The market closed its volatile session with minor losses on September 29 ahead of expiry of September derivative contracts on Thursday, continuing downtrend for second straight day due to selling in select banking & financials, auto and FMCG stocks. However, metals, pharma and PSU banks bucked the trend, rising 1.6-2.7 percent.

The market made a successful attempt to turn positive in last hour of trade but failed to hold on to the same. The BSE Sensex declined 254.33 points to 59,413.27, while the Nifty50 fell 37.30 points to 17,711.30 and formed bullish candle on the daily charts.

"A small positive candle was formed at the lows with minor upper and lower shadow. Technically, this pattern indicate a formation of high wave type candle pattern. Normally, such formations after a reasonable decline could hint at a possibility of halt in present trend and this needs to be confirmed with reasonable upmove in the subsequent sessions," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He feels the short term trend of Nifty remains negative. "But, lack of sharp follow-through selling and an emergence of buying from the lower supports suggest chances of upside bounce in the market in the next 1-2 sessions," he said.

"A sustainable move above the immediate resistance of 17,800 could open strong upside bounce towards 18,000 mark. Immediate support is placed at 17,580-17,600 levels," Shetti added.

The Nifty Midcap 100 and Smallcap 100 indices gained 1.08 percent and 0.41 percent, outperforming benchmark indices.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,619.07, followed by 17,526.83. If the index moves up, the key resistance levels to watch out for are 17,792.67 and 17,874.04.

Nifty Bank

The Nifty Bank slipped 202 points to 37,743 on September 29. The important pivot level, which will act as crucial support for the index, is placed at 37,434.94, followed by 37,126.87. On the upside, key resistance levels are placed at 37,987.23 and 38,231.46 levels.

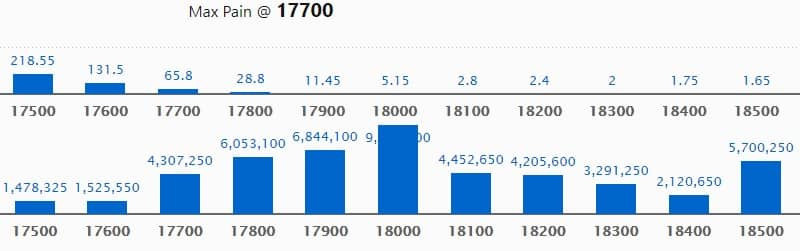

Call option data

Maximum Call open interest of 94.94 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the September series.

This is followed by 17900 strike, which holds 68.44 lakh contracts, and 17800 strike, which has accumulated 60.53 lakh contracts.

Call writing was seen at 18000 strike, which added 15.12 lakh contracts, followed by 17800 strike, which added 12.69 lakh contracts and 17700 strike which added 12.13 lakh contracts.

Call unwinding was seen at 18100 strike, which shed 4.38 lakh contracts, followed by 18500 strike, which shed 3.38 lakh contracts, and 18400 strike which shed 1.29 lakh contracts.

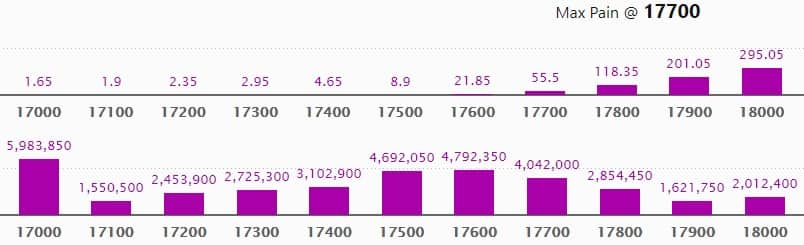

Put option data

Maximum Put open interest of 59.83 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the September series.

This is followed by 17600 strike, which holds 47.92 lakh contracts, and 17500 strike, which has accumulated 46.92 lakh contracts.

Put writing was seen at 17600 strike, which added 13.34 lakh contracts, followed by 17000 strike which added 9.51 lakh contracts, and 17400 strike which added 6.01 lakh contracts.

Put unwinding was seen at 17100 strike, which shed 1.62 lakh contracts, followed by 17300 strike which shed 1.42 lakh contracts, and 17900 strike which shed 1.24 lakh contracts.

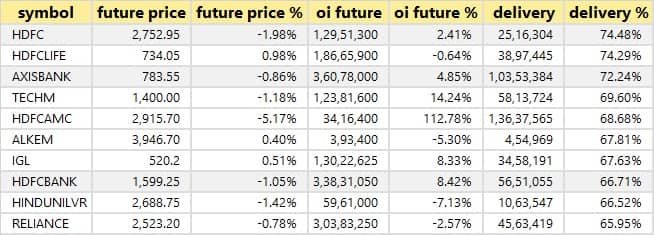

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

37 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

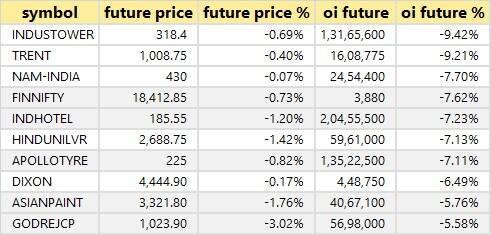

40 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

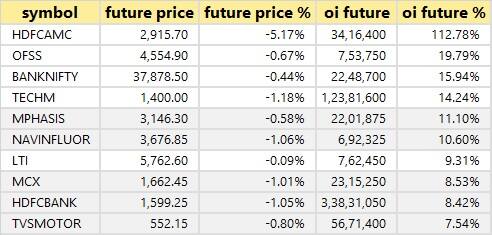

39 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

58 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

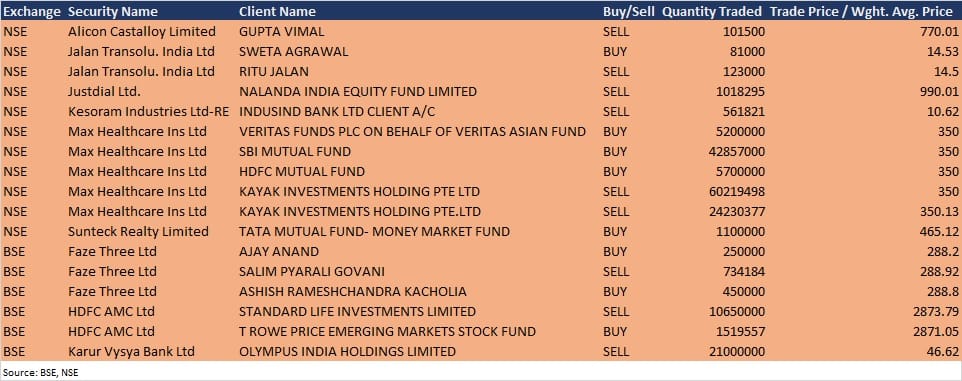

Bulk deals

Faze Three Ltd: Ace investor Ashish Rameshchandra Kacholia bought 4.5 lakh equity shares in the company at Rs 288.80 per share, and Ajay Anand acquired 2.5 lakh shares in the company at Rs 288.20 per share, whereas Salim Pyarali Govani sold 7,34,184 equity shares in the company at Rs 288.92 per share on the BSE, the bulk deals data showed.

HDFC AMC: Foreign promoter Standard Life Investments sold 1,06,50,000 equity shares in the company at Rs 2,873.79 per share, whereas T Rowe Price Emerging Markets Stock Fund acquired 15,19,557 equity shares at Rs 2,871.05 per share on the BSE, the bulk deals data showed.

Karur Vysya Bank: Olympus India Holdings sold 2.1 crore equity shares in the bank at Rs 46.62 per share on the BSE, the bulk deals data showed.

Just Dial: Nalanda India Equity Fund sold 10,18,295 equity shares in the company at Rs 990.01 per share on the NSE, the bulk deals data showed.

Max Healthcare Institute: Veritas Funds Plc on behalf of Veritas Asian Fund acquired 52 lakh shares in the company at Rs 350 per share, SBI Mutual Fund bought 4,28,57,000 shares at same price, and HDFC Mutual Fund purchased 57 lakh shares at same price. However, promoter Kayak Investments Holding Pte Ltd sold 6,02,19,498 equity shares in the company at Rs 350 per share, and 2,42,30,377 equity shares at Rs 350.13 per share on the NSE, the bulk deals data showed.

Sunteck Realty: Tata Mutual Fund - Money Market Fund bought 11 lakh shares in the company at Rs 465.12 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

NOCIL: The company's officials will meet investors in conference organised by Motilal Oswal Financial Services on September 30.

Galaxy Surfactants: The company's officials will meet investors in conference organised by Motilal Oswal Financial Services on September 30.

Graphite India: The company's officials will meet Fidelity Management Research on September 30.

Persistent Systems: The company's officials will meet investors and analysts on September 30.

Century Textiles: The company's officials will meet investors and analysts in B&K's Ideation Conference on September 30.

Stocks in News

Indian Overseas Bank: Indian Overseas Bank is taken out of the Prompt Corrective Action Framework by the RBI.

Ashoka Buildcon: The company further acquired balance 40% stake in Ashoka Bettadahalli Shivamogga Road (ABSRPL) for Rs 2 lakh. ABSRPL is now a wholly owned subsidiary of the company post the acquisition.

Lincoln Pharmaceuticals: Promoter Ashish Rajanibhai Patel picked 31,000 equity shares in the company via open market transaction on September 27, increasing shareholding to 5.16% from 5% earlier.

Persistent Systems: US subsidiary acquire Software Corporation and its affiliate Fusion360. The company also entered into an agreement with Shree Infosoft, India to acquire its business. Along with this transaction, its US subsidiary will acquire certain assets from Shree Partners LLC, USA, parent company of Shree Infosoft.

Blue Dart Express: The company announced its general price increase, effective from January 2022. The average shipping price increase will be 9.6% compared to 2021.

Indag Rubber: The company approved sale of 15 lakh equity shares of joint venture company SUN Mobility EV Infra, to joint venture partner EPIC Mobility Technologies Pte Ltd.

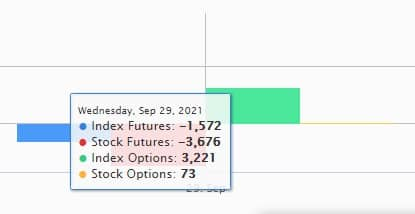

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,896.02 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 3,262.16 crore in the Indian equity market on September 29, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - Sun TV Network - is under the F&O ban for September 30. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!