The market started the new month on a positive note, as the Sensex rallied 556 points, or 0.86 percent, to 65,387 and the Nifty 182 points, or 0.94 percent, to 19,435 on September 1 but whether the momentum will sustain is the big question.

The Nifty formed a long bullish candlestick, which resembled a Bullish Engulfing pattern, on the daily chart, raising the possibility of more upside in the near term.

The index is likely to face a hurdle at 19,500 on the higher side. If it goes past the level, 19,650 would be crucial for a move towards 19,800. On the lower side, support is at 19,300-19,250, experts said.

"On the daily charts, we can observe that the Nifty has witnessed a sharp pullback from the 19,250 zone where the Nifty has been witnessing buying interest. The daily and the hourly momentum indicators triggered a positive crossover with a divergence, which is a bullish sign from a short-term perspective," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

On the weekly charts, the Nifty gained 0.9 percent after falling for five consecutive weeks, which indicates that the index has reached a zone from where buying interest has emerged.

"Considering the above parameters we change our short-term outlook on the index to positive. On the upside, we expect the Nifty to target levels of 19,650," Gedia said. Crucial support is placed at 19,330–19,300, while immediate hurdle is at 19,520–19,550, he said.

The broader markets also traded strong, with the Nifty midcap 100 and smallcap 100 indices rising 0.8 percent and 1.2 percent, aided by positive breadth. The sharp drop in India VIX, the fear index, to 11.37 levels, also gives comfort to the bulls.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty is likely to take support at 19,306 followed by 19,258 and 19,180. In case of an upside, 19,461 can be the key resistance followed by 19,509 and 19,586.

On September 1, the Bank Nifty gained a percent, or 447 points, to close at 44,436 and formed a bullish candlestick on the daily charts by taking support at the 100-day exponential moving average (EMA) placed at 43,930. It faced resistance at 50-day EMA (44,464).

"We expect the pullback to continue over the next week as well. Daily and Hourly momentum indicators have a positive crossover, which is a buy signal," Jatin Gedia, technical research analyst, Sharekhan by BNP Paribas, said.

He expects the Bank Nifty to target 45,000 in the short term.

The pivot point calculator indicates that the Bank Nifty may take support at 43,997 followed by 43,823 and 43,541. On the upside, the initial resistance is at 44,560 then 44,734 and 45,016.

As per the options data, the maximum weekly call open interest (OI) was seen at 19,600 strike, with 68.03 lakh contracts, which can act as a key resistance for the Nifty. It was followed by 19,500 strike, which had 66.52 lakh contracts, while 19,700 strike had 52.92 lakh contracts.

The maximum Call writing was seen at 19,600 strike, which added 23.27 lakh contracts, followed by 19,500 and 20,200 strikes, which added 16.5 lakh and 14.08 lakh contracts.

The maximum Call unwinding was at 19,300 strike, which shed 10.51 lakh contracts, followed by 19,400 strike and 19,200 strike, which shed 5.95 lakh contracts, and 1.74 lakh contracts.

On the put front, the maximum put open interest was at 19,300 strike, with 93.65 lakh contracts. This can be an important support for Nifty in the coming sessions.

It was followed by 19,400 strike, comprising 58.88 lakh contracts, and 19,500 strike with 51.09 lakh contracts.

The maximum put writing was at 19,300 strike, which added 56.91 lakh contracts, followed by 19,400 strike and 19,000 strike, which added 21.4 lakh and 15.54 lakh contracts.

Meaningful put unwinding was at 19,800 strike, which shed 10,300 contracts followed by 19,900 and 20,500 strikes, which shed 1,000 and 350 contracts.

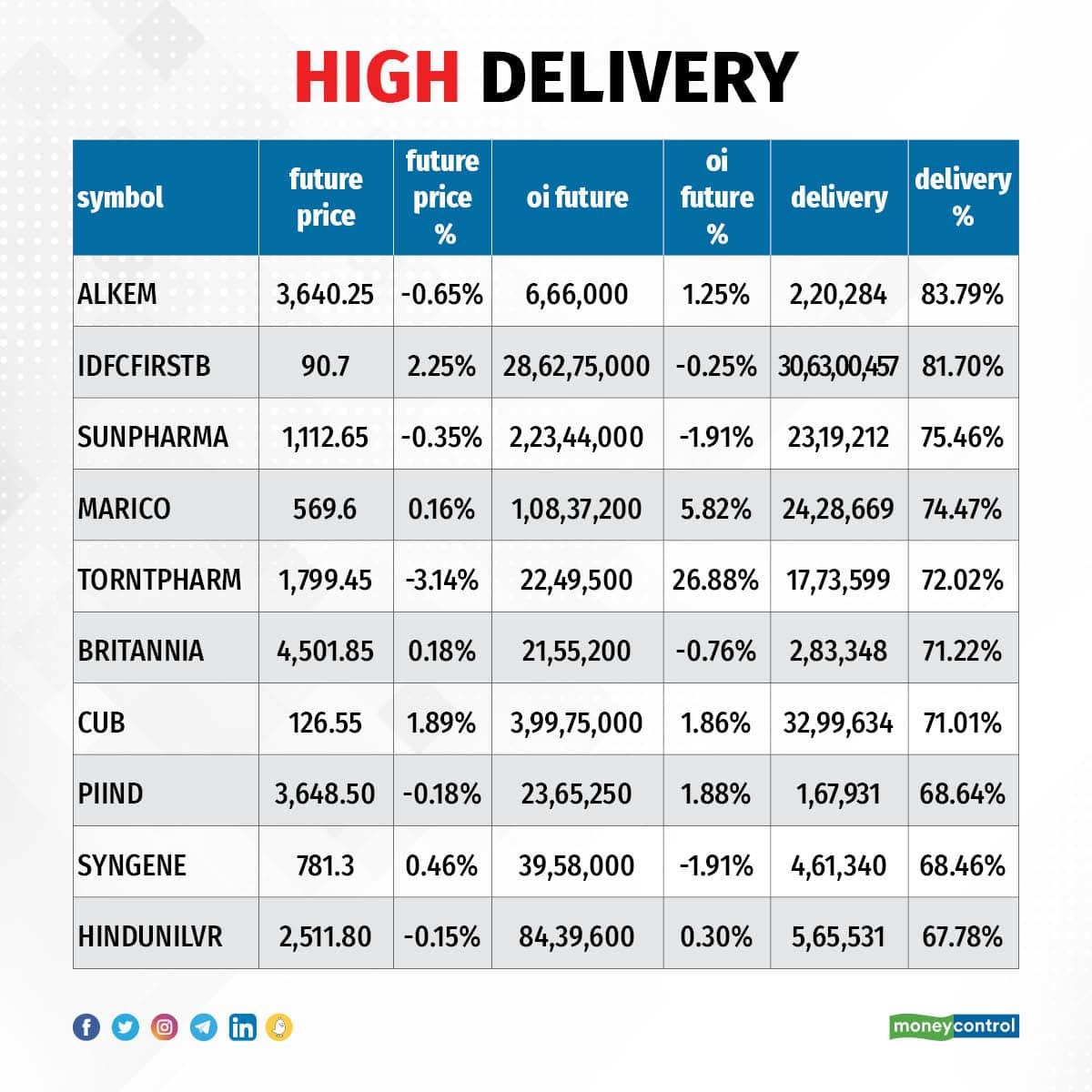

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Alkem Laboratories, IDFC First Bank, Sun Pharmaceutical Industries, Marico, and Torrent Pharma were among the stocks with the highest delivery.

BHEL, India Cements, Vodafone Idea, ONGC, and Oracle Financial were among the 83 stocks to see a long build-up. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 19 stocks, including MRF, Aurobindo Pharma, Shriram Finance, Federal Bank, and Ipca Laboratories, saw long unwinding. A decline in OI and price indicates long unwinding.

29 stocks see a short build-up

A short build-up was seen in 29 stocks, including Torrent Pharma, Indiabulls Housing Finance, Escorts Kubota, RBL Bank, and Aditya Birla Fashion & Retail. An increase in OI along with a fall in price points to a build-up of short positions.

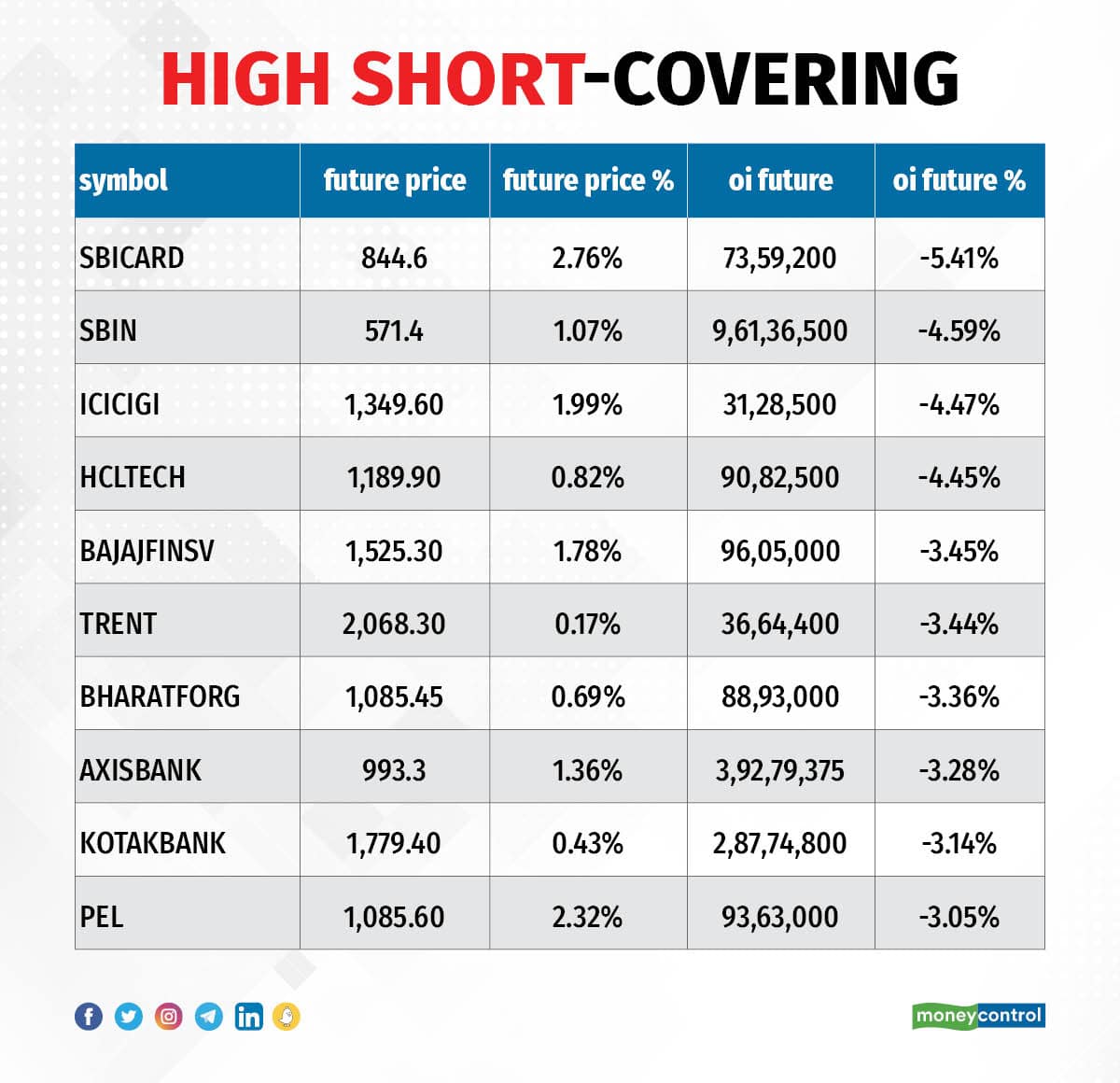

Based on the OI percentage, 57 stocks were on the short-covering list. These included SBI Card, State Bank of India, ICICI Lombard General Insurance, HCL Technologies, and Bajaj Finserv. A decrease in OI along with a price increase is an indication of short-covering.

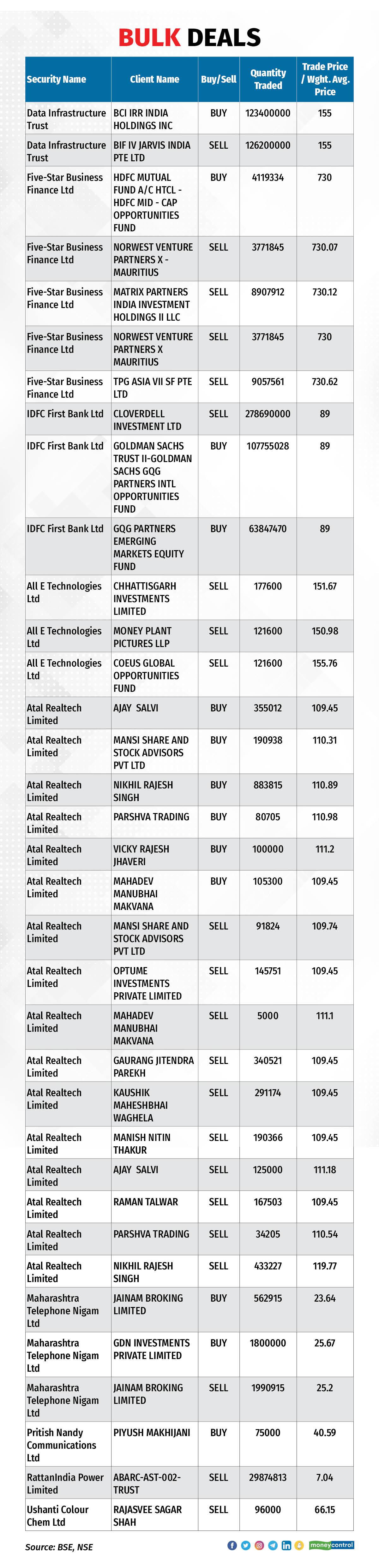

(For more bulk deals, click here)

Investors meeting on September 4

Stocks in the news

Stocks in the news

Kotak Mahindra Bank: Uday Kotak resigned as managing director & CEO of the private sector lender, with effect from September 1, three months ahead of schedule. He will now be a non-executive director. As an interim arrangement, Dipak Gupta, the joint managing director, will carry out the duties of the MD and CEO until December 31, subject to the approval of the RBI and the members of the bank.

GMR Power and Urban Infra: Subsidiary GMR Smart Electricity Distribution (GSEDPL) has received the Letter of Award (LOA) from Purvanchal Vidyut Vitran Nigam to implement smart metering project in Purvanchal (Varanasi, Azamgarh zone and Prayagraj, Mirzapur zone), Uttar Pradesh. The total contract value for Prayagraj & Mirzapur zone is about Rs 2,386.72 crore and for Varanasi & Azamgarh zone is about Rs 2,736.65 crore.

Hindalco Industries: The aluminium major has entered into a shareholder's agreement and power purchase agreement with renewable energy company Seven Renewable Power for the acquisition of a 26 percent stake in SRPPL. The company intends to develop and operate captive power generation plant to supply 100 MW round-the-clock renewable energy to the smelter located in Odisha.

Hero MotoCorp: The world's largest two-wheeler manufacturer dispatched 4.89 lakh units in August, a 5.6 percent growth over 4.63 lakh units sold in the year-ago period. Domestic sales grew by 4.9 percent on-year to 4.73 lakh units and exports jumped 32.87 percent to 15,770 units.

Eicher Motors: Royal Enfield's total sales for August stood at 77,583 units, rising 11 percent over 70,112 bikes sold in the year-ago period, beating analysts' expectations. Exports increased by 13 percent to 8,190 units during the period.

Deepak Fertilisers & Petrochemicals Corporation: The company has signed two gas purchase agreements with GAIL. The company’s gas requirements for the next three years have been tied up with a gas basket consisting of a combination of Brent, HH & domestic linked for a risk-mitigated basket.

Biocon: Subsidiary Biocon Generics Inc acquired Eywa Pharma Inc’s oral solid dosage manufacturing facility in New Jersey on September 1 for $7.7 million. The existing workforce of the facility will transition to Biocon Generics Inc. The facility has the potential for capacity expansion of up to 2 billion tablets/capsules a year.

Fund Flow (Rs Crore)

Foreign institutional investors (FII) bought shares worth Rs 487.94 crore, while domestic institutional investors (DII) purchased Rs 2,294.93 crore worth of stocks on September 1, provisional data from the National Stock Exchange (NSE) showed.

Stocks under F&O ban on NSE

The NSE has added Indiabulls Housing Finance to its F&O ban list for September 4. Securities banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.