The Nifty fell for the second consecutive day on March 8 and but gained 1.5 percent during the week despite global growth concerns.

The 30-share BSE Sensex fell 53.99 points to 36,671.43 as the Nifty slipped 22.80 points to 11,035.40 and formed 'Doji' kind of candle on the daily chart.

The index managed to settle the week above 11,000 and formed bullish candle on the weekly scale with the highest weekly close in the last 24 weeks.

"Overall price setup suggests bullish bias at the upper band of the trading range but requires a hold above 10,985 to extend its fresh move towards 11,118, then 11,200. Whereas on the downside, support exists at 10,929, then 10,888," Chandan Taparia, Associate Vice President | Analyst-Derivatives at Motilal Oswal Financial Services told Moneycontrol.

India VIX fell 8.17 percent to 14.94. The decline in VIX has given a comfort zone to bulls to hold beyond 11,000.

Interestingly, the Nifty is trading above its three major simple moving averages 20-DMA, 50-DMA, and 200-DMA that are placed between 10,830 and 10,870. This suggests a validated up move is in progress and strong support zone exists on the lower side, experts said.

"Bullish crossover in MACD (moving average convergence divergence) indicates positivity in Nifty. An increasing histogram of MACD on the daily chart is also indicating bullishness in the index," Shabbir Kayyumi, Head - Technical & Derivative Research at Narnolia Financial Advisors said.

The broader markets also closed marginally lower on March 8 but continued its momentum for another week and outperformed benchmark indices. The Nifty Midcap rose 2.5 percent and Smallcap index rallied 4.2 percent during the last week.

Key support and resistance level for Nifty

The Nifty closed at 11,035.40 on March 8. According to Pivot charts, the key support level is placed at 11,013.27, followed by 10,991.13. If the index starts moving upward, key resistance levels to watch out are 11,053.27 and 11,071.13.

Nifty Bank

The Nifty Bank index closed at 27,761.80, down 2.80 points on March 8. The important Pivot level, which will act as crucial support for the index, is placed at 27,667.7, followed by 27,573.6. On the upside, key resistance levels are placed at 27,833.6, followed by 27,905.4.

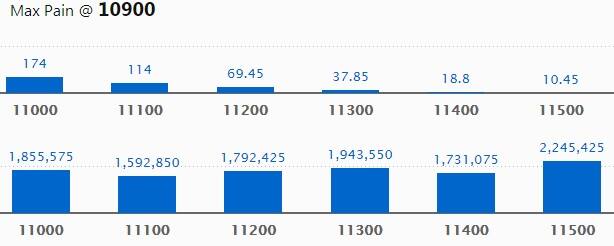

Call options data

Maximum Call open interest (OI) of 22.45 lakh contracts was seen at the 11,500 strike price. This will act as a crucial resistance level for the March series.

This was followed by the 11,300 strike price, which now holds 19.43 lakh contracts in open interest, and 11,000, which has accumulated 18.55 lakh contracts in open interest.

Significant Call writing was seen at the strike price of 11,300, which added 1.26 lakh contracts, followed by 11,000 strike, which added 1.18 lakh contracts and 11,100 strike that added 0.94 lakh contracts.

Call unwinding was seen at the strike price of 11,200 that shed 0.74 lakh contracts, followed by 10,800 strike that shed 0.21 lakh contracts.

Put options data

Maximum Put open interest of 33.70 lakh contracts was seen at the 11,000 strike price. This will act as a crucial support level for the March series.

This was followed by the 10,800 strike price, which now holds 24.04 lakh contracts in open interest, and the 10,500 strike price, which has now accumulated 23.57 lakh contracts in open interest.

Put writing was seen at the strike price of 10,900, which added 0.94 lakh contracts, followed by 11,100 strike that added 0.54 lakh contracts.

Put unwinding was seen at the strike price of 10,800, which shed 2.65 lakh contracts, followed by 10,500 strike that shed 1.2 lakh contracts and 11,200 strike which shed 1.16 lakh contracts.

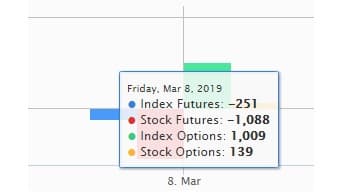

FII & DII data

Foreign Institutional Investors (FIIs) bought shares worth Rs 1,095.06 crore while Domestic Institutional Investors sold Rs 470.7 crore worth of shares in the Indian equity market on March 8, as per provisional data available on the NSE.

Fund flow picture

Stocks with a high delivery percentage

High delivery percentage suggests investors are accepting delivery of the stock, which means that investors are bullish on it.

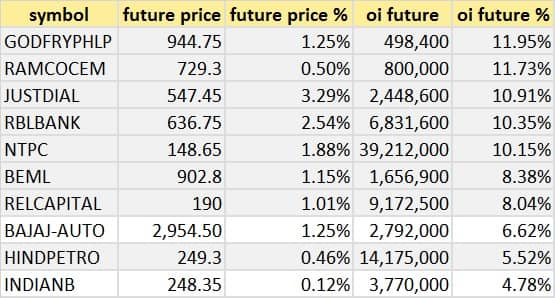

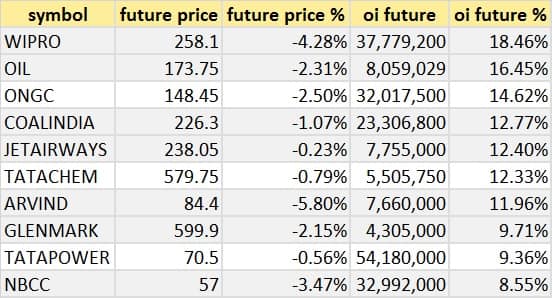

35 stocks saw a long buildup

42 stocks saw short covering

A decrease in open interest along with an increase in price mostly indicates short covering.

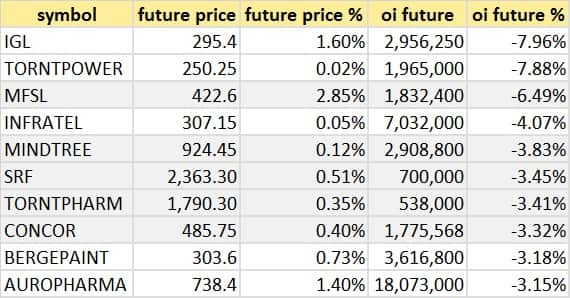

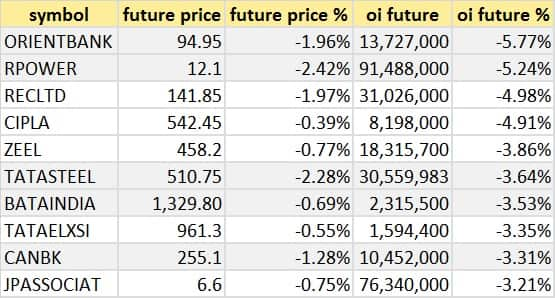

61 stocks saw a short build-up

An increase in open interest along with a decrease in price mostly indicates a build-up of short positions.

60 stocks saw long unwinding

Bulk deals on March 8

Wipro: Promoter Azim Premji Trust sold 2,66,66,667 shares of the company at Rs 256.58 per share on the BSE.

Laurus Labs: Amansa Holdings Private Limited purchased 12,09,249 shares of the company at Rs 350 per share on the NSE and 10,18,308 shares at the same price on the BSE.

Anup Engineering: Avadh Material and Equipment Suppliers LLP bought 1,39,369 shares of the company at Rs 548.35 per share on the NSE and 59,633 shares at Rs 556.53 per share on the BSE.

Vikas EcoTech: Margi Jigneshbhai Shah purchased 21,75,000 shares of the company at Rs 11.45 per share on the NSE.

Balaji Telefilms: Shobha Ravi Kapoor bought 7,02,964 shares of the company at Rs 87 per share on the NSE.

Granules India: Promoter Krishna Prasad Chigurupati sold 50,00,000 shares of the company at Rs 101.08 per share on the NSE.

Thermax: Reliance Mutual Fund bought 10,00,000 shares of the company at Rs 940 per share while Impax Environmental Markets PLC sold 6,04,436 shares at Rs 940.02 on the BSE.

(For more bulk deals, click here)

Analyst or Board meet/briefings

Allcargo Logistics: Management of the company will be attending the Valorem Analyst Conference 2019, organised by Valorem Advisors to be held on March 11.

Shreyas Shipping & Logistics: Management of the company will be attending the Valorem Analyst Conference 2019, organised by Valorem Advisors to be held on March 11.

Alphageo (India): Management of the company will be attending the Valorem Analyst Conference 2019, organised by Valorem Advisors to be held on March 11.

Kwality: Board meeting is scheduled for March 14 to consider the unaudited financial results for the quarter and nine months ended December 2018.

VBC Ferro Alloys: Board meeting is scheduled on March 11 to consider the issue of fully paid up convertible warrants on preferential basis to OPL Renewable Energee Private Limited & Sourya Vidyut Nigam Private Limited.

Blue Star: Company's officials will meet Aberdeen Standard Investments on March 11.

Mahindra & Mahindra: Company's officials will meet Renaissance PMS on March 11, several funds/investors/analysts on March 19 and Banyan Tree Advisors on March 20.

Rallis India: Analyst meet is scheduled to be held on March 11.

Multi Commodity Exchange of India: The company's officials will have concall with Prusik Investment Management on March 11.

Himachal Futuristic Communications: Management of the company will be attending the Valorem Analyst Conference 2019, organised by Valorem Advisors to be held on March 11.

Commercial Syn Bags: Management of the company will be attending the Valorem Analyst Conference 2019, organised by Valorem Advisors to be

held on March 12.

Viceroy Hotels: 18th meeting of the Committee of Creditors of the company is scheduled to be held on March 11.

Fiem Industries: Company's officials will meet IDFC Mutual Fund, DSP Mutual Fund, Reliance Mutual Fund, Principal Mutual Fund, IndgrowthCapitalAdvisors in Mumbai on March 11.

Sheela Foam: Officials of the company will be meeting with various investors on March 11 in Mumbai.

Bharat Forge: Company's officials will interact with Kotak MF, SBI MF and Loomis Sayles in Pune on March 11.

Zenith Healthcare: Board meeting is scheduled for March 22 to review the performance of Non-Independent Directors and the board

as a whole, and the performance of the chairman of the company.

Allied Computers International (Asia): Board meeting is scheduled for March 18 to review the performance of Non-Independent Directors and the board as a whole, and the performance of the chairman of the company.

RCI Industries & Technologies: Company to meet analyst/institutional investors at Valorem Analyst Conference, 2019 on March 12.

Stocks in news

DHFL: Brickwork Ratings India downgraded its rating on secured NCD of the company worth Rs 29,000 crore to AA (credit watch with negative implications) from AA+ (credit watch with developing implications), citing degrowth in business on account of inability to raise funds.

Alok Industries: National Company Law Tribunal approved the resolution plan submitted by Reliance Industries, JM Financial Asset Reconstruction Company and JM Financial Asset Reconstruction Company (as trustee to JMF ARC - March 2018 - Trust).

Sharda Motor Industries: Board unanimously approved the scheme of arrangement of the company with the resulting company presently under incorporation in the name of NDR Auto Components Limited. The scheme provides for the demerger of Automobile Seating undertaking into the resulting company.

GMR Infrastructure: Subsidiary GMR Airports received the formal Letter of Award from MIHAN India Limited, the concessioning authority for the Nagpur Airport, towards the development, operations and management of Dr Babasaheb Ambedkar International Airport, Nagpur, at a revenue share of 14.49 percent of gross revenues.

Vishal Bearings: Board allotted 44,96,000 equity shares of Rs 10 each, as bonus shares to those members of the company entitled thereto as on March 04, 2019 being record date fixed for the purpose.

Bharat Electronics: Board declared the second interim dividend of 70 paise per share of Re 1 each fully paid-up (70 percent) for the financial year 2018-2019.

Suven Life Sciences: Board approved the creation of wholly owned subsidiary (WOS) Suven Pharma, Inc a Delaware Company in USA under CRAMS division, and investment of $75 million in the said WOS for new business opportunities and acquisitions, etc.

HG Infra Engineering: Company has received a letter from NHAI with respect to nullifying of bidding process and to re-invite the bids for new EPC project under NHAI for construction of 6-lane access controlled Green field highway in Rajasthan.

Mangalam Cement: Board approved the amalgamation of Mangalam Timber Products Limited with the company and approved loan up to Rs 5 crore to Mangalam Timber Products.

Salora International: The company proposed voluntary delisting of equity share from National Stock Exchange of India without giving exit opportunity to the shareholders as the equity shares of the company will continue to remain listed on BSE Limited.

Monte Carlo Fashions: Company will dispatch the Letter of Offer along with the tender forms for the buy-back to eligible shareholders appearing on the record date of February 22, on or before March 13, 2019. The buyback will open on March 19 and close on April 2.

Bharat Dynamics: Company has fixed March 27 as the record date for the purpose of payment of first interim dividend.

Tata Motors: Global wholesales in February, including Jaguar Land Rover, dropped 9 percent to 1,10,262 units YoY.

CES: Company completed the acquisition of 37 percent stake in CES Technology Services Private Limited.

Celebrity Fashions: Promoter Rama Rajagopal created a pledge on an additional 7.8 lakh shares (1.64 percent of paid-up equity). He created a pledge on 13.71 percent stake out of total 18.81 percent.

Mcleod Russel: Company decided to dispose of its estates and bearer plants and other assets of Boroi Tea Estate in Assam, and for the said, it entered into a Memorandum of Understanding with Jatinga Agro Tech Private Limited.

CG Power and Industrial Solutions: Company completed the divestment of its power business in the US and the automation business based out of Spain. Hence, the board decided to re-classify its businesses and as of now the non-cash impact of such re-classification is estimated to be approximately Rs 200 crore in the consolidated financial statements.

Cipla: Company's wholly owned subsidiary Goldencross Pharma Private Limited has completed the closing of Wellthy Therapeutics Private Limited, transaction representing an acquisition of 11.71 percent stake in Wellthy.

Eveready Industries: DSP Trustee cuts its stake in the company by 3.8 percent to 1.09 percent.

Religare Enterprises: Board of directors of Religare Broking and Religare Commodities approved a scheme of merger and consequently, Religare Commodities will merge with Religare Broking.

Dilip Buildcon: Company has been declared L-1 bidder for EPC project in Maharashtra, NH-547E, valued at Rs 480.06 crore by the National Highways Authority of India.

Nitesh Estates: Company successfully managed to reduce its debt by Rs 407.88 crore from the overall consolidated debt.

The company through its wholly owned subsidiary Nitesh Indiranagar Retail Private Limited has signed Share Purchase Agreements with Abbey's Realtors LLP a nominee of Ela Realty Private Limited, Group Entity - ABIL Group and sold its 100 percent holdings in step down Tier- II Subsidiary - Koregaon Park High Street Properties Private Limited.

Dhampur Sugar Mills: CARE reaffirmed its rating of the company with revision in outlook from 'A-; Negative to A-; Stable for long term credit facilities from banks and fixed deposits.

UCO Bank: Competent Authority has fixed issue price of Rs 14.25 per share for new equity shares to be issued under UCO Bank Employee Share Purchase Scheme 2019.

Oil India: Company received two oil blocks in Tripura and KG Offshore.

Sun TV Network: Board declared a fourth interim dividend of Rs 2.50 per share of Rs 5 each for the financial year 2018-19.

Zicom Electronic Security Systems: Board appointed Dhaval Mehta as an (additional) independent director of the company.

Three stocks under ban period on NSE

Securities in ban period for the next day's trade under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

For March 11, IDBI Bank, Reliance Power and Jet Airways are present in this list.

Out of F&O ban: Wockhardt

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.