India against a capital infusion of Rs 2,600 crore.

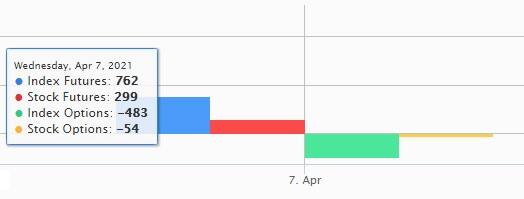

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 227.42 crore, while domestic institutional investors (DIIs) net acquired shares worth Rs 381.08 crore in the Indian equity market on April 7, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - SAIL - is under the F&O ban for April 8. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!