The market remained under pressure for a sixth consecutive session with the benchmark indices falling around third of a percent on February 24, taking the total weekly loss to over 2.5 percent, the first time since June 2022. All sectors, barring pharma and oil & gas, closed in red.

The BSE Sensex fell 142 points to 59,464, while the Nifty50 declined 45 points to 17,466, the lowest closing level since October 17 last year.

The next crucial support to watch out for could be the Budget day's low of 17,353, which coincides with 200-day SMA (simple moving average), whereas 17,600 is expected to act as near-term resistance for the Nifty50, experts said.

The broader markets also traded in line with benchmarks as the Nifty Midcap 100 and Smallcap 100 indices declined 0.2 percent each on weak breadth. About three shares declined for every two rising shares on the NSE.

"Technically, we are in a short-term decline, but we are very close to the 200-day moving average's critical support level, which also happens to be the low for the budget day. Bulls will therefore attempt to protect the Nifty's 200-day moving average," said Santosh Meena, Head of Research at Swastika Investmart.

He feels if Nifty is able to maintain its 200-DMA, the index would form a double bottom, which might trigger a market rebound.

"On the upside, the 20-DMA near 17,770 will continue to serve as a significant hurdle; above it, we may anticipate a short-covering move in the direction of the 18,000–18,100 range. However, there will be more selling pressure if Nifty is unable to hold its 200-DMA, and 17130 will be the next support level," Santosh said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the Nifty has support at 17,428, followed by 17,386 and then 17,318. If the index moves up, the key resistance levels to watch out for are 17,564, followed by 17,606 and 17,674.

The Nifty Bank was also under pressure, trading in line with broader markets and falling 92 points to 39,909. The index has formed bearish candle on the daily charts but saw higher high higher lows after previous day's Doji candle formation.

"Nifty Bank index is stuck in a broad range between 39,500 and 40,500. However, the undertone remains bearish and one should keep a sell-on-rise approach. The index will witness large moves once it breaks out of the mentioned range," said Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities.

He feels the momentum indicator RSI (relative strength index) is trading below the level of 30, which confirms the weakness.

The important pivot level, which will act as a support, is at 39,823, followed by 39,698 and 39,496. On the upside, key resistance levels are 40,228, followed by 40,352, and 40,555.

On a weekly basis, the maximum Call open interest (OI) was seen at 17,600 strike, with 96.16 lakh contracts, which may remain a crucial resistance level for the Nifty in the coming sessions.

This is followed by a 18,500 strike, comprising 91.23 lakh contracts, and a 18,000 strike, where there are more than 76.3 lakh contracts.

Call writing was seen at 17,600 strike, which added 51.08 lakh contracts, followed by 18,000 strike which added 28.73 lakh contracts and 17,700 strike which added 28.34 lakh contracts.

We have not seen any Call unwinding in the band of 16,500-18,500 levels, on first day of March series.

On a weekly basis, we have seen the maximum Put OI at 17,000 strike, with 54.41 lakh contracts, which is expected to act as a crucial support zone for the Nifty50 in the March series.

This is followed by the 17,600 strike, comprising 44.75 lakh contracts, and the 17,400 strike, where we have 40.31 lakh contracts.

Put writing was seen at 17,000 strike, which added 22.19 lakh contracts, followed by 17,600 strike, which added 19.55 lakh contracts and 17,400 strike which added 16.54 lakh contracts.

We have seen Put unwinding at 17,500 strike, which shed 7.56 lakh contracts, followed by 17,800 strike which shed 1.01 lakh contracts, and 17,900 strike which shed 90,150 contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Power Grid Corporation of India, Petronet LNG, Colgate Palmolive, Container Corporation of India, and Dalmia Bharat, among others.

An increase in open interest (OI) and an increase in price mostly indicate a build-up of long positions. Based on the OI percentage, 46 stocks, GAIL India, Piramal Enterprises, GNFC, HDFC AMC, and Mphasis, saw a long build-up.

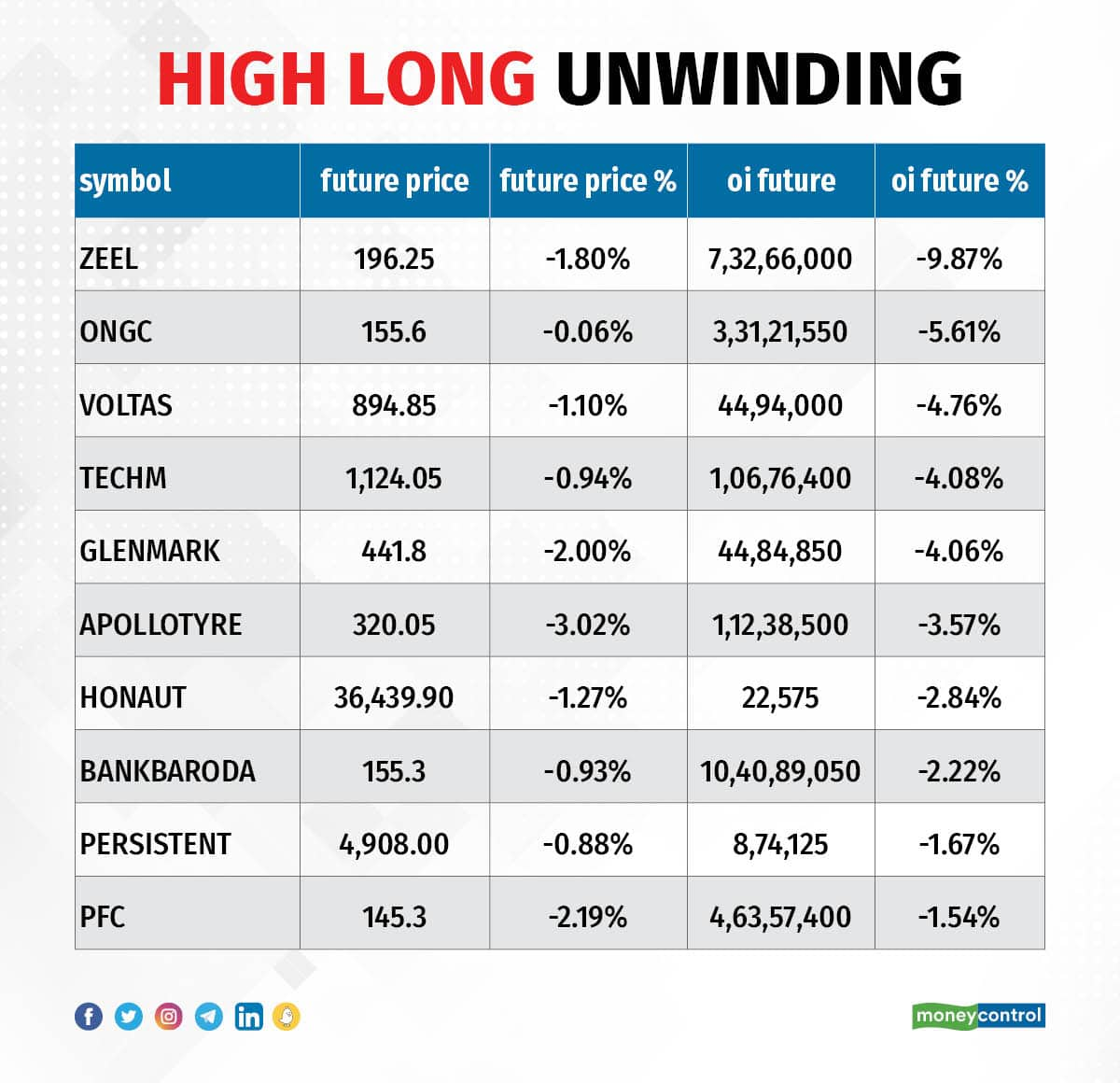

A decline in OI and a decrease in price, in most cases, indicate long unwinding. Based on the OI percentage, 33 stocks including Zee Entertainment Enterprises, ONGC, Voltas, Tech Mahindra, and Glenmark Pharma, witnessed a long unwinding.

74 stocks see a short build-up

An increase in OI accompanied by a decrease in price mostly indicate a build-up of short positions. Based on the OI percentage, 74 stocks - Adani Enterprises, Escorts, Berger Paints, Hindalco Industries, and Hindustan Petroleum Corporation - saw a short build-up.

A decrease in OI along with an increase in price is an indication of short-covering. Based on the OI percentage, 38 stocks were on the short-covering list. These included Aarti Industries, Ashok Leyland, Exide Industries, Shriram Finance, and Indian Hotels.

Redington: Synnex Mauritius has offloaded entire 24.13 percent stake or 18.85 crore shares in the company via open market transactions on February 24. Synnex Technology International Corporation, a Taiwan-based company engaged in the sales of computer, communication and consumer products, was the buyer for these shares in block trade, at an average price of Rs 170.45 per share. The stake sale was worth Rs 3,214.54 crore.

(For more bulk deals, click here)

Investors meetings on February 27

FSN E-Commerce Ventures: Officials of company will interact with Matthews Asia, and GIC (Singapore).

HCL Technologies: Company's officials will participate in Global IT Services Virtual Investor Trip hosted by Citi.

Cipla: Officials of the company will participate in Goldman Sachs: India Pharma and Healthcare Tour.

Anupam Rasayan India: Management team of the company will participate in Investment Promotion Roadshow in Japan.

Grasim Industries: Company's officials will meet Nomura Asset Management investors.

UltraTech Cement: Officials of the company will interact with Theleme Partners.

Crompton Greaves Consumer Electricals: Company's officials will meet Mahindra Asset Management.

The Phoenix Mills: Officials of the company will meet Matthews, Asia.

Indian Energy Exchange: Company's officials will interact with Baillie Gifford.

Medplus Health Services: Officials of the company will participate in Ambit India Access- Healthcare Tour.

Stocks in the news

Tega Industries: The company is set to acquire McNally Sayaji Engineering. NCLT has approved Tega's resolution plan for the acquisition of McNally Sayaji through CIRP process. Once completed, this will be Tega’s first acquisition in India and fourth worldwide. The acquisition is in line with the company’s objective of widening its product portfolio to service global and Indian businesses better.

Power Grid Corporation of India: The Committee Of Directors on Investment of the company has approved 4 projects worth Rs 803.57 crore including implementation of western region expansion scheme-XXV, and north eastern region expansion scheme-XX.

IRB Infrastructure Developers: The road developer has received Letter of Award from National Highways Authority of India (NHAI) for the project of 'upgradation to six lane with paved shoulder of NH-27 from Samakhiyali to Santalpur section in Gujarat on BOT (Toll) mode.

Kalpataru Power Transmission: The company has successfully completed the sale and transfer of an additional 25 percent stake in Kohima-Mariani Transmission, to Apraava Energy. Post the transaction, the company has now transferred an aggregate of 48 percent stake in KMTL, with an agreement to sell balance 26 percent to Apraava, after obtaining requisite regulatory and other approvals. The company had held 74 percent equity stake in Kohima-Mariani Transmission, and the remaining 26 percent held by Techno Electric and Engineering Company.

Pfizer: The pharma company has completed sale of its Thane business undertaking to Vidhi Research and Development LLP after receiving all requisite approvals from the concerned authorities. Company transferred its business undertaking at Thane including land, plant & machinery and all the workmen employed at the said undertaking.

Indiabulls Housing Finance: The Securities Issuance Committee of the company has approved the public issue of secured redeemable non-convertible debentures of Rs 100 crore, with an option to retain oversubscription up to Rs 800 crore, aggregating up to Rs 900 crore. This is within the shelf limit of Rs 1,400 crore. The said Tranche V Issue will open for subscription during March 3 and March 17, 2023.

Tube Investments of India: Subsidiary TI Clean Mobility (TICMPL) has signed definitive documents with Tube Investments, Multiples Private Equity Fund III, State Bank of India along with other co-investors to raise capital up to Rs 1,950 crore in form of equity and CCPS. The total investment by Multiples, SBI and other co-investors would be Rs 1,200 crore. Tube Investments' total investment would be Rs 750 crore, of which Tube Investments has already invested Rs 639 crore by way of equity and ICD. Further, TICMPL plans to raise additional funding of Rs 1,050 crore by end of March 2024, thereby taking the total fund raise to Rs 3,000 crore.

The Phoenix Mills: Subsidiary Palladium Construction (PCPL) has completed acquisition of a prime land parcel approximately 5.5 acres, in Alipore, Kolkata, for Rs 414.31 crore. This acquisition provides the company to build a residential development of more than 1 million square feet of saleable area.

SpiceJet: The board of directors of the company will meet again on February 27 to consider issuance of equity shares on preferential basis consequent upon conversion of outstanding liabilities into equity shares, and raising fresh capital through issue of eligible securities to qualified institutional buyers.

Fund Flow

Foreign institutional investors (FII) sold shares worth Rs 1,470.34 crore, whereas domestic institutional investors (DII) bought shares worth Rs 1,400.98 crore on February 24, the National Stock Exchange's provisional data showed.

Stocks under F&O ban on NSE

The National Stock Exchange has not added any stock on its F&O ban list for February 27. Securities banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!